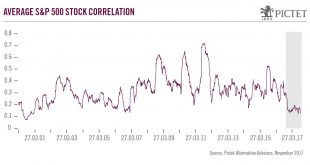

The performance of hedge funds has been bolstered in 2017 by the reversal of the tight market correlations of recent years. The gradual reversal of quantitative easing offers further opportunities to shine.A few years back, news that the Fed was reducing its balance sheet and considering rate rises would have prompted a severe market reaction. Today, as the ECB sets out plans for shrinking its own quantitative easing (QE) programme, the calm on financial markets is striking, affording, we...

Read More »Is This The Best Way To Bet On The Fed Losing Control Of The Bond Market?

Lately, one of my biggest duds of a call has been for the yield curve to steepen. Sure, I have all sorts of fancy reasons why it should steepen, but reality glares back at me in black and white on my P&L run. Sometimes fighting with the market is an exercise in futility. Now I know many of your eyes glaze over when I start talking about different parts of the yield curve flattening or steepening, but I urge you to...

Read More »Hedge funds: US value strikes back?

Macroview Growth vs. value has been an important theme in long/short hedge fund portfolios--and a recent source of pain for some and profit for others owing to trend reversals this year. Amid slowing growth worldwide, growth stocks have outperformed value both in the US and Europe in the past decade and have been a profitable bet in long/short managers' books. There are some inherent differences in what value stocks represent in the two regions. Looking at the composition of the MSCI US...

Read More »Hedge funds: risk-off mode in equities

Macroview Macro managers have reduced their equity exposure amid modest positive returns year-to-date, while long/short equity managers have been challenged by sharp market rotations. Equity risk in macro managers' portfolios is below the historical average. Many expect stock markets to trend lower – not necessarily because of a coming recession but because of peak margins and outflows from petrodollar-dependent sovereign wealth funds. The effectiveness of QE programmes is also being...

Read More »Survey: Institutional Investors Expect Hedge Fund Growth in 2016

Institutional hedge fund investors surveyed by Credit Suisse predict a 3.5 percent increase in hedge fund assets under management this year. That would push industry assets back over $3 trillion, a rebound from January, when assets declined to $2.96 trillion. January marked the first time industry assets dipped below $3 trillion since May, 2014. “Institutional investors remain committed to their hedge fund allocations and are optimistic for further growth in the industry during...

Read More »Hedge funds: looking ahead

Macroview Tactical trading hedge funds are known for their long term decorrelation with traditional assets. After a news-heavy year so far, markets are gearing up for further volatility. Increased uncertainty and volatility offers opportunities for tactical traders, providing a differentiated source of returns. It has been a bumpy start to 2016. Amid sharp sell-offs on financial markets, it may seem that there is no place to hide. However, certain hedge fund managers think otherwise. For...

Read More »Who Is Worth More: Some Hedge Funds or All our Kindergartens?

“The top 25 hedge fund managers made more than all the kindergarten teachers in the country,” declared President Obama in a discussion of poverty at Georgetown University. Calling them “society’s lottery winners,” he proposed to hike their taxes. Hedge Funds vs Kindergarten: Who is worth more? Predictably, battle lines have been formed between two polarized sides. One side—let’s call them the Gauche for convenience’s sake—is unhappy with the pay disparity. CBS News, in an almost neutral...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org