Over the last two years, we’ve all witnessed state abuses of power and extreme overreaches the likes of which many average citizens had never imagined they’d see in their own lifetimes. This caused a great part of the body politic in many Western nations to revisit their previously held beliefs about what is and isn’t possible for their governments to do and to question whether there really is such a thing as going “too far” or whether anyone in the...

Read More »I Told You It *Wasn’t* Money Printing; How The Fed Helped Cause, But Can’t Solve, Our Current ‘Inflation’

Trust the Fed. Ha! It’s one thing for money dealers to look upon Jay Powell’s stash of bank reserves with remarkable disdain, more immediately damning when effects of the same liquidity premiums in the real economy create serious frictions leaving the entire world exposed to the consequences. When all is said and done, the Federal Reserve has created its own doom-loop from which it won’t likely escape. The 2022 FOMC has made itself plain, incredibly hawkish to an...

Read More »Impact of Swiss finance sector on country’s GDP waning

Switzerland’s finance industry: a little less important than a decade ago, but still a big plank of the economy. Keystone / Gian Ehrenzeller The contribution of Switzerland’s finance industry to the country’s gross domestic product (GDP) has decreased over the past ten years. The share of GDP accounted for by financial and insurance services was 9% last year, down from 10% in 2011, the State Secretariat for International Finance (SIF)External link said in a report...

Read More »Jon Stewart Asks Great Questions of Federal Reserve Chief

In a recent episode of “The Problem With Jon Stewart,” the former Daily Show host asks former president of the Kansas City Fed Thomas Hoenig why the Fed couldn’t have bailed out homeowners, or just “quantitative ease” away the Treasury’s debt. Hoenig gives muddy answers, so Bob tries to clarify. Mentioned in the Episode and Other Links of Interest: Jon Stewart’s full interview with Thomas Hoenig Jon Stewart skewers Paul Krugman Jon Stewart interviews Kelton and...

Read More »The Yen Bounces after 13-Day Slide and BOJ Defends Yield Cap

Overview: The record-long yen slide has stalled just shy of JPY129.50, even though the Bank of Japan defended its Yield-Curve Control cap on the 10-year bond and will continue to do so for the next four sessions. The greenback fell to almost JPY128 before steadying. China again defied expectations for lower rates (loan prime rate), the yuan’s sell-off accelerated and slide to its lowest level since last October. Chinese and Hong Kong shares fell, but most of the...

Read More »The Deferentials

Let’s have a thought experiment. Suppose that North Korean leader Kim Jong-un and Cuban president Miguel Mario Díaz-Canel Bermúdez issued a joint announcement stating that North Korea had accepted an invitation to install some of its nuclear missiles in Cuba. The announcement made it clear that although the missiles could reach any American city, they would be entirely for the defense of Cuba, not for the purpose of attacking the United States. There is no...

Read More »A Couple of Thoughts on Big Numbers

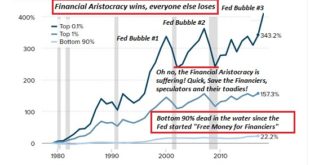

Let’s ask “cui bono” of the $33 trillion in added debt and the $9 trillion added to GDP: to whose benefit? I’ve been thinking about how hard it is to get our heads around big numbers. Technical analyst Sven Henrich (@NorthmanTrader) recently provided one method to grasp the immense wealth of Elon Musk: How to become as wealthy as Elon Musk? Easy. Get paid $1 Million every single day. For 750 years in a row and you’re there. How can we get a handle on the $33...

Read More »Swiss to decide individually on Russian commodity deals

It is estimated that about a third of the oil traded globally is bought and sold in Switzerland. Keystone/Sergey Ponomarev Switzerland will decide case by case whether to curtail traders’ purchases from Russia’s state-controlled companies under European Union sanctions. The State Secretariat for Economic Affairs (SECO) which is in charge sanctions confirmed the Swiss policy to follow in principle the EU measures, which aim to limit commodity deals to those deemed...

Read More »Yen Blues

Overview: Benchmark 10-year bonds yields in the US and Europe are at new highs for the year. The US yield is approaching 2.90%, while European rates are mostly 5-8 bp higher. The 10-year UK Gilt yield is up nine basis points to push near 1.98%. The higher yields are seeing the yen’s losing streak extend, and the greenback has jumped 1% to around JPY128.45 The dollar is trading lower against the other major currencies but the Swiss franc. The dollar-bloc currencies...

Read More »Zahlungen mit Cryptocoins auf Amazon noch weit entfernt

Zurzeit würde wohl nichts die Mass Adoption mehr fördern, als wenn Amazon Zahlungen mit Cryptocoins akzeptierte. Doch Amazons CEO macht der Crypto-Community wenig Hoffnung, wenn es um eine baldige Implementierung von Zahlungen mit Bitcoin und Co. geht. Crypto News: Zahlungen mit Cryptocoins auf Amazon noch weit entferntOffenbar gibt es derzeit keine Pläne, Zahlungen mit Cryptocoins auf Amazon zu akzeptieren. CEO Andy Jessy sprach auf CNBC über den Cryptomarkt und...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org