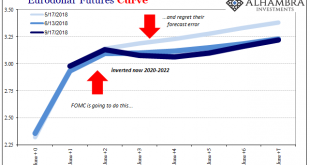

For Janet Yellen, during her somewhat brief single term she never made the same kind of effort as Ben Bernanke had. Her immediate predecessor, Bernanke, wanted to make the Federal Reserve into what he saw as the 21st century central bank icon. Monetary policy wouldn’t operate on the basis of secrecy and ambiguity. Transparency became far more than a buzzword. Way back in 2012, under Bernanke’s direction officials would...

Read More »Bankers are no longer Switzerland’s top earners

The gross median monthly salary in Switzerland is CHF6,502 (2018). The pharmaceutical industry and insurance companies have overtaken banking as the best paid sectors in Switzerland, according to the NZZ am Sonntag. In 2016, bank executives took home an average gross salary of CHF220,000 ($220,394) per year, which is CHF 40,000 less than ten years ago. The pharmaceutical sector, in contrast, is paying CHF280,000. The...

Read More »The Interesting Seasonal Trends of Precious Metals

Precious Metals Patterns Prices in financial and commodity markets exhibit seasonal trends. We have for example shown you how stocks of pharmaceutical companies tend to rise in winter due to higher demand, or the end-of-year rally phenomenon (last issue), which can be observed almost every year. Gold, silver, platinum and palladium are subject to seasonal trends as well. Although gold and silver are generally perceived...

Read More »The Ultimate Stablecoin, Report 18 Nov 2018

A long time ago in a galaxy far, far away we wrote a series of articles arguing that bitcoin is not money and is not sound. Bitcoin was skyrocketing at the time, as we wrote most of them between July 30 and Oct 1 last year. Back in those halcyon days, volatility was deemed to be a feature. That is, volatility in the upward direction was loved by everyone who said that bitcoin is money, in their desire to make money. In...

Read More »FX Daily, November 19: Does Monday’s Calm mean a Storm is Around the Corner?

Swiss Franc The Euro has fallen by 0.32% at 1.1378 EUR/CHF and USD/CHF, November 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: There is an uneasy calm in the global capital markets. Investors are digesting the weekend news, which includes the failure of APEC to issue a joint statement due to US-China tensions that we highlighted by dueling speeches by China...

Read More »FX Weekly Preview: Unfinished Business

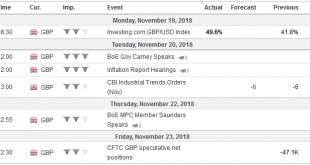

Often, and apparently wrongly attributed to Mark Twain is the observation that it is not what we know that gets into trouble, but “what we know that just ain’t so.” Now though, investors suffer from a different problem. Several processes are in motion, and there is little confidence in their outcomes. Among these are Brexit, US-China trade, the trajectory of Fed policy, and the EC’s efforts to enforce the agreed-upon...

Read More »Swiss civil servants incur CHF121 million in expenses

Diplomats and finance ministry officials have the highest travel-related expenses, The expenses of Swiss civil servants added up to CHF 121.7 million ($122 million) last year, according to the SonntagsBlick newspaper. Counting the 34,800 full-time positions in the federal administration in 2016, that level of spending amounts to almost CHF3,500 per civil servant. The biggest spender is the defence ministry, with an...

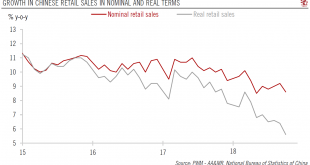

Read More »China hard data for October reveals mixed picture

Disappointing consumption numbers point to growth deceleration in early 2019, but government measures beginning to be felt. Hard data out of China for October was mixed. On the positive side, growth in infrastructure picked up, suggesting the government’s fiscal policy easing is taking effect in the real economy. Industrial production numbers stopped declining, and the mining sector has a particularly strong...

Read More »Minimum return on Swiss pensions unchanged

© Andrey Popov | Dreamstime.com A government commission looking at the rate, called for a reduction to 0.75%, while unions demanded a rise to 1.25%. In the end the Federal Council decided to take the middle road and leave the rate at 1% for 2019. The rate is the minimum pension funds must apply to employment related 2nd pillar pension assets in 2019. Some pension funds are concerned about the long term effect imposed...

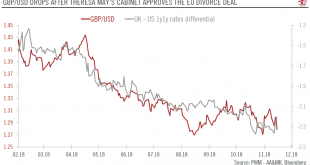

Read More »After May’s divorce deal: the road ahead for Brexit

But significant political challenges lie ahead before the 29 March deadline for Brexit. Sterling likely to be in the spotlight for several months. Theresa May’s cabinet has approved her divorce deal with the European Union (EU). A few cabinet secretaries have resigned, including Brexit Secretary Dominic Raab because the deal keeps the UK in a transitory ‘customs union’ with the EU, which in his view continues to give...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org