Better-than-expected is the new strong. Even I’m amazed at the satisfaction being taken with October’s payroll numbers. While you never focus too much on one monthly estimate, this time it might be time to do so. But not for those other reasons. Sure, GM caused some disruption and the Census is winding down, both putting everyone on edge. The whisper numbers were low double digits, maybe even a negative headline estimate. Markets had been riding pure pessimism beforehand, with inverted curves and increasing worries about recession maybe just on the horizon. It created the perfect storm for everyone to talk themselves into +128k being somehow really good. It wasn’t as bad as people were thinking and even saying, therefore the labor market must be strong! Add to

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, 5) Global Macro, Data Revisions, economy, employment report, establishment survey, Featured, Federal Reserve/Monetary Policy, Financial Planning, Labor market, newsletter, payrolls, Recession

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| Better-than-expected is the new strong. Even I’m amazed at the satisfaction being taken with October’s payroll numbers. While you never focus too much on one monthly estimate, this time it might be time to do so. But not for those other reasons.

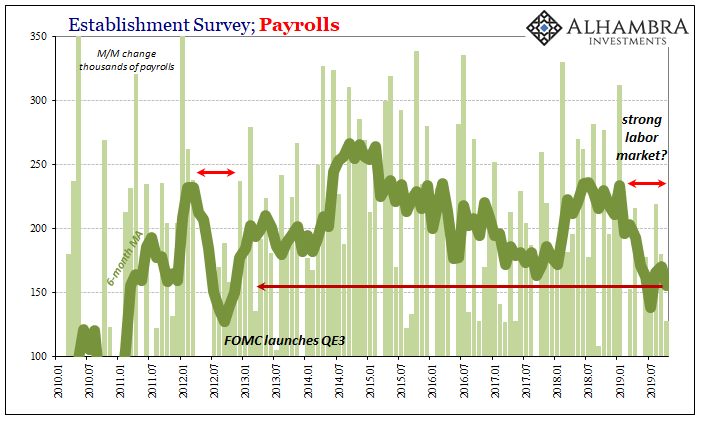

Sure, GM caused some disruption and the Census is winding down, both putting everyone on edge. The whisper numbers were low double digits, maybe even a negative headline estimate. Markets had been riding pure pessimism beforehand, with inverted curves and increasing worries about recession maybe just on the horizon. It created the perfect storm for everyone to talk themselves into +128k being somehow really good. It wasn’t as bad as people were thinking and even saying, therefore the labor market must be strong! Add to October’s number upward revisions to August and September, and, boy, Jay Powell is looking good. Is he, though? Step back from October’s it-wasn’t-worse +128k, and the same problems that had emerged early on this year are still there. With the upward revisions to the prior two months, the 6-month average bumped up – a little. Include the new estimates for October, it’s back down to +156k. That’s still way too much like 2012 and QE3. |

Establishment Survey; Payrolls 2010-2019 |

| The latest payroll numbers show that, going back to January, there still hasn’t been one month better than +250k. That’s a pretty consistent and conspicuous absence of what used to pass for strong months. Of the nine reports since, three, including the latest one, have been below +130k. These are not good times in the labor market.

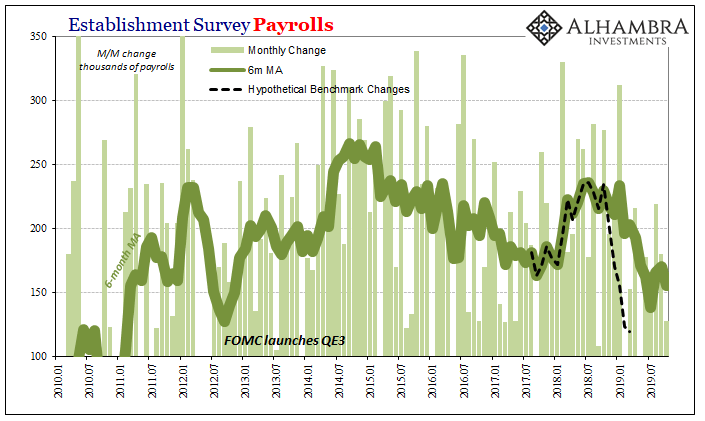

And that’s before we get to the looming benchmark changes. Come February, the BLS is going to tell us that the labor market is a substantially worse than it appears right now. We know that because the agency has already told us with its eye-popping preliminary assessment. |

Establishment Survey Payrolls 2010-2019 |

| We’ve seen this kind of behavior before – the last time the “business cycle” changed. I’m not saying that it has in 2018 and 2019, but there is an awful lot of reasonable suspicion that it could be happening. And one thing you cannot rely upon during those times is the BLS. |

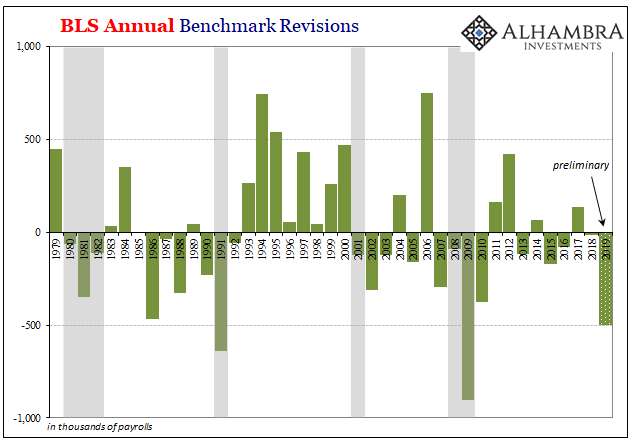

BLS Annual Benchmark Revisions, 1979-2019 |

| If you are searching for data to confirm the view that recession just isn’t in the cards, then the payroll numbers aren’t going to be of much help.

In late 2007, markets were similarly worried about the same sort of situation. Screwy things in markets, inversions, the Fed cutting rates though it said they weren’t really warranted, nothing more than an abundance of caution. And the stock market soaring to new record highs. Coming just off those highs, in early November 2007, the BLS reported a “strong” headline payroll figure. For the month of October, the agency said the number of jobs gained was +166k during a month when everyone feared it might be double digits if not negative. The estimate that was initially published instead was met with a huge sigh of relief, better-than-expected was strong. The New York Times reported:

Apart from mentioning the housing slump, if you didn’t know any better you might’ve mistaken that for something written today. The article continued with the typical comment from the usual credentialed Economist, which is equally timeless:

|

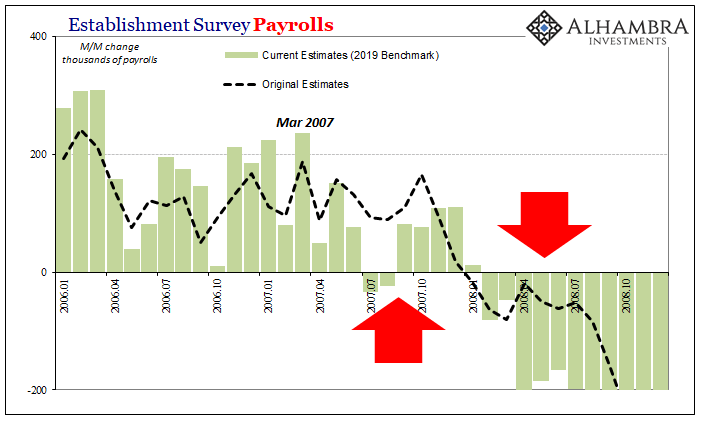

Establishment Survey Payrolls 2006-2008 |

To its credit, elsewhere in the pages of the New York Times there were those who were calling BS. On the same day, and for the very same payroll report, Floyd Norris wrote that people should be very careful about placing too much emphasis on questionable figures:

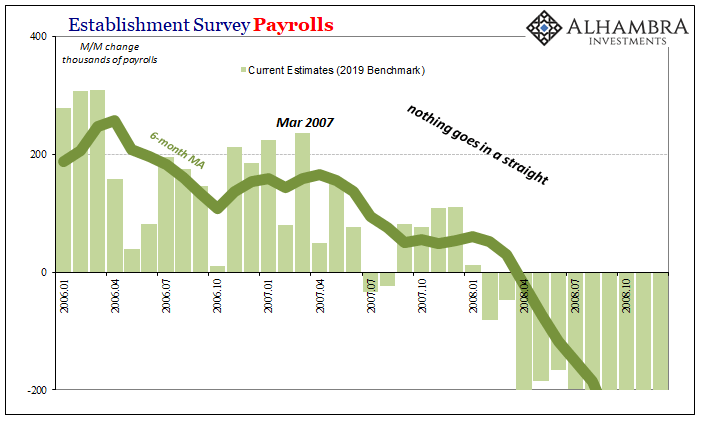

He was exactly right; as of the 2019 benchmarked estimates, the BLS now says that October 2007 gained just +76k payrolls. It actually had been a monthly change in the double digits, as bad as many were fearing at the time. Not only that, he correctly calculated that something had changed the prior spring, as the updated numbers show: The BLS originally had the labor market a little slower in 2007 than 2006, but relatively steady throughout – right up until that December. And then in early 2008, the BLS thought job losses were relatively mild – until Lehman et al. What really had happened was a double slowdown, as you can see clearly in the modern calculations: |

Establishment Survey Payrolls 2006-2008 |

| The reverse of the housing bubble high late in 2006 put the labor market, and the economy, into a questionable, critical state. By the middle of 2007, it downshifted again but didn’t immediately go into recession. There was a time in between that for quite a few months kept looking like everything might be fine (the data, especially payroll data, leading many people to believe that was true).

At the same time, the bond market kept indicating that things were not fine. The downside risks were much larger than mainstream commentary (outside of Mr. Norris) was ready to consider. It was only later on at the end of 2007 that it became clear just how much trouble had been underneath for nearly a year during that whole period in question. |

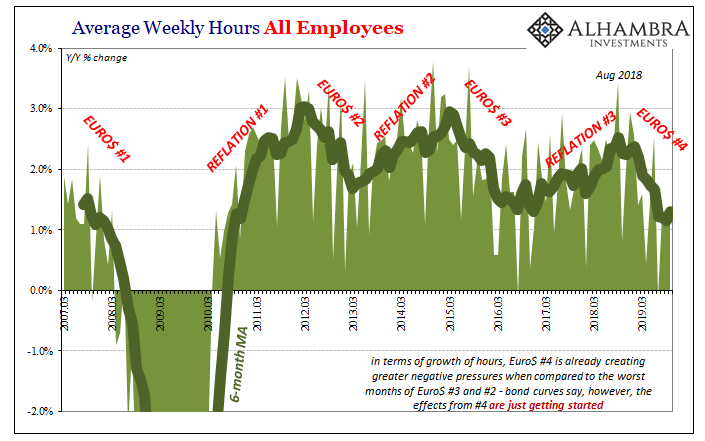

Average Weekly Hours All Employees, 2007-2019 |

And then it took another year before the true scale of that early part of the recession was published (after September 2008, there would be no doubt).

If over the next several months the US economy does come back, that mythical second half rebound does somehow show up halfway through, then none of this will matter. The data says it’s already a downturn, or a soft patch if you like. That by itself doesn’t necessarily tell us much either way.

If, on the other hand, the downside risks are heavier than they might otherwise appear, everyone attempting to characterize +126k as strong being a pretty substantial red flag to that end, then clinging to the payroll data will do you no good. Should it turn out that way, the numbers you see reported today will end up being completely rewritten in the future.

The more important takeaway, as far as I am concerned, is that we continue to see sustained weakness – more consistent evidence of a material change, like from 2006 to 2007, right in the labor market. A very clear downshift. That obvious lack of good months.

You can’t immediately assume that because the economy didn’t go from landmine at the end of 2018 right into recession by February 2019 that it has avoided one altogether; that because it didn’t immediately shift from positive to negative there can’t be another downshift in the months ahead.

It just doesn’t work that way. Nothing goes in a straight line – not even payrolls. Though it may take several years before it gets confirmed. In the meantime, you have to rely on a lot of other data and markets to gain a better sense of where things might really stand.

The post Red Flags Over Labor appeared first on Alhambra Investments.

Tags: Data Revisions,economy,employment report,establishment survey,Featured,Federal Reserve/Monetary Policy,Financial Planning,Labor Market,newsletter,payrolls,recession