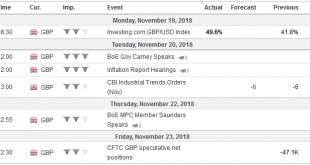

Often, and apparently wrongly attributed to Mark Twain is the observation that it is not what we know that gets into trouble, but “what we know that just ain’t so.” Now though, investors suffer from a different problem. Several processes are in motion, and there is little confidence in their outcomes. Among these are Brexit, US-China trade, the trajectory of Fed policy, and the EC’s efforts to enforce the agreed-upon...

Read More »Swiss civil servants incur CHF121 million in expenses

Diplomats and finance ministry officials have the highest travel-related expenses, The expenses of Swiss civil servants added up to CHF 121.7 million ($122 million) last year, according to the SonntagsBlick newspaper. Counting the 34,800 full-time positions in the federal administration in 2016, that level of spending amounts to almost CHF3,500 per civil servant. The biggest spender is the defence ministry, with an...

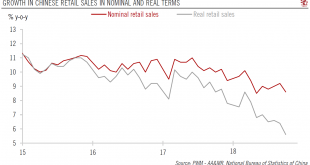

Read More »China hard data for October reveals mixed picture

Disappointing consumption numbers point to growth deceleration in early 2019, but government measures beginning to be felt. Hard data out of China for October was mixed. On the positive side, growth in infrastructure picked up, suggesting the government’s fiscal policy easing is taking effect in the real economy. Industrial production numbers stopped declining, and the mining sector has a particularly strong...

Read More »Minimum return on Swiss pensions unchanged

© Andrey Popov | Dreamstime.com A government commission looking at the rate, called for a reduction to 0.75%, while unions demanded a rise to 1.25%. In the end the Federal Council decided to take the middle road and leave the rate at 1% for 2019. The rate is the minimum pension funds must apply to employment related 2nd pillar pension assets in 2019. Some pension funds are concerned about the long term effect imposed...

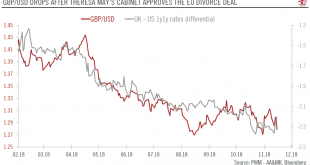

Read More »After May’s divorce deal: the road ahead for Brexit

But significant political challenges lie ahead before the 29 March deadline for Brexit. Sterling likely to be in the spotlight for several months. Theresa May’s cabinet has approved her divorce deal with the European Union (EU). A few cabinet secretaries have resigned, including Brexit Secretary Dominic Raab because the deal keeps the UK in a transitory ‘customs union’ with the EU, which in his view continues to give...

Read More »Home-care services increase, nursing home stays stagnate

A Spitex employee checks on an old lady at her home in Biel, northwestern Switzerland Better at home than in a home: almost 350,000 people made use of assistance and home-care services (Spitex) last year, 10,000 more than in 2016. In contrast, the number of residents of old-age and nursing homes remained constant at 149,000, 15% of them for a short stay. Spitexexternal link, a Swiss non-profit organisation that provides...

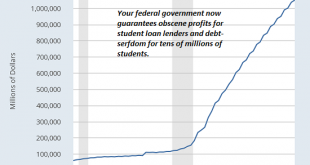

Read More »Does Any of This Make Sense?

Does any of this make sense? No. But it’s so darn profitable to the oligarchy, it’s difficult to escape debt-serfdom and tax-donkey servitude. We rarely ask “does this make any sense?” of things that are widely accepted as beneficial – or if not beneficial, “the way it is,” i.e. it can’t be changed by non-elite (i.e. the bottom 99.5%) efforts. Of the vast array of things that don’t make sense, let’s start with borrowing...

Read More »FX Daily, November 16: Turning Brexit into a Dog’s Breakfast

Swiss Franc The Euro has risen by 0.17% at 1.1422 EUR/CHF and USD/CHF, November 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: It is the height of irony or tragedy that what was offered as a non-binding referendum on UK’s membership in the European Union to bring the country, or at least the Tory Party, together is the most destabilizing event since the UK...

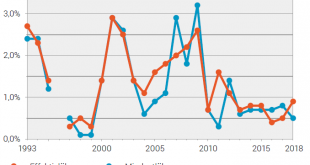

Read More »Swiss wage index 2018: Real and minimum wages increased by 0.9 percent and 0.5 percent respectively in 2018

16.11.2018 – The social partners signatory to Switzerland’s main collective labour agreements (CLA) agreed a nominal rise in real wages of 0.9% and a nominal rise in minimum wages of 0.5% for 2018. Real wages increased by 0.3% at collective level and by 0.6% at individual level. These are the some of the results of the wage agreements survey carried out by the Federal Statistical Office (FSO). Wage adjustments in...

Read More »Switzerland’s rising rate of farm suicide

© Leonid Eremeychuk | Dreamstime.com The high and rising suicide rate among Switzerland’s male farmers stands in contrast to the declining rate among rural men working in other professions, according to a new study by the University of Bern published by the newspaper SonntagsZeitung. The rate among rural men working outside farming is 33 per 100,000, compared to 38 per 100,000 among farmers, a rate that has risen since...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org