Dear Mr. Taft: I eagerly read your piece Warriors for Opportunity on Wednesday, as I often do about pieces that argue that capitalism is not working today. You begin by saying: “Financial capitalism – free markets powered by a robust financial system – is the dominant economic model in the world today. Yet many who have benefited from the system agree it’s not working the way it ought to.” Leaving aside that our financial system is not robust—the interest rate is...

Read More »USD/CHF finds support near 0.9800 before SNB’s Quarterly Bulletin

Major European stocks post modest losses on Wednesday. US Dollar Index clings to gains above 97.30. Coming up: Swiss National Bank’s (SNB) Quarterly Bulletin. The USD/CHF pair dropped to its lowest level since late August at 0.9798 on Wednesday but staged a technical recovery in the last hour. As of writing, the pair was up 0.05% on the day at 0.9808. After major Asian equity indexes closed the day in the negative territory on Wednesday, European stocks struggled to...

Read More »FX Daily, December 18: Markets Turn Quiet Ahead of Central Bank Meetings

Swiss Franc The Euro has fallen by 0.22% to 1.0905 EUR/CHF and USD/CHF, December 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The capital markets have turned quiet as the year-end positioning drives prices in lieu of fresh developments. Equities in the Asia Pacific region were narrowly mixed. The smaller markets in Asia performed better than the large bourses of Japan, China, and Korea, which eased....

Read More »Court rejects Lake Zurich cablecar project

According to the plans, the cablecar would have 18 cabins, each able to carry 34 people between the Mythenquai beach on one side of the lake to the Zurichhorn park on the other. (Keystone) A Zurich court has rejected plans for a cablecar link crossing over Lake Zurich, stating that the project, known as ‘Zuribahn’, did not have sufficient local support. The court annulled construction plans for the city cablecar, which had been presented by Zurich Cantonal Bank (ZKB)...

Read More »Court rejects damages claims against Volkswagen and Swiss importer

VW was caught using illegal software to cheat pollution tests in 2015, triggering a global backlash against diesel and numerous court cases around the world that have so far cost the German company €30 billion euros ($33 billion). (Keystone / Julian Stratenschulte) A Zurich commercial court has dismissed claims for damages by a consumer group against the German car firm Volkswagen and Swiss importer Amag, linked to the “Dieselgate” emissions-rigging scandal. In a...

Read More »China Data: Something New, or Just The Latest Scheduled Acceleration?

The Chinese government was serious about imposing pollution controls on its vast stock of automobiles. The largest market in the world for cars and trucks, the net result of China’s “miracle” years of eurodollar-financed modernization, for the Chinese people living in its huge cities the non-economic costs are, unlike the air, immediately clear each and every day. A new set of relatively strict pollution controls was added in the second half of this year. As is...

Read More »Hyperinflation, Money Demand, and the Crack-up Boom

In the early 1920s, Ludwig von Mises became a witness to hyperinflation in Austria and Germany — monetary developments that caused irreparable and (in the German case) cataclysmic damage to civilization. Mises’s policy advice was instrumental in helping to stop hyperinflation in Austria in 1922. In his Memoirs, however, he expressed the view that his instruction — halting the printing press — was heeded too late: Austria’s currency did not collapse — as did Germany’s...

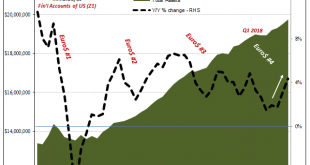

Read More »A Repo Deluge…of Necessary Data

Just in time for more discussions about repo, the Federal Reserve delivers. Not in terms of the repo market, mind you, despite what you hear bandied about in the financial media the Fed doesn’t actually go there. Its repo operations are more RINO’s – repo in name only. No, what the US central bank actually contributes is more helpful data. Since our goal is to use that data to produce the best possible, most accurate interpretation of the facts, the depth and...

Read More »FX Daily, December 17: Sterling Drops as New Brinkmanship Begins

Swiss Franc The Euro has risen by 0.04% to 1.0945 EUR/CHF and USD/CHF, December 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Efforts by a UK Prime Minister emboldened by a strong electoral victory to ensure that trade negotiations with the EU are not extended as the divorce has encouraged further profit-taking on sterling. After testing the $1.35 area on the exit polls last week, sterling had returned...

Read More »USD/CHF retreats to 0.9820 area as USD loses strength

US Dollar Index erases daily recovery gains ahead of American session. European equity indexes stay in the negative territory. Coming up: Building Permits, Housing Starts and Industrial Production data from US. The USD/CHF lost its traction in the last couple of hours and retraced its daily recovery gains pressured by the sour market mood and the broad USD weakness. As of writing, the pair was down 0.02% on the day at 0.9818. The USD recovery during the early trading...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org