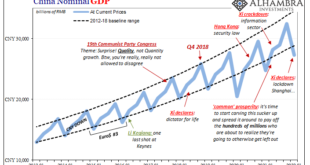

The first chapters to China’s new story now playing out in Shanghai were written down in October 2017. Planning for them had begun years earlier, their author Xi Jinping requiring more research before committing them to paper. Communist authorities there had grown increasingly concerned about the lack of growth potential for its political system by then utterly dependent for a quarter-century on the economy growing. So long as other places around the world wanted...

Read More »To Fight Russia, Europe’s Regimes Risk Impoverishment and Recession for Europe

European politicians are eager to be seen as “doing something” to oppose the Russian regime following Moscow’s invasion of Ukraine. Most European regimes have wisely concluded—Polish and Baltic recklessness notwithstanding—that provoking a military conflict with nuclear-armed Russia is not a good idea. So, “doing something” consists primarily of trying to punish Moscow by cutting Europeans off from much-needed Russian oil and gas. The problem is this tactic doesn’t...

Read More »Real Wages Fall Again as Inflation Surges and the Fed Plays the Blame Game

Money printing may bring rising wages, but it also brings rising prices for goods and services. And those increases are outpacing the wage increases. Original Article: “Real Wages Fall Again as Inflation Surges and the Fed Plays the Blame Game” According to a new report released Wednesday by the US Bureau of Labor Statistics, the Consumer Price Index increased in March by 8.6 percent, measured year over year (YOY). This is the largest increase in more than forty...

Read More »Energy prices: government considers measures to help households

The issue of rising energy and fuel prices is ‘on the government’s radar’, according to Energy Minister Simonetta Sommaruga © Keystone / Christian Beutler The Swiss government has set up a working group to examine whether measures are needed to relieve the burden on households caused by rising energy prices. “[The government] is observing the development very closely in order to clarify whether support is needed to cushion hardship cases,” said Energy Minister...

Read More »Swiss trade unions sound alarm about rising cost of living

Prices in Switzerland are on the rise, albeit less drastically than in the EU and the US. © Keystone / Christian Beutler Trade unions say middle- and lower-income workers in Switzerland are facing a “shock” in 2022, with wages unable to offset rising inflation and health insurance costs. With inflation currently over 2% in Switzerland, the cost of living is going up, and workers need a salary boost to offset this, said the country’s biggest trade union group on...

Read More »China, Japan, And The Relative Pre-March Euro$ Calm In February

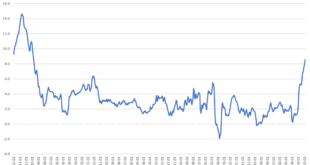

The month of February 2022, the calm before the latest storm. Russians went into Ukraine toward the month’s end, collateral shortage became scarcity, maybe a run right at February’s final day, and then serious escalations all throughout March – right down to pure US Treasury yield curve inversion. Given that setup, it was unsurprising to find Treasury’s February TIC data mostly unremarkable. Top to bottom, there wasn’t really much that changed. No huge negatives,...

Read More »The Nationalities Question

[This article was published in in The Irrepressible Rothbard, available in the Mises Store.] Upon the collapse of centralizing totalitarian Communism in Eastern Europe and even the Soviet Union, long suppressed ethnic and nationality questions and conflicts have come rapidly to the fore. The crack-up of central control has revealed the hidden but still vibrant “deep structures” of ethnicity and nationality. To those of us who glory in ethnic diversity and yearn for...

Read More »What’s Your Plan A, B and C?

Nothing unravels quite as dramatically as systems which are presumed to be rock-solid and forever. Here’s the default Bullish case for stocks and the economy: let’s call it Plan Zero. 1. The economy and equities can grow forever (a.k.a. infinite growth on a finite planet in a waste-is-growth Landfill Economy) 2. Higher energy costs have near-zero effect on the economy and stocks. 3. The Federal Reserve will deliver a soft landing which reduces inflation back to...

Read More »Coincub bezeichnet Deutschland als Crypto-freundlichstes Land der Welt

Coincub ist ein Exchange Aggreagator für digitale Assets. Laut Recherche des Unternehmens ist Deutschland das freundlichste Land für die Crypto-Community weltweit. Damit hat Deutschland im ersten Quartal des neuen Jahres Singapur als Nummer 1 abgelöst. Crypto News: Coincub bezeichnet Deutschland als Crypto-freundlichstes Land der WeltInsgesamt wurden 46 Länder auf ihre Crypto-Freundlichkeit hin untersucht. Die dabei durchleuchteten Parameter umfassen ICOs in der...

Read More »Easter march through Bern addresses war in Ukraine

Peace marchers head towards the centre of Bern on Monday © Keystone/peter Schneider The traditional Easter march has taken place in the Swiss capital, Bern. This year the “Walk for Peace” focused on issues including the climate and Russia’s invasion of Ukraine. Up to 1,000 people, waving rainbow-coloured peace flags, gathered by the River Aare on Monday. They walked along the river, within sight of the Ukrainian embassy at Helvetiaplatz, into the city and ended in...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org