The demonstration in Lausanne was the latest in a series of regional protests against plans by the employers in the building sector. (Keystone) Construction workers have continued their protests against worsening labour conditions in Switzerland. An estimated 4,000 people took to the streets of Lausanne on Monday in the latest stage of a series of short regional strikes underway since mid-October. The trade unions have...

Read More »Talking Turkey

Turkey’s economic challenges arise from the imbalances created during the economic boom that saw poverty halved between 2002 and 2011, extensive urbanization, and integration in the world economy through trade and capital flows. The dramatic economic changes saw the rise of Erdogan, who was re-elected as President for a second term in June. His party (AKP) is joined by the Nationalists (MHP). The imbalances, amidst a...

Read More »Wizard’s First Rule, Report 4 Nov 2018

Terry Goodkind wrote an epic fantasy series. The first book in the series is entitled Wizard’s First Rule. We recommend the book highly, if you’re into that sort of thing. However, for purposes of this essay, the important part is the rule itself: “Wizard’s First Rule: people are stupid.” “People are stupid; given proper motivation, almost anyone will believe almost anything. Because people are stupid, they will believe...

Read More »Pushing Past the Breaking Point

Schemes and Shams Man’s willful determination to resist the natural order are in vain. Still, he pushes onward, always grasping for the big breakthrough. The allure of something for nothing is too enticing to pass up. Systems of elaborate folly have been erected with the most impossible of promises. That prosperity can be attained without labor. That benefits can be paid without taxes. That cheap credit can make...

Read More »Does the recent spate of Central Bank gold buying impact demand and price?

There has been a lot of media coverage recently about the re-emergence of central bank gold buying and the overall larger quantity of gold than central banks as a group have been buying recently compared to previous years. For example, according to the World Gold Council’s Gold Demand Trends for Q3 2018, net purchases of gold by central banks in the third quarter of this year were 22% higher than Q3 2017, and the...

Read More »Federal office decides drug price cuts

A trip to the pharmacy could soon be cheaper (© KEYSTONE / GAETAN BALLY) - Click to enlarge There will be an average drop of almost 20% in the price of 288 medicines from December 1, the Federal Office of Public Health says. Savings of around CHF100 million ($100 million) are expected. The move comes at a time of debate over the high costs of medicines in Switzerland. The price reduction, which averages 18.8%, will...

Read More »FX Weekly Preview: Stocks, Trade, and the Fed in the Week Ahead

Last month’s downdraft in equities spooked investors. The fear that is often expressed is that the end of the business cycle may coincide with the end of a credit cycle and a return to 2008-2009 crisis. It seems like an increasing number of economists agree with the sentiment expressed by President Trump that the Fed is too aggressive. Of course, they do not think the president should comment on Fed policy, but they...

Read More »Turn Off, Tune Out, Drop Out

An unknown but likely staggeringly large percentage of small business owners in the U.S. are an inch away from calling it quits and closing shop. Timothy Leary famously coined the definitive 60s counterculture phrase, “Turn on, tune in, drop out” in 1966. (According to Wikipedia, In a 1988 interview with Neil Strauss, Leary said the slogan was “given to him” by Marshall McLuhan during a lunch in New York City.) An...

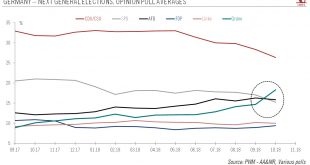

Read More »The Beginning of the End for Angela Merkel

The transition to new leadership in Germany could have implications for Europe as a whole. As a consequence of the heavy drop of support in recent regional elections, Chancellor Merkel has declared she would not run again for leadership of the CDU at the 6-8 December party convention. Merkel also said she would retire from politics at the end of the current parliament in 2021. It is questionable whether she will get...

Read More »Geneva Aims for a New Company Tax Rate of 13.79 percent

According to bilan.ch, Geneva’s Council of State, or executive, has put forward a proposed corporate tax rate of 13.79% as part of its tax reform project, work triggered by international pressure on Switzerland and its cantons to remove preferential tax treatment for certain international companies. ©-Sam74100-_-Dreamstime.com_ - Click to enlarge This rate is the same as the rate already accepted by the government and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org