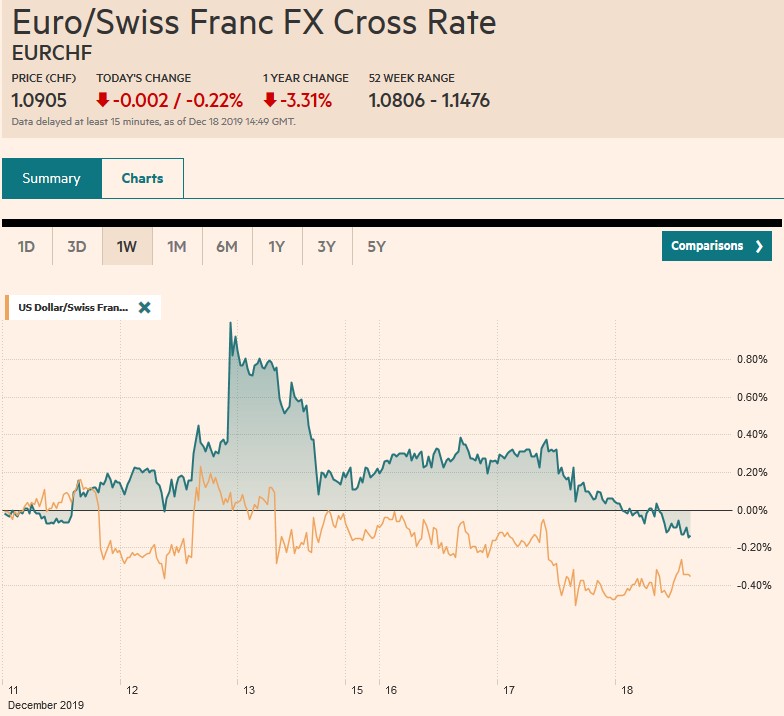

Swiss Franc The Euro has fallen by 0.22% to 1.0905 EUR/CHF and USD/CHF, December 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The capital markets have turned quiet as the year-end positioning drives prices in lieu of fresh developments. Equities in the Asia Pacific region were narrowly mixed. The smaller markets in Asia performed better than the large bourses of Japan, China, and Korea, which eased. European equities are off to a firm start, and the Dow Jones Stoxx 600 is consolidating near the record high set Monday. US shares are also trading a little higher, and the S&P 500 is within spitting distance of 3200. Benchmark bond yields are little changed, with softer yields in Japan, the UK, and the

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Currency Movement, Featured, Japan, MXN, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.22% to 1.0905 |

EUR/CHF and USD/CHF, December 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

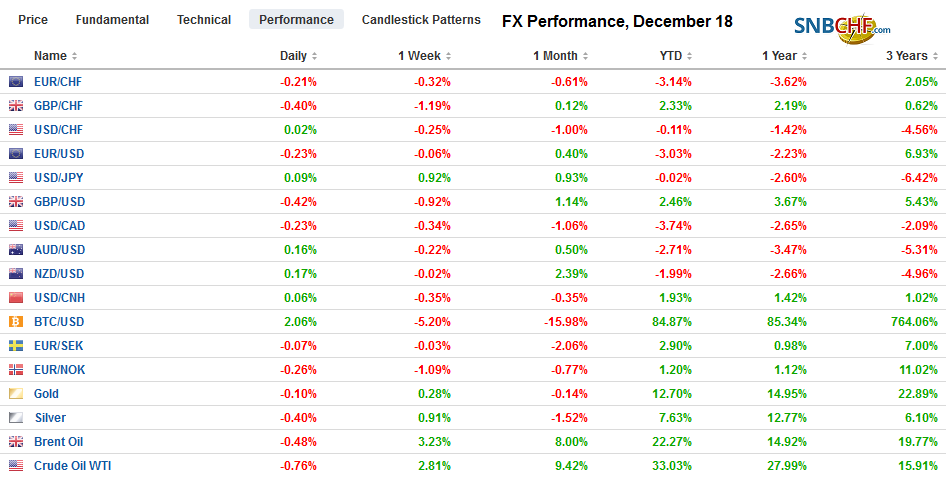

FX RatesOverview: The capital markets have turned quiet as the year-end positioning drives prices in lieu of fresh developments. Equities in the Asia Pacific region were narrowly mixed. The smaller markets in Asia performed better than the large bourses of Japan, China, and Korea, which eased. European equities are off to a firm start, and the Dow Jones Stoxx 600 is consolidating near the record high set Monday. US shares are also trading a little higher, and the S&P 500 is within spitting distance of 3200. Benchmark bond yields are little changed, with softer yields in Japan, the UK, and the European periphery. Of note, the 10-year Greek yield has slipped below the 10-year Italian yield for the first time in about a dozen years, amid reports suggesting the regulators may allow Greek banks to buy more of their sovereign bonds. The US yield is slightly softer, at 1.87%. The dollar itself is up against most of the major currencies, with sterling and the Swedish krona seeing the biggest losses (less than 0.2%). Emerging market currencies are trading with a heavier bias and the JP Morgan Emerging Market Currency Index is lower after small losses yesterday. Unless there is a recovery, it will be the first back-to-back loss this month. Gold is a few dollars higher but stuck around $1475, and January WTI has been sold a little after reaching $61 a barrel yesterday, a three-month high. |

FX Performance, December 18 |

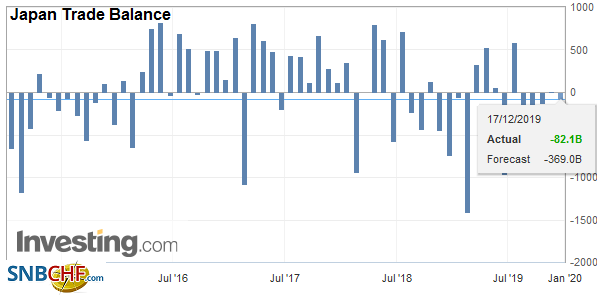

Asia PacificJapan’s November trade figures were mixed. Exports fell less than expected (-7.9%) but are still the third worse of the year. Japanese exports have fallen on a year-over-year basis since last November. In October, exports were off 9.2%, the most in the cycle. However, the greater surprise was on imports. Rather than improve, they contracted by 15.7% after a 14.8% decline in October. The fall in imports appears to reflect the weak domestic economy and soft demand for durable goods, like autos and cell phones. On a seasonally adjusted basis, it was the ninth consecutive month of trade deficit. A positive note from today’s figure is that net exports may not be a drag on Q4 GDP, which is being depressed by the sales tax increase and the tsunami that hit in October. The dollar is in less than a 20 pip range against the Japanese yen and remains inside last Friday’s range. The dollar is still within the range set Monday (~JPY109.25-JPY109.70). The dollar is finding a bid in the European morning near JPY109.40. The Bank of Japan meets tomorrow and may downgrade its economic assessment. The Australian dollar is consolidating yesterday’s loss that carried it slightly below $0.6840. A move above $0.6860 now may take the pressure off the downside. For the fifth consecutive session, the dollar has straddled the CNY7.0-level. It appears to be the third mainland session that it has finished with a CNY6.99-handle. |

Japan Trade Balance, November 2019(see more posts on Japan Trade Balance, ) Source: investing.com - Click to enlarge |

EuropeThe German manufacturing sector remains hampered according to the PMI and factory orders. However, sentiment appears to be improving gradually. The IFO survey showed the assessment of the business climate rose more than expected to 96.3 from 95.1. The measure bottomed in August at 94.4 and is now at the highest since June. The expectations component rose for the third consecutive month. The current assessment edged higher for the second month, and at 98.8, it is the best since July. |

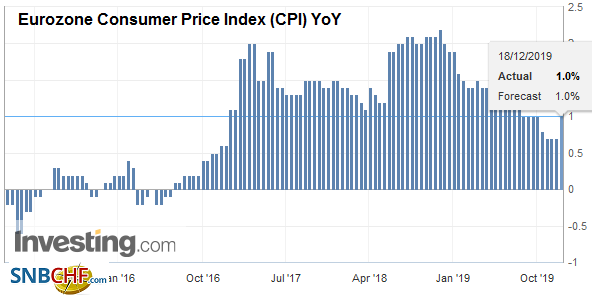

Eurozone Consumer Price Index (CPI) YoY, November 2019(see more posts on Eurozone Consumer Price Index, ) Source: investing.com - Click to enlarge |

| UK November consumer prices were steady. The preferred CPIH, which includes owner-occupied housing costs, was unchanged at 1.5%. The core rate was steady at 1.7%. Producer prices were softer than expected. Input prices slipped and have now fallen for five of the past six months. Output prices also eased and have not risen for the past three months. The Bank of England meets tomorrow and is widely expected to hold policy steady. Even though two members of the MPC dissented last month, ostensibly the lifting of uncertainty around Brexit and the fiscal promises made during the campaign will likely keep the BOE’s hand steady at Carney’s second to the last meeting as governor.

S&P changed the outlook for the UK credit to stable from negative. While it acknowledged that a no-deal exit is still possible, it anticipates, despite the government’s move to block it, that it will eventually request an extension of the transition period. Separately, Fitch took the UK off its negative credit watch but maintained a negative outlook. Both rating agencies rate the UK AA. Moody’s has the equivalent rating and also has a negative outlook. |

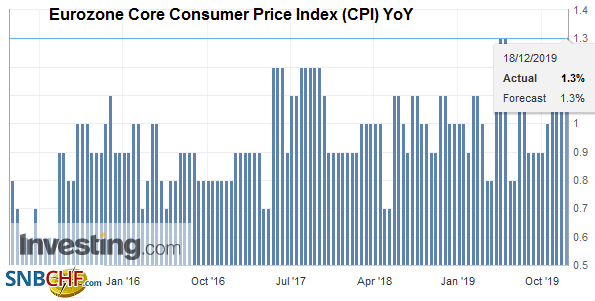

Eurozone Core Consumer Price Index (CPI) YoY, November 2019(see more posts on Eurozone Core Consumer Price Index, ) Source: investing.com - Click to enlarge |

The euro’s upside momentum stalled ahead of last weekend near $1.12. Recall that it began the month a little above $1.10. The risk is that some of the late longs cut and run and push the euro to $1.11, where there is a roughly 500 mln euro option that expires today. On the topside, there are 1.6 bln euro in expiring options between $1.1140 and $1.1150 that may provide the immediate cap. The prospect of another year of brinkmanship between the UK and EU over trade negotiations undercut the post-election enthusiasm for sterling that had carried it to $1.35. Yesterday’s decline to $1.31 has been extended to almost $1.3070 today, and new bids appeared in the European morning. A move above $1.3150 now would suggest a near-term low is in place. Sweden and Norway’s central banks meet tomorrow. Norway is on hold, and Sweden’s Riksbank will be more interesting. It is expected to lift the repo rate to zero from minus 25 bp. The deposit rate is at minus 35 bp, and bringing it to zero would be more significant.

America

The impeachment vote in the US House of Representatives appears to be of little consequence to investors, but without new data or developments, it is the talk of the day. Yesterday’s stronger than expected industrial output and housing starts/permits spurred an uptick in the Atlanta Fed’s GDP tracker to 2.3%. As of December 13, the NY Fed’s tracker was at 0.7%. It is updated on Fridays typically. Canada reports November CPI figures today. Due to the base effect, a month-over-month decline of 0.1% that economists expect is still consistent with a rise in the year-over-year rate to 2.2% from 1.9% in October. It would be the highest since May. The underlying core rates (the Bank of Canada reports three) are expected to unchanged to firmer, hovering around 2%.The inflation readings give the central bank incentive not to join many other countries that have eased monetary policy. The calculus would change if there were to be a serious deterioration in the labor market. Mexico’s central bank meets tomorrow. It is widely expected to deliver its fourth 25 bp cut of the year. It will bring the overnight rate to 7.25% and unwinding nearly all of the 2018 hikes. With inflation running near 3%, the Banxico has scope to continue cutting rates next year.

The US dollar continues to trade in a narrow range around CAD1.3150. It had inexplicably broken down to CAD1.3115 on Monday but closed back above there. The greenback needs to resurface above CAD1.3200 to be anything of note. The peso has been on a one-way move this month. Coming into today, it has fallen in only two sessions here in December. The dollar dipped below MXN18.90 earlier today. The low in H2 is not far (~MXN18.8645). We suspect it short-term flows drawn to the high yield that is the main driver. The technical indicators are getting stretched.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Currency Movement,Featured,Japan,MXN,newsletter