Tensions over North Korea’s nuclear programme look set to continue, but we believe the chances of a military conflict are low in the near term.The tensions between North Korea and the US that rose a notch in early August are rooted in the deep sense of insecurity of the regime of Kim Jong Un. A significant new stage in North Korea’s nuclear programme has now been reached, and the regime appears to believe that developing a credible nuclear deterrent is necessary to guarantee its survival.Despite the heated rhetoric on both sides, we believe a military conflict between the US and North Korea remains a low probability in the near term. For Kim Jong Un, an attack on the US or its allies would be suicidal. For the US, the risk of devastation to South Korea’s capital, Seoul, make the barrier

Topics:

Dong Chen considers the following as important: Asian markets North Korea, Geopolitical tensions North Korea, Korea escalation markets, Macroview, US-Chinese relations, US-North Korean conflict

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Tensions over North Korea’s nuclear programme look set to continue, but we believe the chances of a military conflict are low in the near term.

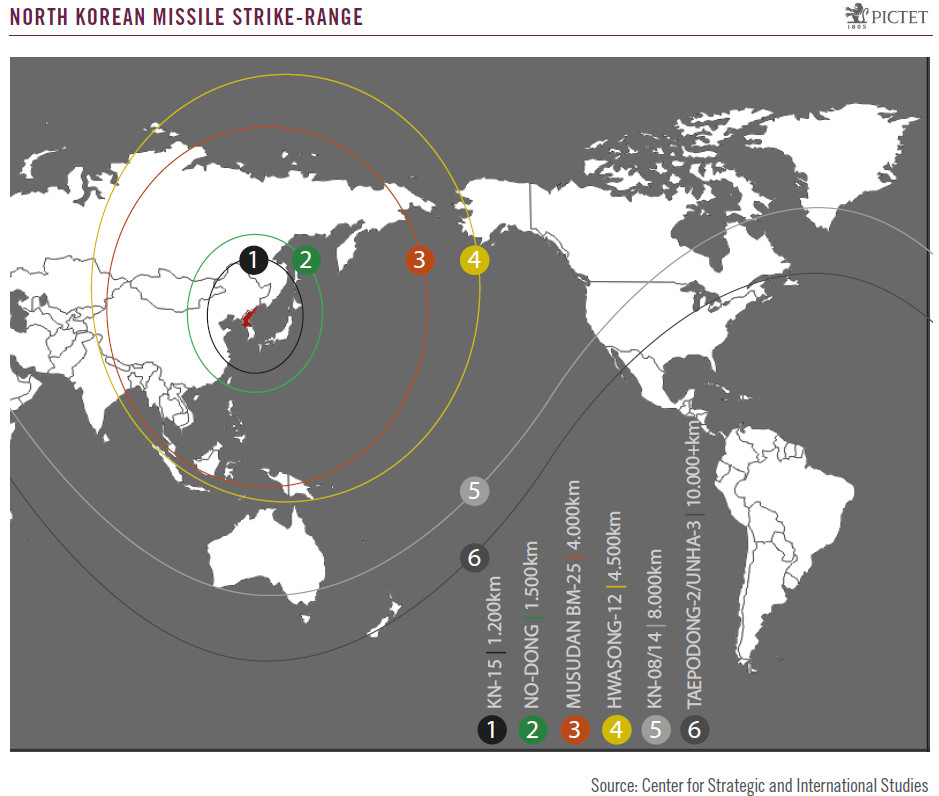

The tensions between North Korea and the US that rose a notch in early August are rooted in the deep sense of insecurity of the regime of Kim Jong Un. A significant new stage in North Korea’s nuclear programme has now been reached, and the regime appears to believe that developing a credible nuclear deterrent is necessary to guarantee its survival.

Despite the heated rhetoric on both sides, we believe a military conflict between the US and North Korea remains a low probability in the near term. For Kim Jong Un, an attack on the US or its allies would be suicidal. For the US, the risk of devastation to South Korea’s capital, Seoul, make the barrier to military action extremely high.

The latest escalation led to a spike in equity volatility and temporary pressure on markets in early August, but our portfolios are well protected should further tensions lead to a major market sell-off. Given that we do not expect a full-scale conflict, and that high valuations are currently the main obstacle to buying Asian assets, we would be inclined to view such a sell-off as a buying opportunity.

Although we cannot ignore there is a risk of miscalculation, exacerbated by the aggressive rhetoric and posturing on both sides, our base-case scenario on a 12-month horizon is for a continuation of the current stand-off between the US and North Korea. Pyongyang will likely carry out more missile tests, or even nuclear tests, which will lead to spikes in tensions. In the longer term, potential scenarios are: the world learns to live with a nuclear-armed North Korea, with the US relying on its own nuclear deterrent; a negotiated solution is achieved; or the Kim regime collapses.

The risks posed by North Korea should be seen not just in isolation, but also in terms of how they play into the geopolitically pivotal US-China relationship. China is seeking a negotiated solution. But the Trump administration could seek to pressure China, for example by moves on trade protectionism, to do more to rein in the Kim regime.