In 1975, after nearly a decade of outright conflict, the United States government abandoned its doomed escapade in Vietnam. It left a devastated country and over a million corpses in its wake. The corrupt South Vietnamese regime, already teetering on utter collapse, completely dissolved without American support. And the Communist forces of North Vietnam eagerly descended on Saigon, impatient to implement their antimarket and antiproperty policies. What followed was a...

Read More »CNY’s Drop Wasn’t ‘Devaluation’ in ’15 nor ’18, and It Isn’t ‘Devaluation’ Now

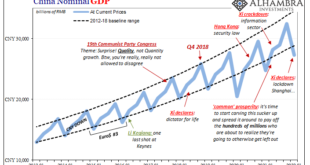

For one thing, that whole Bretton Woods 3 thing is really off to an interesting start. And by interesting, I mean predictably backward. According to its loud and leading proponent, China’s yuan was supposed to be ascending while the dollar sank, its first step toward what many still claim will end up in some biblical-like abyss. Instead, CNY is doing the plummeting and at a speed reminiscent of August 2015. That month did not, obviously, lead to a vast rearrangement...

Read More »The (less) Dollars Behind Xi’s Shanghai of Shanghai

What everyone is saying, because it’s convenient, is that China’s zero-COVID policies are going to harm the economy. No. Economic harm of the past is the reason for the zero-COVID policies. As I showed yesterday, the cracking down didn’t just show up around 2020, begun right out in the open years beforehand, born from the scattering ashes of globally synchronized growth. Xi Jinping saw how a very different post-2008 global economy without any recovery was going to...

Read More »It’s Time for TINA to Retire

To listen to the audio version of this article click here. In the world of trends, history repeats more than it rhymes. Things which were considered “in” decades ago, reemerge as cool again decades later. From mom jeans to vinyl records and even Marxist ideology. The spotlight of today turns to things—both good and bad—once forgotten. Inflation is the latest trend to reemerge. But this isn’t the kind and considerate inflation which hummed quietly in the background...

Read More »Swiss technology foils Russian censorship

Since the start of the war in Ukraine, many Russian internet users have been using the Swiss software Kiwix to download Wikipedia fearing that it will soon be banned. © Keystone / Christian Beutler The Swiss software Kiwix enables the user to copy entire websites so they can be accessible offline. Now that Wikipedia risks sanction in Russia because of its content on the Ukraine war, downloads of the free online encyclopaedia using Kiwix are off the charts. Wikipedia...

Read More »Not Good Goods

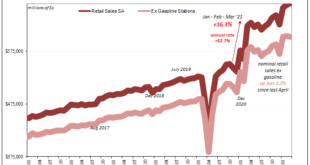

The goods economy in the United States is – maybe was – the lone economic bright spot. That in and of itself should’ve provoked more caution, instead there was the red-hot recovery to sell under the cover of supply shock pricing changes. The sheer spending on goods, and how they arrived, each unabashedly artificial from the get-go. Combine those two factors, however, the necessary supply squeeze surge in prices along with the artificiality behind it wearing off,...

Read More »The ‘Friend- Shoring’ of Gold- A New World Order?

Gold and the US Federal Reserve have a love-hate relationship. Hate because they both enjoy it when the other one performs badly, but love it because the Fed owns over 8,000 tonnes of gold and would rather no one else had any. So it was a funny thing when a former Chair of the Federal Reserve proposed measures this week that would go a long way to boosting many aspects of the gold market, including the price of gold bullion… ...

Read More »Mises in America

[William Peterson was the 2006 Schlarbaum laureate, and here is his acceptance speech, delivered October 8, 2005.] Gary Schlarbaum, I thank you for this award and high honor from your grand legacy in loving memory of a genius in our time, Ludwig von Mises (1881–1973). But let me say up front, fellow Miseseans, meet me, Mr. Serendipity, Bill Peterson, here by a fluke, a child of fickle fate. For frankly I had never heard of the famous Mises when I took his course for...

Read More »Teilt Binance Nutzerdaten mit Russland?

Reuters hat gegen Ende der Woche gemeldet, dass die weltweit größte Crypto-Börse Binance Nutzerdaten mit staatlichen russischen Instituten teilen würde. Laut Reuters wurden diese Daten vor allem vom russischen Sicherheitsdienst genutzt, um Kriminalität im eigenen Land zu bekämpfen. Doch Binance verneinte diese Anschuldigungen nun. Crypto News: Teilt Binance Nutzerdaten mit Russland?In einem konkreten Fall ging es um finanzielle Unterstützung des Kreml Kritikers...

Read More »AKA Part I

Thanks for all of those great questions you submitted! Make sure you follow us on Twitter, Facebook and LinkedIn and are subscribed to our YouTube Channel so you can submit question and check out all of our audio articles, media appearances, podcasts episodes and more. A Gold Mine of Show Notes Ukraine and inflation Famous Buyer and Seller Fallacy Monetary Metals fundamental gold price World Gold Council estimates on amount of gold mined The Dawn of Gold by Philip...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org