US Dollar Index erases daily recovery gains ahead of American session. European equity indexes stay in the negative territory. Coming up: Building Permits, Housing Starts and Industrial Production data from US. The USD/CHF lost its traction in the last couple of hours and retraced its daily recovery gains pressured by the sour market mood and the broad USD weakness. As of writing, the pair was down 0.02% on the day at 0.9818. The USD recovery during the early trading hours of the European session allowed the pair to stretch higher toward the 0.9850 area. The US Dollar Index, which tracks the greenback’s value against a basket of six major currencies, rose to 97.30 but reversed its direction. At the moment, the index is at 97.10, losing 0.04% on a daily basis.

Topics:

Eren Sengezer considers the following as important: 1.) FXStreet on SNB&CHF, 1) SNB and CHF, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- US Dollar Index erases daily recovery gains ahead of American session.

- European equity indexes stay in the negative territory.

- Coming up: Building Permits, Housing Starts and Industrial Production data from US.

The USD/CHF lost its traction in the last couple of hours and retraced its daily recovery gains pressured by the sour market mood and the broad USD weakness. As of writing, the pair was down 0.02% on the day at 0.9818.

The USD recovery during the early trading hours of the European session allowed the pair to stretch higher toward the 0.9850 area. The US Dollar Index, which tracks the greenback’s value against a basket of six major currencies, rose to 97.30 but reversed its direction. At the moment, the index is at 97.10, losing 0.04% on a daily basis.

Risk appetite softens on TuesdayThe risk rally seems to be losing its momentum amid a lack of fresh developments following the completion of the phase-one US-China trade deal. After closing the previous day with decisive gains, major European equity indexes are posting moderate losses on Tuesday. Furthermore, the 10-year US Treasury bond yield is erasing 0.75% on the day to reflect the sour mood, which helps the CHF find demand as a safe-haven. Commenting on the US-China trade dispute, “official communication from China has so far been notably lacking in detail on the amounts imports from the US would rise by, and Chinese officials cautioned in a rare press conference last Friday that any increases ‘should be based on market principles and WTO rules’,” noted ABN AMRO analysts. “Such parameters defining the deal means trade relations will remain fragile, and while a step in the right direction, we fear the deal could be torn up if President Trump finds himself dissatisfied with the progress made next year.” In the second half of the day, Building Permits, Housing Starts and Industrial Production data from the US will be looked upon for fresh impetus. |

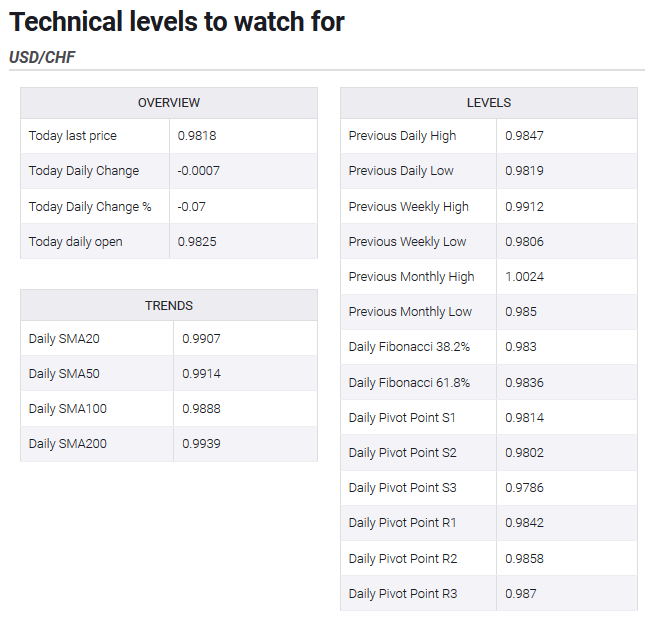

Technical levels to watch for USD/CHF(see more posts on USD/CHF, ) |

Tags: Featured,newsletter