BMO Nesbitt Burns - Click to enlarge Despite speculation over the past year that Canada may join Japan and Europe in the NIRP club and launch negative interest rates, so far the BOC has stood its ground. However, starting on December 22, for the broker dealer clients of one of Canada’s most reputable financial institutions, BMO Nesbitt Burns, it will be as if the Canadian bank has cut its deposit rate on most...

Read More »BOJ “Fires Warning At Bond Market” Sending Global Yields, Dollar Lower; All Eyes On Yellen

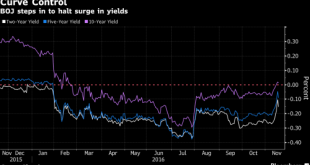

Yesterday morning we noted why, in light of the ongoing global bond rout, all eyes would be on the BOJ, and specifically whether Kuroda would engage his "Yield control" operation to stabilize the steepness of the JGB yield curve and implicitly support global bond yields in what DB said would be "full blown helicopter money" where the "BoJ is flying the copter over the US and may be about to become the new US government’s best friend." And sure enough that is precisely what Kuroda did last...

Read More »Former Treasury Secretary Summers Calls For End Of Fed Independence

Larry Summers - Click to enlarge At an event in Davos, Switzerland earlier today, Former U.S. Treasury Secretary, Larry Summers, argued that Central Bank independence from national governments should be scrapped in favor of a coordinated effort between politicians, central bankers and treasury to engineer inflation. Seems reasonable, right?…what could possibly go wrong? According to Market Watch, Summers argued that...

Read More »Nominal and Real Interest Rates over the Medium Term

From the NZZ:

Read More »World War I Turned the Swiss Franc Into a Strong Currency

In Die Volkswirtschaft, Ernst Baltensperger and Peter Kugler summarize the history of the Swiss Franc since the mid 19th century: After 1973, the Swiss Franc has been strong. Swiss Franc yields have been lower than what uncovered interest parity would suggest. Before 1914, the Swiss Franc was weak in the sense that it enjoyed only limited credibility. In periods with fixed exchange rates, Swiss Franc yields typically exceeded yields in French Franc or Sterling. Throughout the 20th...

Read More »Negative Interest Rates vs. Higher Inflation

On his blog, Ben Bernanke weighs the pros and cons of negative (nominal) interest rates vs. a higher inflation target to create monetary “policy space.” His main points are: Lower rates work immediately. In contrast, a higher inflation target only works once agents’ expectations adjust. A higher target may not be politically tenable a thus, not be credible. In contrast, “institutional changes … [such] as eliminating or restricting the issuance of large-denomination currency, could expand...

Read More »Monetary Policy When Interest Rates are Near Zero

In the 18th Geneva Report on the World Economy, Laurence Ball, Joseph Gagnon, Patrick Honohan and Signe Krogstrup ask whether “central banks can do [more] to provide stimulus when rates are near zero; and … whether policies exist that would lessen future constraints from the lower bound.” They are optimistic and argue that the unconventional policies of recent years can be extended: “[I]t is likely that rates could go somewhat further than what has been done so far without adverse...

Read More »Developing Countries Issue Sovereign Debt (Lots of)

In the FT, Elaine Moore reports that “[d]eveloping economies are on course to raise a record sum on global debt markets this year, as ultra-low rates in the developed world cheapen borrowing costs for countries from Asia to South America.” By the end of the year, hard currency debt sales by countries such as Mexico, Quatar, Saudi Arabia and Argentina are expected to reach USD 125 billion.

Read More »America’s Mortgages

The Economist reports about the political economy aspects of America’s semi-nationalized mortgage industry.

Read More »Central Bank Independence, Old-Fashioned?

The Economist speculates that central bank independence might be on its way out. The article suggests that motives for independence (i.e., Sargent/Wallace or Barro/Gordon type arguments) might be less relevant given the environment of low inflation and interest rates. See also my earlier, related blog post.

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org