Introduction by George Dorgan My articles About meMy booksFollow on:TwitterFacebookGoogle +YoutubeSeeking AlphaCFA SocietyLinkedINEconomicBlogs Summary: The UK High Court defends Parliament’s right to vote before Article 50 is triggered. The decision will be appealed. Sterling approached an important resistance as it extended its rally for the fifth session. The UK High Court ruled that Parliament has the...

Read More »Great Graphic: Sentix Shows a Shift

Introduction by George Dorgan My articles About meMy booksFollow on:TwitterFacebookGoogle +YoutubeSeeking AlphaCFA SocietyLinkedINEconomicBlogs Summary: The risk that the eurozone implodes over the next year has risen, but is still modest. Italy has surpassed Greece as the most likely candidate. The December referendum is the second part of Renzi’s political reforms. Sentix conducts investor surveys...

Read More »Great Graphic: Italian Banks and a German Bank

Summary: DB and Italian bank stocks have been moving in tandem. They suffer from fundamentally different problems. The euro has been selling off as the bank shares rebound. European banks may not be the main driver of the investment climate, but their challenges are not resolved. Investors have focused on two country’s banks recently. Germany’s Deutsche Bank and Italian banks more generally. This Great...

Read More »Great Graphic: Consumer Inflation: US, UK, EMU

Summary: Price pressures appear to have bottomed for the US, UK, and to a lesser extent, EMU. Rise in prices cannot be reduced solely to the increase of oil. Core prices are also rising. Back in the early post-crisis days, many pundits consumed lots of ink and column inches warning the strong inflationary pressures would be fueled by the orthodox and unorthodox monetary policy. Not only did this not...

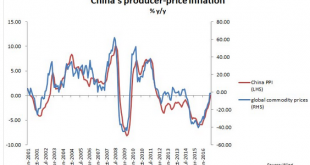

Read More »Great Graphic: China’s PPI and Commodities

Summary: China’s PPI rose for the first time in four years. It is related to the rise in commodities. Yet there are good reasons there is not a perfect fit between China’s PPI and commodity prices. US and UK CPI to be reported next week, risk is on the upside. China reported its first increase in producer prices in four years earlier today. As one might suspect, producer prices are often driven by commodity...

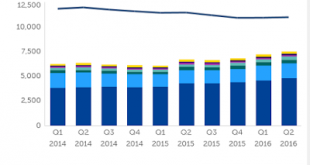

Read More »IMF’s Reserve Data: Dollar Share Little Changed, Yen Share Jumps, Helped By Valuation

Summary: The increase in the yen’s share of reserves was flattered by the yen’s 9% appreciation. The dollar and euro’s share of reserves were stable. Chinese integration has seen the share of unallocated reserves fall. Starting with Q3 data, (available end of March 2017) will break out the yuan’s share of reserves. The IMF provides the most authoritative data on central bank reserves. The composition is...

Read More »Great Graphic: Euro is Approaching Year-Long Uptrend

Summary: The year-long euro uptrend comes in near $1.1035, just below the August lows. The technical are fragile, but the euro is below its lower Bollinger Band. The fundamental driver seems to be the backing up of US rates, and widening premium over Germany. This Great Graphic, composed on Bloomberg shows the euro against the dollar since the start of the year. It shows the trendline drawn off the...

Read More »Great Graphic: US-German 2-Yr Differential and the Euro

Summary: The US premium over Germany is at its widest since 2006. This is despite a small reduction in odds of a hike in December. There are many forces are work, but over time, the widening differential will likely give the dollar better traction. This Great Graphic from Bloomberg shows two time series. The white line is the spread between the German two-year interest rate and the US two-year yield. The...

Read More »The Yen in Three Charts

Summary: The dollar is taking out a several month downtrend against the yen. The correlation between the yen and the S&P 500 has broken down. The US 2-year premium over Japan has steadily risen. One of the big stories in the foreign exchange market this year has been the strength of the Japanese yen. It is up 17.3% so far this year, despite negative interest rates through 10-years and among the worst...

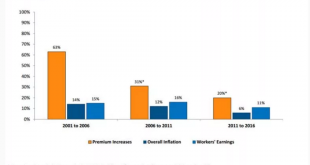

Read More »Great Graphic: Growth in Premiums of Employer-Sponsored Health Insurance

Upward pressure on US consumer prices is stemming from two elements. Rents and medical services. Due to the differences the composition of the basket of goods and services that are used, the core personal consumption deflator, which the Fed targets, typically lags behind core CPI. At is time of year, the concern tends to be on health care costs and premiums. Many US employees are given “open enrollment” when they can...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org