Many demands for tax payments were not sent out (Keystone) The Federal Tax Administration’s IT project Insieme was a financial disaster and its replacement isn’t much better, according to the Swiss Federal Audit Office (SFAO). Systems are unreliable and underperforming, with billions in tax demands still outstanding. The old application for direct federal tax, withholding tax and stamp duty was replaced in October 2017...

Read More »Gloomy Signals for Euro Area Manufacturing

Weakness in the sector signals continuing downward trend. The euro area economy started the fourth quarter on a weak note; the flash composite PMI dipped to 52.7 in October from 54.1 in September. Both manufacturing and services showed a notable loss of momentum. A common feature in France and Germany was the weakness in manufacturing, where both countries posted similar declines. Part of the drop may reflect issues in...

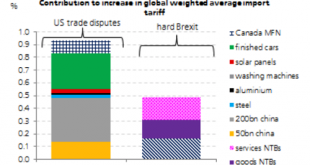

Read More »UBS Warns Trump’s Trade Fights Are ‘Reversing 15-Years Of Global Progress

Protectionism has cross-party support in the U.S., and nationalist parties continue to gain traction in Europe. Where there is inequality, there is a surge in protectionism; a risk that could trigger the next global economic crisis sometime around 2020. The Trump administration’s trade war and a hard Brexit could send tariffs to levels not seen in 15 years, according to UBS economist, as per Market Watch. The Swiss bank...

Read More »FX Daily, October 24: Disappointing Flash PMI Weighs on Euro

Swiss Franc The Euro has fallen by 0.31% at 1.1375 EUR/CHF and USD/CHF, October 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The US dollar is firmer against the major currencies and most emerging market currencies. While the seemingly fragile equity markets are still the center of investors’ attention, the weakness of the eurozone flash PMI is disconcerting...

Read More »Mountain regions to benefit from digital push

Economics Minister Schneider-Ammann (second from right) and his counterparts from Austria, Germany and Liechtenstein attended a panel discussion at the ETH Zurich on digitalisation. A campaign has been launched to promote digitalisation in small companies based in Swiss mountain regions. On Wednesday, the Federation of Adult Learningexternal link and Swiss Mountain Aidexternal link presented a project for companies with...

Read More »Monthly Macro Monitor – October 2018

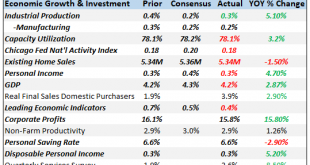

Stocks have stumbled into October with the S&P 500 down about 6% as I write this. The source of equity investors’ angst is always hard to pinpoint and this is no exception but this correction doesn’t seem to be due to concerns about economic growth. At least not directly. The most common explanation for the pullback in stocks – 6% doesn’t even qualify as a correction – is rising interest rates but I think it is a...

Read More »Europe Challenged

Europe is in an untenable position. It is being challenged on many fronts. A weaker euro need not result, but it is the path of least resistance. The economy has lost its momentum. What was first written off as a soft patch, now looks a bit more serious. This will be driven home by the flash PMI later this week, which is expected to fall to a two-year low. Draghi is likely to still put an optimistic spin on things, as...

Read More »FX Daily, October 23: Stock Slump Pushes Yields Lower and Buoys Yen

Swiss Franc The Euro has fallen by 0.13% at 1.14 EUR/CHF and USD/CHF, October 23(see more posts on EUR/CHF, USD/CHF, ) - Click to enlarge FX Rates Overview: There is one main story today, and that is the resumption of the slide in equities. It is having a ripple effect through the capital markets. Bond yields are tumbling. Gold is firm. The dollar is narrowly mixed, though the yen stands out with almost a 0.5%...

Read More »Cool Video: Bloomberg Discussion of Late US Cycle

An assessment of the US economy is an important input into the expectations of the dollar’s behavior in the foreign exchange market. As a currency strategist, my views of the US economy are often subsumed in discussions or talked about indirectly by talking about Fed policy. However, in this clip with Alix Steel and David Westin, I have an opportunity to sketch outlook for the US economy. I agree with those that do...

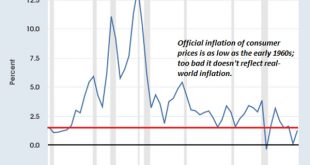

Read More »The Coming Inflation Threat

Falling asset inflation plus rising cost inflation equals stagflation. Inflation is a funny thing: we feel it virtually every day, but we’re told it doesn’t exist—the official inflation rate is around 2.5% over the past few years, a little higher when energy prices are going up and a little lower when energy prices are going down. Historically, 2.5% is about as low as inflation gets in a mass-consumption economy like...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org