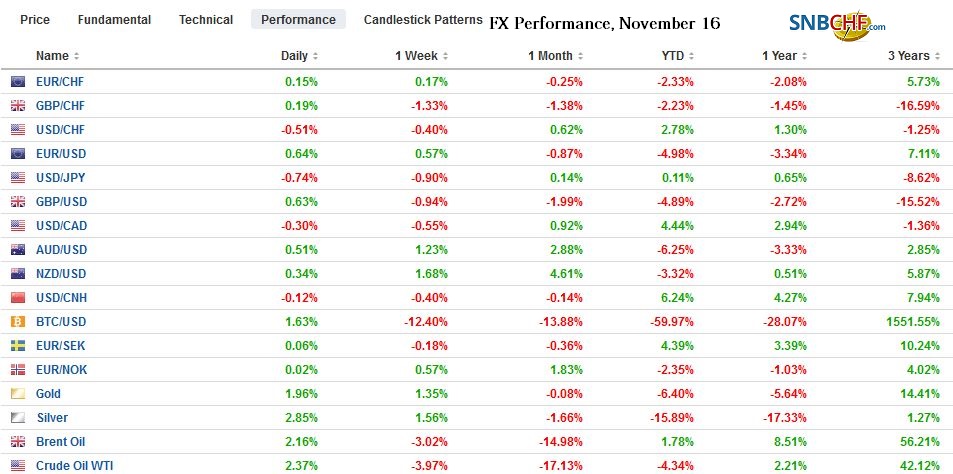

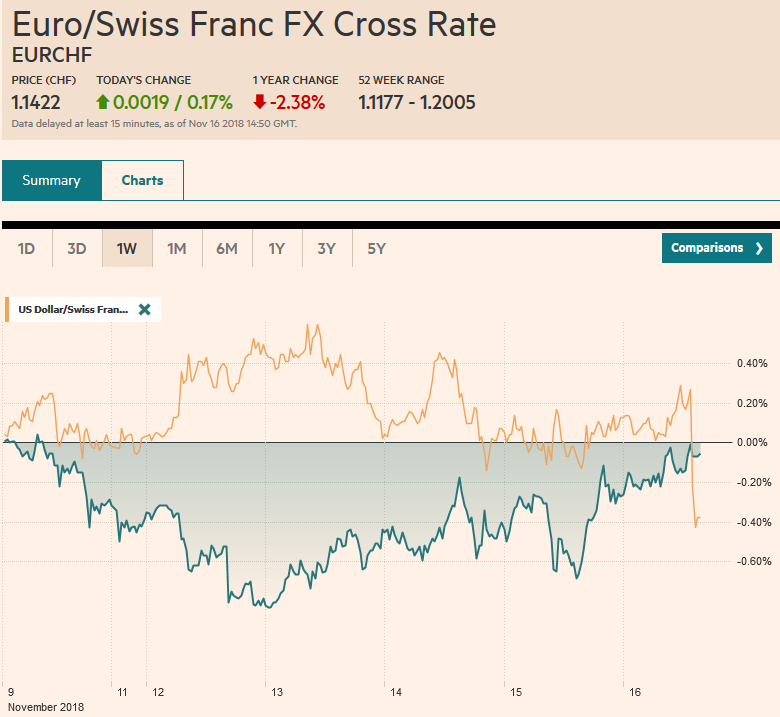

Swiss Franc The Euro has risen by 0.17% at 1.1422 EUR/CHF and USD/CHF, November 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: It is the height of irony or tragedy that what was offered as a non-binding referendum on UK’s membership in the European Union to bring the country, or at least the Tory Party, together is the most destabilizing event since the UK unceremoniously quit the European Exchange Rate Mechanism more than a quarter of a century ago. Sterling has stabilized for the moment, but reports indicate that Prime Minister May is unlikely to survive a vote of confidence. Asian equities were mostly higher, but Japan and Taiwan markets were dragged down

Topics:

Marc Chandler considers the following as important: $CNY, 4) FX Trends, AUD, Brexit, EUR, Featured, JPY, MXN, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.17% at 1.1422 |

EUR/CHF and USD/CHF, November 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: It is the height of irony or tragedy that what was offered as a non-binding referendum on UK’s membership in the European Union to bring the country, or at least the Tory Party, together is the most destabilizing event since the UK unceremoniously quit the European Exchange Rate Mechanism more than a quarter of a century ago. Sterling has stabilized for the moment, but reports indicate that Prime Minister May is unlikely to survive a vote of confidence. Asian equities were mostly higher, but Japan and Taiwan markets were dragged down by the chipmakers following the more news from Nvidia and Applied Materials. European shares are firmer, and the Dow Jones Stoxx 600 is about 0.3% higher, leaving it around 1.65% lower on the week. US shares are trading lower, and the S&P 500 will begin the session off about 1.8% for the week after gaining about 4.5% over the past two weeks. Bond markets are mixed. Yields slipped in Asia, and the 10-year JGB yield has finished the week below 10 bp, the previous BOJ cap. Core bond yields in Europe are slightly firmer, with the UK’s 10-year Gilt yield up a couple of basis points after falling 13 bp yesterday. The US 10-year yield has not risen since November 8 but is threatening to end the streak today. In the foreign exchange market, the US dollar is little heavier against most of the major currencies, but the Australian and New Zealand dollars which are paring this week’s gains. Oil is trading higher for the third consecutive session. |

FX Performance, November 16 |

Asia Pacific

Many participants want to believe that the bellicose rhetoric from the White House is part of the way it negotiates and that an agreement with China is likely. After not formally engaged in talks in recent months, the resumption of discussions last week is spun as “increasing efforts.” The same people who negotiated the agreement earlier this year, which was later rejected by Trump, are leading the talks now. China formally responds to US and stakes out its position as it has been for some time, and investors are told they are compromising. On the other hand, as US importers tried to build up some inventory ahead of new tariffs, the US bilateral trade balance with China widened to new a new record and some cite this as evidence the US is losing the trade war. Separately, China has reduced the tariff on US LNG to 10% from 25%, ostensibly because it was hurting itself.

US Commerce Secretary Ross, who reports suggest may be replaced soon, offered a bit of realism amidst the inflated hopes. Ross indicated that when Trump and Xi meet at the month-end G20 meeting, only a broad framework of talks can be agreed, meaning that no deal will be struck. The US is prepared to raise the 10% tariff on $200 bln of Chinese goods to 25% on January 1. Trump also threatened to slap another tariff on the remaining Chinese imports but has yet to formally start the process. Meanwhile, a clash between Kudlow and Navarro over China has seen the former come on top of the skirmish but is not seen effecting Trump Administration’s position. Note that Vice President Pence is delivering a speech over the weekend on what the administration has dubbed the Indo-Pacific. In a series of speeches, Pence has laid out a view of the strategic not simply trade challenge China poses. Although the US administration may not recognize the importance of words, it seems to be unrealistic to think its adversary’s share this penchant. It seems unreasonable to expect Chinese officials to negotiate in good faith with continued threats.

The dollar was straddling the JPY114 area to start the week and is finishing new the lows of the week a little above JPY113, where an $830 mln option is set to expire today. The technical indicators warn a break is likely in the coming days, and the next immediate target is near JPY112.50-80. The Australian dollar was turned back from $0.7300 yesterday, and it is consolidating today. There are A$980 mln options at $0.7275 that will be cut today. Given that many players see the Aussie as a proxy for China, we suspect it is vulnerable to disappointing news on the trade front. A break of the $0.7160 area would be seen as confirmation of that a top is in place.

Europe

Brexit remains the main issue. Four ministers resigned yesterday, and Gove turned down the top Brexit job because May refused his demand that he try renegotiating with the EC. The EC also has rejected a re-opening of negotiations at this juncture. Raab, who helped negotiate the “deal” resigned shortly after it in protest, which befuddled observers. The unionist party from Northern Ireland (DUP), which provided the Tories with the votes to secure a majority after it failed to do so on its own in last year’s election, has reportedly (Telegraph) threatened to pull its support unless May is replaced. Other reports suggest that there are enough signatures (1922 Committee) to hold a confidence vote. The Tories are in disarray. A loss of a confidence vote would likely trigger new elections, and the prospects of a Labour-led government scares investors. It will take a few days for the situation to clarify.

Sterling reached roughly $1.2725 yesterday (the low for the year is near $1.2660) and has recovered to about $1.2835 today, apparently as some momentum players book some profits ahead of the weekend. There are nearly GBP400 mln on an option at $1.2765 and another GBP950 mln at $1.28 that expire today. Although the volatility and uncertainty will deter many participants, look for corrective upticks above $1.2850 to be pounced upon by the bears.

The euro needs to finish the North American session today above $1.1335 or it will extend its losing streak for the fifth consecutive week. The single currency has advanced for only one week since September 21. The euro briefly poked above $1.1360 but has been sold off in the European session. There is a $1.1340 option for about 750 mln euros that expires today and 1.4 bln euros at $1.1300 that also will be cut.

North America

Quietly and without much fanfare, investors’ expectations for Fed policy next year is being scaled back. Over the past week, the implied yield for next June and December have eased by around a dozen basis points. Roughly half of the decline can be accounted for by shifting expectations for as early as Q1 19. The implied yield of the April contract fallen about seven basis points this week. Fed Chair Powell’s speech this week acknowledged potential headwinds that could emerge next year, but he gave no reason to think the Fed would not hike next month and the early part of next year. The April fed funds futures contract was already moving higher before Powell spoke and is taking a six-day rally into today’s session.

Separately, some are playing up yesterday’s comments by the Fed’s Bostic and Kashkari. Both expressed concern about the slowing of world growth as a reason to give the Fed pause. Yet these are among the most dovish regional presidents, who have opposed every rate hike or nearly so. The foreign slowdown story is only their latest arguments. And part of the problem with the global slowdown story is that the contraction in the world’s third and fourth largest economies (Japan and Germany respectively) were anomalies and both economies appear to have resumed their expansion at the start of Q4.

The US reports October industrial production and manufacturing output. Both are expected to have increased by 0.2%. It tends not to move the markets. The Treasury’s International Capital (TIC) report will be released after the markets close today. Consider that the TIC data has tracked an average inflow of $106 bln a month this year through August, compared with an average of almost $36 bln a month in 2017. Some observers prefer to focus on long-term instruments. The average of long-term inflows is almost $60 bln a month through August, a little more than twice the average of the same period in last year.

Mexico’s central bank hiked the overnight rate yesterday by 25 bp to 8.00% as widely expected. The accompanying commentary was hawkish and the central bank staked out a position independent and antagonistic to the new government, which has yet to take office. Another rate hike at the next meeting (December 20) appears largely discounted. One board member called for a 50 bp hike. In the unusually pointed statement, the central bank argued that it had to take action because of the policy uncertainty, including the cancellation of the $13 bln project to build a new airport, that undermined the peso. The depreciation of the peso poses a risk to the central bank’s anti-inflation efforts.

Ten new projects may put to voters by the end of the month. Meanwhile, the resignation of the deputy governor of the central bank (reportedly for health reasons) means that AMLO will be able to name two of the five board members in the first few weeks of his term, which begins next month. The US dollar tested the MXN20.50 area, a five-month high Tuesday and Wednesday and found support yesterday near MXN20.20, which may denote the near-term range. We like it higher.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$AUD,$CNY,$EUR,$JPY,Brexit,Featured,MXN,newsletter