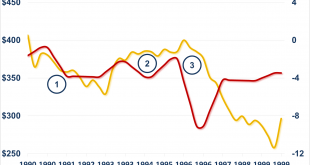

Gold market analysts have for many years puzzled over the unusual behaviour of the gold market during the 1990s, specifically the bizarrely flat gold price from 1993 to 1996 in the face of sustained selling pressure from central banks and gold miners hedging their production. To-date no one has been able to identify the hidden source of demand that was obviously supporting the gold market during that period. In addition, conventional justifications that accelerated sales by central banks...

Read More »The Path to the Final Crisis

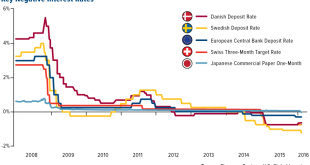

Reader Questions on Negative Interest Rates Our reader L from Mumbai has mailed us a number of questions about the negative interest rate regime and its possible consequences. Since these questions are probably of general interest, we have decided to reply to them in this post. The NIRP club – negative central bank deposit rates – click to enlarge. Before we get to the questions, a few general remarks: negative interest rates could not exist in an unhampered free market. They are an...

Read More »Are We Becoming a Nation of Silver-Haired Crooks?

A Salutary Effect BALTIMORE – “Ike and Dick Sure to Click” was an exciting election slogan. Their Democratic opponents, Adlai Stevenson and Estes Kefauver, had their snazzy campaign jingle, too: “Adlai and Estes… They’re the Bestes.” Surely, the men behind these slogans had their private hungers and perversions. But they kept them to themselves. The 1956 presidential election campaign was a dull affair. Google “Adlai Stevenson’s wife,” and you will get only the barest biographical...

Read More »The Pitfalls of Currency Manipulation – A History of Interventionist Failure

The G-20 and Policy Coordination Readers may recall that the last G20 pow-wow (see “The Gasbag Gabfest” for details) featured an uncharacteristic lack of grandiose announcements, a fact we welcomed with great relief. The previously announced “900 plans” which were supposedly going to create “economic growth” by government decree seemed to have disappeared into the memory hole. These busybodies deciding to do nothing, is obviously the best thing that can possibly happen. Yuan, weekly –...

Read More »Silver Relative Strength Report, 27 Mar, 2016

Gold went down (as the muggles would measure it, in dollars). It dropped almost 40 bucks. Silver fell almost 60 cents. Since silver fell proportionally farther than gold, the gold-silver ratio went up. Why do we keep reiterating that gold goes nowhere, that it’s the dollar which mostly goes down over long periods of time and sometimes up as in 2011-2015? Why do we insist that the dollar be measured in gold, and that gold cannot be measured in dollars the way a steel meter stick cannot be...

Read More »Silver Gone Wild Report, 20 Mar, 2016

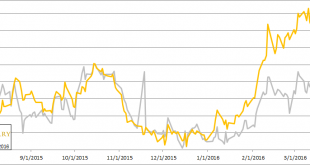

Early on Monday morning (Arizona time), silver began to rise. From its close on Friday of $15.46, it ran up to $15.82. Then it began to slide, eventually dropping to $15.17 by midmorning on Wednesday. Then… *BAM* The Fed said not a lot. It will go on manipulating the rate of interest rate to the same level as it had been previously. This was not what the market was expecting, as many believed the Fed was on the war rate-hiking path. Lower interest means more quantity of money dollars which...

Read More »Supply and Demand Report, 13 Mar, 2016

On the week, the prices of the metals didn’t move all that much. However, the move around 6am (Arizona time) on Thursday is notable. The price of silver spiked up from around $15.12 to $15.64—3.4%—by around 8am. Twelve hours later, the price touched $15.73 before sliding off. We are always interested in the fundamentals, as we watch price moves. The question is always: is this speculators, betting with leverage on the silver price using futures? Or is it industrial or stacker demand for...

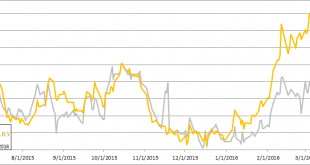

Read More »Gold-Silver Ratio Reversal Report, 6 Mar, 2016

So the price of silver rocketed up 80 cents, while the price of gold jumped $37. Silver is now more expensive than it was two weeks ago; the price decline of last week was more than overcompensated. This pushed the gold-silver ratio down about two whole points, with virtually the whole move on Friday. Last week, we said this: Monetary Metals has been predicting a ratio well over 80 for a long time. And for two months, we have been calling for it to go much higher still. Could there be a...

Read More »Interest on Gold Is the New Tempest in a Teapot

Zero Hedge published an article on Canadian Bullion Services (CBS) last week. Other sites ran similar articles. The common thread through these articles, and in the user comments section, is that CBS is committing criminal fraud. Or, if not, then it’s a conspiracy by the Canadian government to confiscate gold. Terms like fractional reserve and re-hypothecation were dusted off for the occasion. I don’t know anything about this company other than what I read that day. I am writing today to...

Read More »Gold-Silver Ratio Breakout Report, 28 Feb, 2016

The gold to silver ratio moved up very sharply this week, +4.2%. How did this happen? It was not because of a move in the price of gold, which barely budged this week. It was due entirely to silver being repriced 66 cents lower. This ratio is now 83.2. It takes 83.2 ounces of silver to buy an ounce of gold. Conversely, it takes 1/83.2oz (about 0.37 grams) of gold to buy an ounce of silver. This ratio is now within a hair’s breadth of breaking out past the high set on Oct 17, 2008. See the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org