But significant political challenges lie ahead before the 29 March deadline for Brexit. Sterling likely to be in the spotlight for several months. Theresa May’s cabinet has approved her divorce deal with the European Union (EU). A few cabinet secretaries have resigned, including Brexit Secretary Dominic Raab because the deal keeps the UK in a transitory ‘customs union’ with the EU, which in his view continues to give the EU too much influence on UK affairs. The next step is formal approval of the deal by EU leaders at a 25 November summit.The biggest challenge facing May’s deal is UK parliamentary approval by mid-December as the ‘hard Brexiteers’ within the Conservative party oppose it. The Labour party also rejects

Topics:

Thomas Costerg considers the following as important: 2) Swiss and European Macro, Brexit, British Pound, Dominic Raab, European Union, Featured, Macroview, newsletter, Pictet Macro Analysis, Theresa May, U.K., UK sterling

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

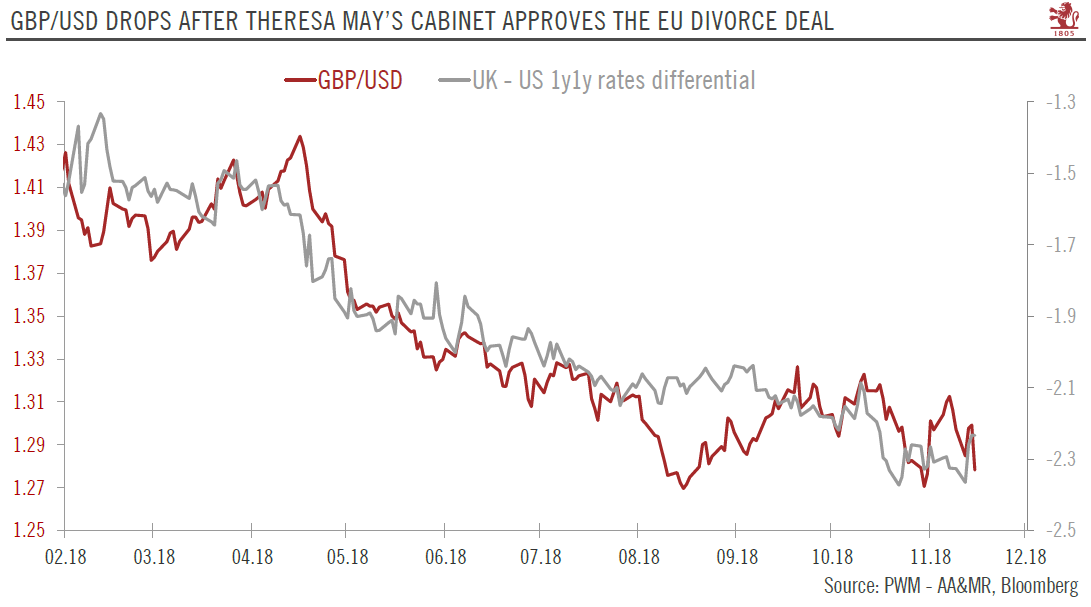

But significant political challenges lie ahead before the 29 March deadline for Brexit. Sterling likely to be in the spotlight for several months.

Theresa May’s cabinet has approved her divorce deal with the European Union (EU). A few cabinet secretaries have resigned, including Brexit Secretary Dominic Raab because the deal keeps the UK in a transitory ‘customs union’ with the EU, which in his view continues to give the EU too much influence on UK affairs.

The next step is formal approval of the deal by EU leaders at a 25 November summit.The biggest challenge facing May’s deal is UK parliamentary approval by mid-December as the ‘hard Brexiteers’ within the Conservative party oppose it. The Labour party also rejects the deal and wants new elections instead, even though a small group of Labour members of parliament (MP) could dissent and vote their approval. In the near term, Theresa May could face a no-confidence motion, ensuring political uncertainty remains elevated.

| The tail risk of a no-deal Brexit on 29 March remains high, although there could still be room for some alternatives, including extension of the March deadline—for instance if new elections were called. More positively, the end-march deadline offers breathing room to find alternative options should the divorce deal be rejected by the British Parliament. There could also be a second parliamentary vote, potentially tied to the promise of a second referendum on the EU. Although there is considerable uncertainty, our base case scenario is for the British parliament ultimately to approve May’s divorce deal (or at least an amended version of it).

New elections could add to economic uncertainty, especially as the pro-business credentials of some Labour leaders are in doubt. We remain cautious on sterling (GBP) relative to the US dollar (USD) in the short term given the high political uncertainty. Our three-month forecast is for a GBP/USD rate of USD1.27. |

GBP/USD drops after Theresa May's cabinet approves the Eu divorce deal(see more posts on GBP/USD, ) |

Tags: Brexit,British Pound,Dominic Raab,European Union,Featured,Macroview,newsletter,Theresa May,U.K.,UK sterling