Stocks have stumbled into October with the S&P 500 down about 6% as I write this. The source of equity investors’ angst is always hard to pinpoint and this is no exception but this correction doesn’t seem to be due to concerns about economic growth. At least not directly. The most common explanation for the pullback in stocks – 6% doesn’t even qualify as a correction – is rising interest rates but I think it is a...

Read More »We Need a Free Market in Interest Rates

We do not have a free market in interest rates today. We have not had one since the creation of the Fed in 1913. The Fed began buying bonds almost immediately, which pushes up the price and hence pushes down the interest rate. However, as I discuss in my theory of interest and prices, the Fed creates a resonant system with positive feedback loops. It wants lower rates (so the government can borrow more, more cheaply)...

Read More »Monthly Macro Monitor – September

This has already been one of the longest economic expansions on record for the US and there is little in the data or markets to indicate that is about to come to an end. Current levels of the yield curve are comparable to late 2005 in the last cycle. It was almost two years later before we even had an inkling of a problem and even in the summer of 2008 – nearly three years later – there was still a robust debate about...

Read More »Illicit Arbitrage Cut by Tax Cuts and Jobs Act, Report 3 Sep 2018

This week, we are back to our ongoing series on capital destruction. Let’s consider the simple transaction of issuing a bond. Party X sells a bond to Party Y. We will first offer something entirely uncontroversial. If the interest rate rises after Y buys the bond, then Y takes a loss. Or if the interest rate falls, then Y makes a capital gain. This is simply saying that the bond price moves inverse to the interest...

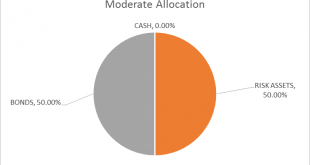

Read More »Global Asset Allocation Update

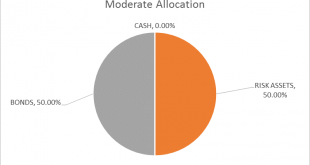

The risk budget is unchanged again this month. For the moderate risk investor, the allocation between bonds and risk assets is evenly split. The only change to the portfolio is the one I wrote about last week, an exchange of TIP for SHY. Interest rates are on the rise again, the 10 year Treasury yield punching through 3% again this morning. That is an indication that growth and/or inflation expectations have risen...

Read More »Global Asset Allocation Update

Note: This will be a short update. We are shifting the timing of some of our reports. The monthly Global Asset Allocation update will now be published in the first week of the month, aiming for the first of each month. I’ll put out a full report next week. The Bi-Weekly Economic Review is shifting to a monthly update, published on the 15th of each month. We are doing this to make room for some new reports, podcasts and...

Read More »Great Graphic: US 2-year Premium Grows and Outlook for G3 Central Banks

A cry was heard last week when President Trump expressed displeasure with the Fed’s rate hikes. Some, like former Treasury Secretary Lawrence Summers, claimed that this was another step toward becoming a “banana republic.” Jeffrey Sachs, another noted economist, claimed that “American democracy is probably one more war away from collapsing into tyranny.” The line that Trump supposedly crossed did not change investors’...

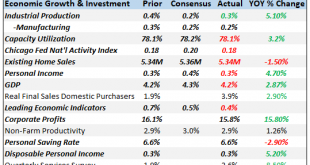

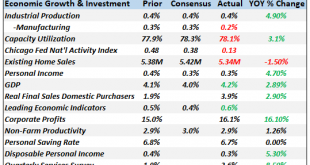

Read More »Bi-Weekly Economic Review

This will be a fairly quick update as I just posted a Mid-Year Review yesterday that covers a lot of the same ground. There were, as you’ll see below, some fairly positive reports since the last update but the markets are not responding to the better data. Markets seem to be more focused on the trade wars and the potential fallout. I would also note that at least some of the recent strength in the data is related to...

Read More »Great Graphic: Two-year Rate Differentials

Given that some of the retail sales that were expected in June were actually booked in May is unlikely to lead to a large revision of expectations for Q2 US GDP, the first estimate of which is due in 11 days. Before the data, the Atlanta Fed’s GDP Now projects the world’s biggest economy expanded at an annualized pace of 3.9% in Q2. If true, it would be the strongest quarterly expansion since Q3 14, when the economy...

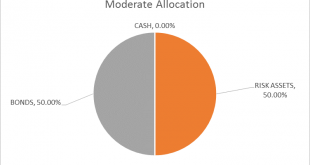

Read More »Global Asset Allocation Update

The risk budget is unchanged this month. For the moderate risk investor the allocation to bonds and risk assets is evenly split. There are changes this month within the asset classes. How far are we from the end of this cycle? When will the next recession arrive and more importantly when will stocks and other markets start to anticipate a slowdown? These are critical questions for investors and ones that can’t be...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org