In a recent NBER working paper, Luca Benati, Robert E. Lucas, Jr., Juan Pablo Nicolini, and Warren Weber report estimates of long-term money demand. They write: [U]sing annual data on money (M1, for us), nominal GDP, and short term interest rates from 31 countries over periods that range in some cases to over 100 years. We find remarkable stability in long run money demand behavior in many countries, and an equally surprising sameness across different countries. In some cases of...

Read More »“Dirk Niepelt über die Folgen eines Brexit für die Schweiz (What Brexit Means for Switzerland),” SRF, 2016

SRF, Tagesgespräch, June 16, 2016. HTML with link to MP3. Half-hour-long interview on the Swiss news channel. Topics include monetary policy, exchange rates, financial stability, Brexit.

Read More »“Zinsen, Inflation und Realismus (Interest, Inflation and Realism),” FuW, 2016

Finanz und Wirtschaft, April 30, 2016. PDF. Ökonomenstimme, May 6, 2016. HTML. The winners and losers of the current monetary environment are not that easy to identify. Investors holding long-term, non-indexed debt gain as unexpectedly low inflation shifts wealth from borrowers to lenders. Governments suffer from increased real debt burdens and reduced revenue due to effectively lower capital income tax rates. Policies that succeed in affecting the real exchange rate entail...

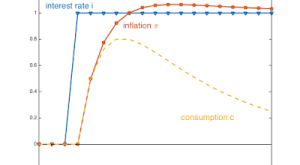

Read More »Neo-Fisherianism Turns Mainstream

On his blog, John Cochrane offers a stripped down model and some intuition for why inflation would rise after an increase in the interest rate. The model features the usual Euler (IS) equation and a Mickey Mouse Phillips curve—inflation is proportional to consumption (or output). The intuition: During the time of high real interest rates — when the nominal rate has risen, but inflation has not yet caught up — consumption must grow faster [the Euler equation, DN]. … Since more consumption...

Read More »Longer-Term Interest Rate Pegs

In his blog, Ben Bernanke discusses the merits of longer-term interest rate targeting as a monetary policy tool. A lot would depend on the credibility of the Fed’s announcement. If investors do not believe that the Fed will be successful at pushing down the two-year rate … they will immediately sell their securities of two years’ maturity or less to the Fed. … the Fed could end up owning most or all of the eligible securities, with uncertain consequences for interest rates overall. On the...

Read More »I Would Like to Withdraw A Couple Billion Swiss Francs: Legal Aspects

On his blog, Urs Birchler offers different perspectives on the question whether the Swiss National Bank (SNB) is obliged to pay out banks’ reserves in cash. One view: Reserves are legal tender. The SNB therefore is not obliged to exchange reserves against cash. Another view: According to the law, the SNB is required to provide sufficient cash. Moreover, reserves and cash were meant to be perfect substitutes. Yet another view: Lawmakers would have written a different law had they known that...

Read More »Liquidity Trap Kills Liquidity Effect

In his blog, John Cochrane registers disagreement with Larry Summers and reiterates his own argument that in a liquidity trap, interest rate policy does not have a liquidity effect and thus, only a long-run “expected inflation” or “Fisher” effect: When the liquidity effect is absent, the expected inflation effect is all that remains. Inflation must follow interest rates.

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org