Note: This will be a short update. We are shifting the timing of some of our reports. The monthly Global Asset Allocation update will now be published in the first week of the month, aiming for the first of each month. I’ll put out a full report next week. The Bi-Weekly Economic Review is shifting to a monthly update, published on the 15th of each month. We are doing this to make room for some new reports, podcasts and videos. The risk budget is unchanged this month. For the moderate risk investor, the allocation to bonds and risk assets is evenly split. There are changes this month within the asset classes. 50-50 Risk budget - Click to enlarge The only change to the portfolio this month is a shift in the bond

Topics:

Joseph Y. Calhoun considers the following as important: 5) Global Macro, Alhambra Research, asset allocation, Bank of Japan, bonds, China, ECB, economic growth, Election, EU, Featured, Free trade, Global Asset Allocation Update, Interest rates, Markets, Model Portfolios, newsletter, The United States, TIPS, Trade Wars, treasuries

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Note: This will be a short update. We are shifting the timing of some of our reports. The monthly Global Asset Allocation update will now be published in the first week of the month, aiming for the first of each month. I’ll put out a full report next week. The Bi-Weekly Economic Review is shifting to a monthly update, published on the 15th of each month. We are doing this to make room for some new reports, podcasts and videos.

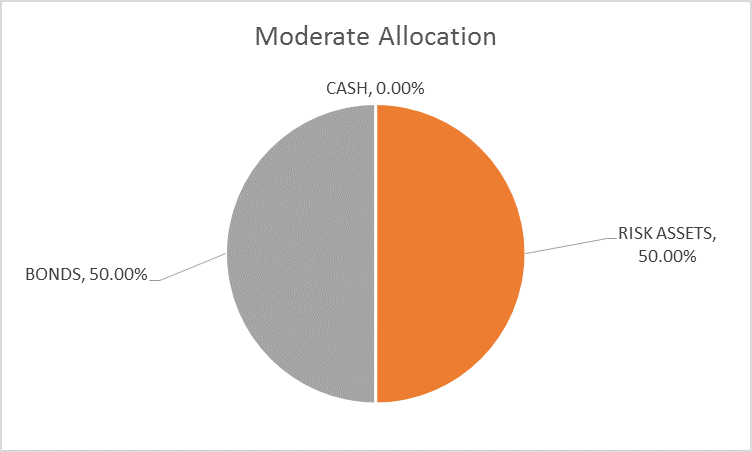

| The risk budget is unchanged this month. For the moderate risk investor, the allocation to bonds and risk assets is evenly split. There are changes this month within the asset classes. |

50-50 Risk budget |

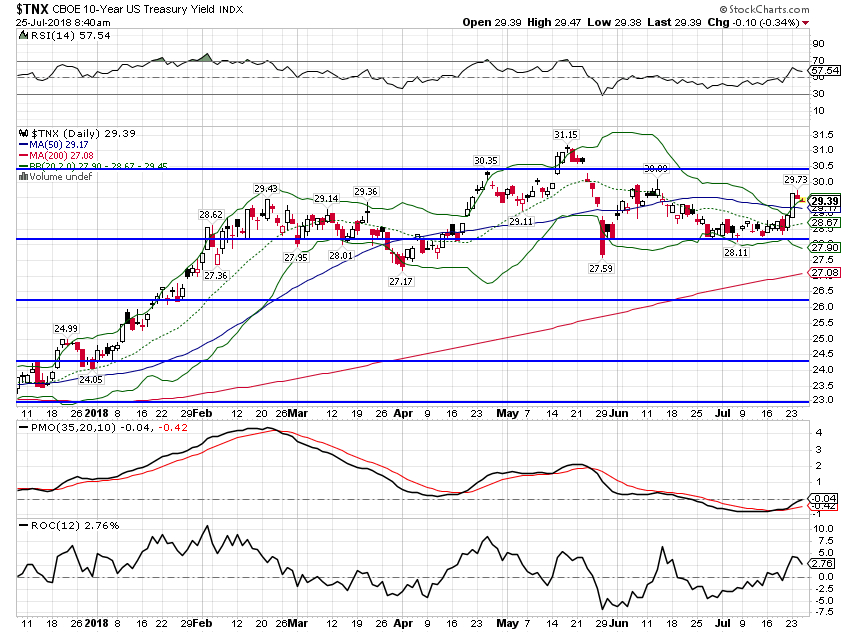

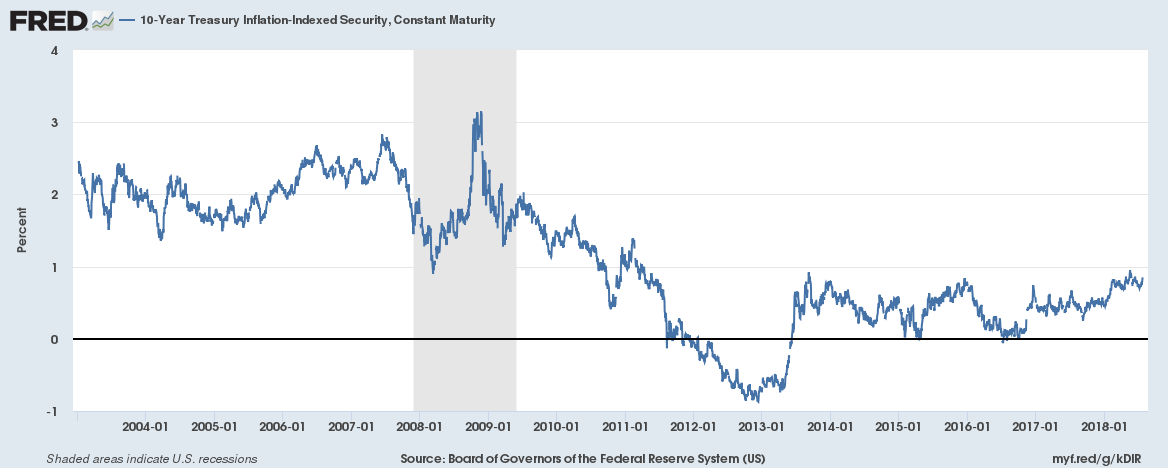

| The only change to the portfolio this month is a shift in the bond allocation. Interest rates have started to rise again and it appears to be rooted in rising real growth expectations. Much of the recent rise in the 10 year nominal rate was matched by a rise in 10 year TIPS yields. With a GDP report later this week that is expected to show a big jump in Q2 growth, it seems likely the narrative from now to the election will be about a continued upshift in growth. Any positive movement on trade would just add to that narrative. More on that later.

There could be, of course, other factors moving the bond market. The recent move up in rates has come as expectations regarding monetary policy in Europe and Japan have shifted to a slightly more hawkish stance. There is a belief – not one I particularly share – that low rates in Japan and Europe have held down US long term rates. The idea is that faced with low or negative rates in those areas, investors have shifted instead to US Treasuries. I’m not so sure about that since doing so would introduce currency risk to a fixed income portfolio. Anyone making that trade at the beginning of 2017 lost 15% on the dollar exposure until the spring of this year. The dollar rally since then has only recovered part of that loss. Of course, one could hedge the currency risk but doing so isn’t costless and the fact is that we can see in other markets that it isn’t happening. So, yes, the ECB and BOJ may be about to run monetary policy that is somewhat tighter than it has been but I don’t think there is a direct connection between that and higher Treasury rates. The connection, if any, is through investors’ perception of growth and inflation. If the ECB and BOJ are tightening that must mean the global economy is improving, right? Well, maybe, maybe not but certainly there are plenty of people in markets who will believe that. I would also just add that any change in monetary policy at the BOJ or ECB will be marginal. Very marginal. |

10-Year US Treasury Yield Index(see more posts on US Treasury, ) |

| So, we’ll go with the Occam’s Razor explanation that the rise in rates is a reflection of rising growth expectations. It isn’t hard to see why. We’re going to get a GDP report on Friday that will likely show Q2 growth annualizing over 4% (with an outside shot at 5%). A quarter of +4% growth, contrary to the rhetoric of the current administration, is not unheard of in this cycle. We have had 3 other quarters where quarterly annualized growth exceeded 4% (Q4 2011, Q2 2014 and Q3 2014). The question is whether the economy can muster more than a quarter or two of that kind of growth. A year after the 4% growth of Q4 2011, growth was at zero. Q2 and Q3 2014 were preceded by one of the two negative quarters we’ve had in this cycle and by Q4 2015 growth was down to less than 0.5%.

We have our doubts as to whether Q2 growth is sustainable as does, obviously, the bond market. While rates have risen lately, the 10 year nominal Treasury yield is still less than 3% and the 10 year TIPS yield is less than 0.9%. Real rates would have to rise almost 60 basis points to reach the low print of the last cycle before recession hit. Rates are not at levels associated with sustained, robust growth. Heck, rates aren’t at levels associated with weak growth. Another reason growth expectations will probably remain positive is earnings. Less than a quarter of the S&P 500 has reported so far but what we’ve seen has been very good. That isn’t exactly a surprise but guidance has been pretty positive too. Yes, there are some anecdotal reports of problems created by tariffs or fear of tariffs but we don’t really have any data yet that points to any sustained damage. So long as the market believes the tariffs are a temporary inconvenience for the sake of negotiation, investors will probably look past the negatives. |

10-Year Treasury Inflation-Index Security 2004-2018 |

The unknown variable in the growth equation is trade. I have no doubt – none – that tariffs are negative for growth in the long term and inflationary to boot. But the short term – as is often the case – is harder to figure. We know that some companies stockpiled some products such as steel and aluminum ahead of the tariffs. We also know that China stocked up on soybeans before imposing retaliatory tariffs. That likely – no, certainly – had a positive impact on Q2 growth. So it may be that we have shifted some economic activity around but the overall impact so far is probably fairly mild. And it could even be slightly positive; a number of foreign companies have indicated they will be shifting some production to the US to avoid the taxes. Of course, we also have some US companies – Harley isn’t the only one – shifting production outside of the US to avoid the retaliation. So maybe it’s a wash in the short term.

I suspect though that we will see some positive announcements on trade soon. President Trump and the Republicans are going to want to be able to point to some positive results on the trade front for the mid-term elections. I don’t know what form it will take but there were hints this week – from Mexico and the White House – that a deal with Mexico might be struck fairly soon. The new Mexican President has said he’d like to get a deal done by the end of August. Maybe the administration will use that to force a bigger settlement of the NAFTA negotiations. The EU is also probably open to a deal. They just signed a free trade agreement with Japan that even included agriculture. So, some kind of deal could certainly be fashioned in time for the President to crow about it before the election. Details to come later no doubt.

What I wouldn’t expect is a settlement with China anytime soon. The issues there are more complex and the egos involved are huge. And of all the trade spats right now, the one Americans seem most united in support is against China. It doesn’t even seem to be partisan as both Democrats and Republicans believe that China has been every bit the bad actor President Trump says they are. This is power geo-politics writ large and neither side seems likely to back down soon.

But over the next few months until the election that probably doesn’t matter. If the economy appears strong and especially if the administration can pull a trade win out of its…hat…then the market probably continues to discount an improvement in growth. If that is true, the risk for investors is higher interest rates and more negative returns for their bond allocation.

The change for this short update is to sell half the TIP position and use the proceeds to buy SHY, the 1-3 year Treasury index ETF. That is a small hedge against the possibility that economic growth is better than we currently expect.

I’ll be back next week with a full update – and maybe some more changes.

Tags: Alhambra Research,Asset allocation,Bank of Japan,Bonds,ECB,economic growth,Election,EU,Featured,Free trade,Global Asset Allocation Update,Interest rates,Markets,Model Portfolios,newsletter,TIPS,Trade Wars,treasuries