In a surprising announcement on Friday morning, the European Central Bank said the 21 signatories of the 4th Central Bank Gold Agreement (CBGA) “no longer see the need for formal agreement” as the market has developed and matured, and as a result the signatories “decided not to renew the Agreement upon its expiry in September 2019.” For readers unfamiliar, the first CBGA was signed in 1999 to coordinate planned gold sales by the various central banks. When it was introduced, the ECB notes that “the Agreement contributed to balanced conditions in the gold market by providing transparency regarding the intentions of the signatories. It was renewed three times in 2004, 2009 and 2014, gradually moving towards less

Topics:

Tyler Durden considers the following as important: 2.) Europe and Euro Crisis, 2) Swiss and European Macro, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

In a surprising announcement on Friday morning, the European Central Bank said the 21 signatories of the 4th Central Bank Gold Agreement (CBGA) “no longer see the need for formal agreement” as the market has developed and matured, and as a result the signatories “decided not to renew the Agreement upon its expiry in September 2019.”

For readers unfamiliar, the first CBGA was signed in 1999 to coordinate planned gold sales by the various central banks. When it was introduced, the ECB notes that “the Agreement contributed to balanced conditions in the gold market by providing transparency regarding the intentions of the signatories. It was renewed three times in 2004, 2009 and 2014, gradually moving towards less stringent terms.”

The fourth CBGA, which expires on 26 September 2019, was signed by the ECB, the Nationale Bank van België/Banque Nationale de Belgique, the Deutsche Bundesbank, Eesti Pank, the Central Bank of Ireland, the Bank of Greece, the Banco de España, the Banque de France, the Banca d’Italia, the Central Bank of Cyprus, Latvijas Banka, Lietuvos bankas, the Banque centrale du Luxembourg, the Central Bank of Malta, De Nederlandsche Bank, the Oesterreichische Nationalbank, the Banco de Portugal, Banka Slovenije, Národná banka Slovenska, Suomen Pankki – Finlands Bank, Sveriges Riksbank and the Swiss National Bank.

| The simplest reason why the agreement is no longer needed, is that whereas central banks used to sell gold in the 1990s and early 2000s, most famously the UK’s sale of 401 tonnes of gold of its total 715 tonne holdings under Gordon Brown, broadly seen as one of the “worst investment decisions of all time“, currently they are buying at an unprecedented pace, and in 2018, central bank gold demand was the highest in the “modern” era, or since Nixon closed the gold window in 1971. |

Central Bank Demand, 1971 - 2018 |

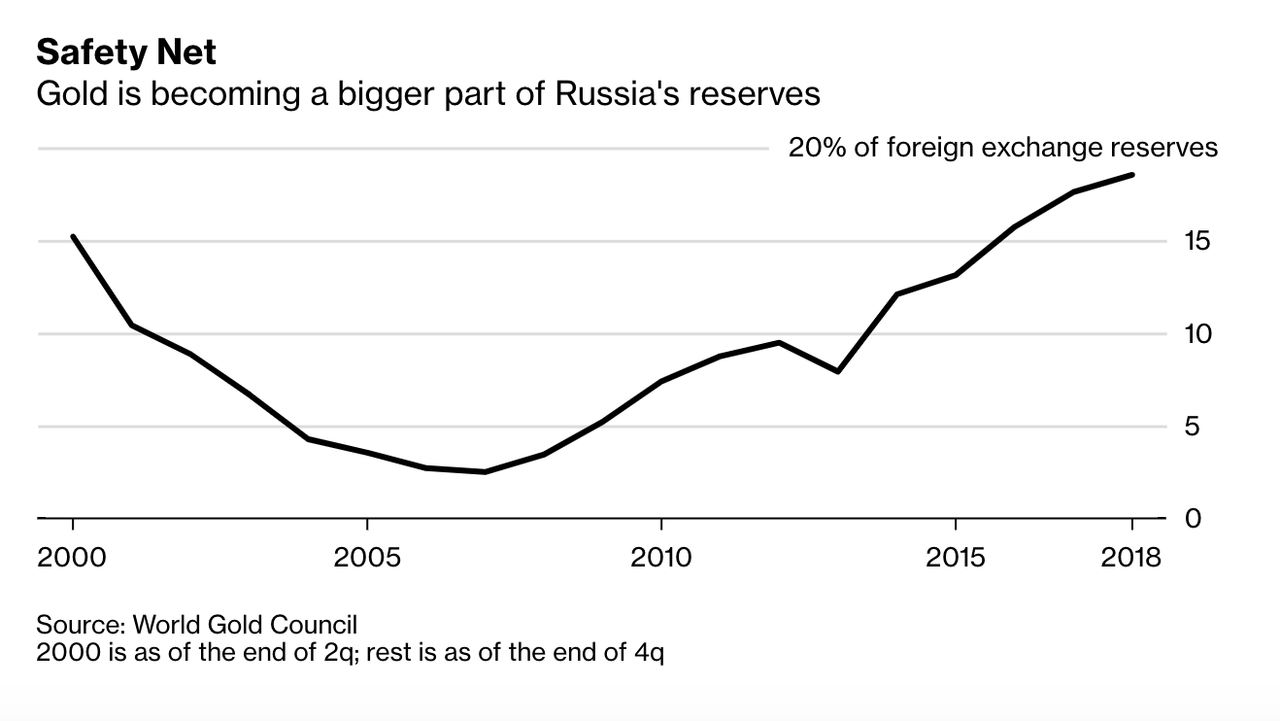

| More recent data shows that gold buying by central banks in 2019 has persisted and remains the highest in years, with no central bank buying more than Russia, which after dumping most of its US Treasury holdings in 2018, has continued to aggressively convert its foreign reserves into the precious metal. |

Gold as Russian Reserve |

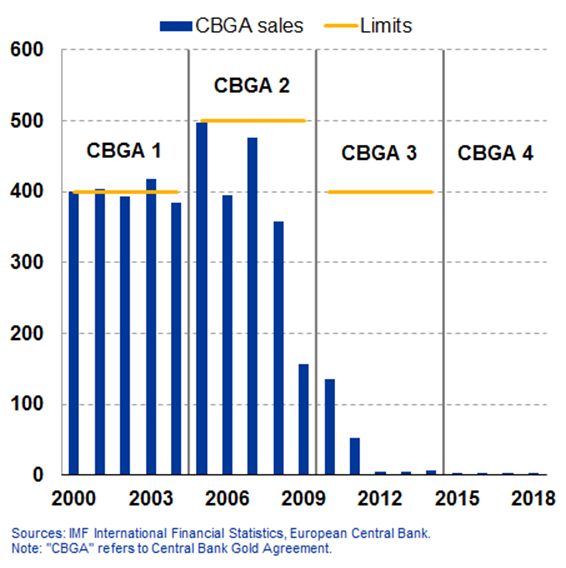

| As a result of a shift in official institutional sentiment from selling to buying, the original agreement which was designed to coordinate primarily selling intentions in order to avoid flooding the market has become an anachronism. Indeed, as the following chart from the ECB shows, there have been virtually no gold sales under the CBGA this decade. |

CBGA Sales and Limits, 2000 - 2018 |

Still, as Bloomberg’s Pimm Fox notes, just because they did not sell any gold recently, does not mean they won’t in the future. Fox notes that among the CBGA signatories are Banca d’Italia and Banque de France, each of which holds more than 2,400 metric tons of the precious metal and are faced with deteriorating finances. Well, as the OECD reported recently, Italy’s deficit would rise to 2.5% of GDP this year while the economy shrinks 0.2%. Italy’s public debt will hit a record 133.8% of GDP this year and climb to 134.8% in 2020, according to the OECD. In France, the government has reduced its GDP growth forecast for 2019 to 1.4% from 1.6% and is on course for a budget deficit higher than 3% of GDP. The country’s public debt is more than 98% of GDP.

His conclusion: “when the bills come due, politicians may start looking at something that rhymes with sold.”

Perhaps, but on the other hand, states such as Russia and China will be more than happy to buy up whatever gold France and Italy have to sell.

Meanwhile, following the report, gold jumped to intraday highs, but to Fox, the jump could be a short-lived move if some of the abovementioned central banks begin selling their holdings to help support cash-strapped economies.

Then again, with global bonds yields now negative across virtually all of Europe, it would take nothing short of a crisis, or the ECB losing all its credibility overnight, for Italy or France to be unable to sell bonds in the current environment. Of course, if and when bond yields soar and central banks finally lose control of the bond market, it is distinctly possible that Italy will have no choice but to sell its gold. The good news – if only for gold bugs – is that when that happens, demand for gold from every other source – will be so high thanks to the scramble out of fiat and into hard currency, that any marginal sales will hardly be noticed as the price of gold explodes just in time for the global hyperinflation episode.

In any case, keep an eye on the gold market on September 26: that when the CBGA will officially conclude.

The full ECB statement ending the CBGA is below (link)

As market matures central banks conclude that a formal gold agreement is no longer necessary

- Signatories of the fourth Central Bank Gold Agreement no longer see need for formal agreement as market has developed and matured

- Signatory central banks confirm gold remains an important element of global monetary reserves and none of them currently has plans to sell significant amounts of gold

The European Central Bank (ECB) and 21 other central banks that are signatories of the Central Bank Gold Agreement (CBGA) have decided not to renew the Agreement upon its expiry in September 2019.

The first CBGA was signed in 1999 to coordinate the planned gold sales by the various central banks. When it was introduced, the Agreement contributed to balanced conditions in the gold market by providing transparency regarding the intentions of the signatories. It was renewed three times in 2004, 2009 and 2014, gradually moving towards less stringent terms.

Since 1999 the global gold market has developed considerably in terms of maturity, liquidity and investor base. The gold price has increased around five-fold over the same period. The signatories have not sold significant amounts of gold for nearly a decade, and central banks and other official institutions in general have become net buyers of gold.

The signatories confirm that gold remains an important element of global monetary reserves, as it continues to provide asset diversification benefits and none of them currently has plans to sell significant amounts of gold.

The fourth CBGA, which expires on 26 September 2019, was signed by the ECB, the Nationale Bank van België/Banque Nationale de Belgique, the Deutsche Bundesbank, Eesti Pank, the Central Bank of Ireland, the Bank of Greece, the Banco de España, the Banque de France, the Banca d’Italia, the Central Bank of Cyprus, Latvijas Banka, Lietuvos bankas, the Banque centrale du Luxembourg, the Central Bank of Malta, De Nederlandsche Bank, the Oesterreichische Nationalbank, the Banco de Portugal, Banka Slovenije, Národná banka Slovenska, Suomen Pankki – Finlands Bank, Sveriges Riksbank and the Swiss National Bank.

Tags: Featured,newsletter