The BoJ is keeping its policies unchanged, and there is no change in our scenario regarding its future policy moves.In July’s monetary policy meeting, the Bank of Japan (BoJ) decided to keep its monetary easing programme unchanged, maintaining its qualitative and quantitative easing (QQE) with yield-curve control (YCC). In addition, the BoJ cut its inflation estimates for the current and next fiscal years, and revised its expectation for hitting its 2% target to one year later than the previous projection.The reason for the BoJ to stay put despite other central banks’ tightening is that inflation in Japan is showing very little momentum so far, way below what the BoJ hopes to achieve.In September 2016, the BoJ reinforced its monetary easing stance by committing to overshooting the 2%

Topics:

Dong Chen considers the following as important: Bank of Japan policy, Japan GDP, Japanese growth, Japanese inflation, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The BoJ is keeping its policies unchanged, and there is no change in our scenario regarding its future policy moves.

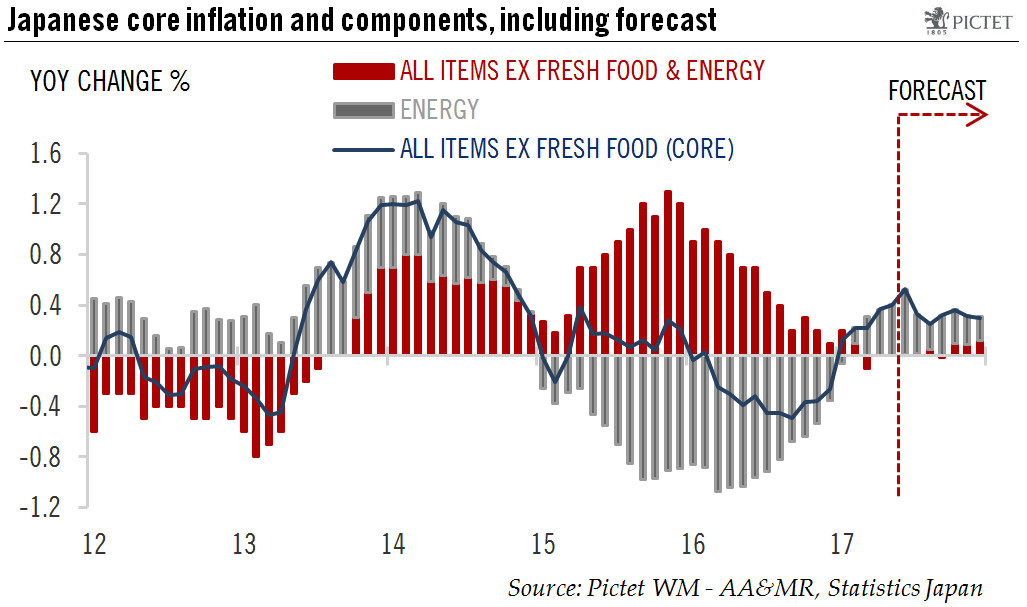

In July’s monetary policy meeting, the Bank of Japan (BoJ) decided to keep its monetary easing programme unchanged, maintaining its qualitative and quantitative easing (QQE) with yield-curve control (YCC). In addition, the BoJ cut its inflation estimates for the current and next fiscal years, and revised its expectation for hitting its 2% target to one year later than the previous projection.

The reason for the BoJ to stay put despite other central banks’ tightening is that inflation in Japan is showing very little momentum so far, way below what the BoJ hopes to achieve.

In September 2016, the BoJ reinforced its monetary easing stance by committing to overshooting the 2% inflation target. In our view, the further delay to achieving the inflation target, combined with the inflation overshoot commitment, implies that policy normalisation by the BoJ is still very far away.

This means the BoJ will keep nailing the 10-year Japanese government bond (JGB) yield at about 0% and keep the short-term policy rate at -0.1%. So far the BoJ has been quite successful in controlling the yield curve, and there has not been any sign that it will deviate from this strategy any time soon.

In conclusion, no surprise from BoJ’s July policy meeting, and no change in our scenario regarding the BoJ’s future policy moves.