See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Fundamental Developments The prices of the metals shot up last week, by $28 and $0.57. Heavy metals became pricier last week, but we should point out that the stocks of gold and silver miners barely responded to this rally in the metals, which very often (not always, but a very large percentage of the time) is a sign...

Read More »Central Bank Chiefs and Currencies

Summary: Market opinion on the next Fed chief is very fluid. BOE Governor Carney sticks to view, but short-sterling curve flattens. New Bank of Italy Governor sought. A second term for Kuroda may be more likely after this weekend election. The market is fickle. It has jumped from one candidate to another as the most likely Fed Chair. Until his belated and mild criticism of the President dealing with race issues,...

Read More »NAFTA Worries Take Toll, Yellen’s Best Guess Supports Greenback

Summary: Risk that NAFTA collapses weighs on CAD and MXN. Yen is slightly firmer despite US yields edging higher and weekend polls suggesting LDP could nearly secure a 2/3 majority of its own. The sterling is consolidating after sharp moves at the end of last week. (Greetings from San Francisco, where I will be speaking at a CFA seminar on currencies tomorrow. The rebuilding from destruction of the of...

Read More »Taleb Explains How He Made Millions On Black Monday As Others Crashed

Former trader and author of best-selling book “The Black Swan” sat down for an interview with Bloomberg News to mark the upcoming thirtieth anniversary of the stock-market crash that occurred on Oct. 19, 1987 – otherwise known as Black Monday. Taleb famously supercharged his career – and earned a considerable sum of money (though turns out it was less than Taleb felt he deserved) – thanks to his trading profits from...

Read More »Credit Suisse targeted for break-up by activist hedge fund

Tidjane ThiamTidjane Thiam, Credit Suisse CEO since 2015. (Keystone) - Click to enlarge A Swiss hedge fund is poised to launch an activist campaign to break up Credit Suisse, tapping into investor impatience with the progress of the bank’s turnround under chief executive Tidjane Thiam. RBR Capital Advisors, supported by Gaël de Boissard, a former Credit Suisse investment bank co-head, is set to unveil the...

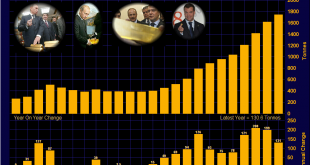

Read More »Neck and Neck: Russian and Chinese Official Gold Reserves

Official gold reserve updates from the Russian and Chinese central banks are probably one of the more closely watched metrics in the gold world. After the US, Germany, Italy and France, the sovereign gold holdings of China and Russia are the world’s 5th and 6th largest. And with the gold reserves ‘official figures’ of the US, Germany, Italy and France being essentially static, the only numbers worth watching are those...

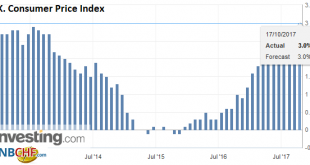

Read More »About Those “Hedonic Adjustments” to Inflation: Ignoring the Systemic Decline in Quality, Utility, Durability and Service

The quality, durability, utility and enjoyment-of-use of our products and services has been plummeting for years. One of the more mysterious aspects of the official inflation rate is the hedonic quality adjustments that the Bureau of Labor Statistics makes to the components of the Consumer Price Index (CPI). The basic idea is that when innovations improve the utility (and pleasure derived from) a product, the price is...

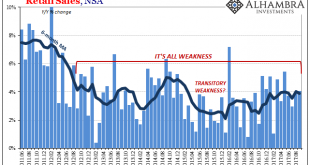

Read More »US Retail Sales: Retail Storms

Retail sales were added in September 2017 due to the hurricanes in Texas and Florida (and the other states less directly impacted). On a monthly, seasonally-adjusted basis, retail sales were up a sharp 1.7% from August. US Retail Sales, Jun 2011 - Aug 2017(see more posts on U.S. Retail Sales, ) - Click to enlarge The vast majority of the gain, however, was in the shock jump in gasoline prices. Retail sales at...

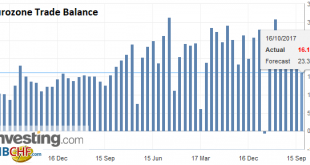

Read More »FX Weekly Preview: The Markets and the Long Shadow of Politics

Summary: Rise in paper asset prices, including so-called cyber currencies, reflects the abundance of capital. Have we forgotten what Minski taught again? Political considerations may dominate ahead of the ECB meeting later this month. Why should we think there is anything amiss by looking at the global capital markets? The S&P 500 and the German Dax are at record levels. The Japanese market is at 20-year...

Read More »Emerging Markets: Preview of the Week Ahead

Stock Markets EM FX closed the week on a firm note, as softer than expected US CPI data weighed on the dollar. We continue to believe that investors are underestimating the Fed’s tightening potential. Meanwhile, idiosyncratic political risk remains high for MXN, TRY, and ZAR. Stock Markets Emerging Markets, October 14 Source: economist.com - Click to enlarge China China reports CPI and PPI Monday. The former is...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org