Interview with Robert Hartmann As we enter the second quarter of 2021, the year during which so many mainstream analysts and politicians have predicted we’ll see a miraculous recovery from the covid crisis, it is becoming increasingly clear that the damage inflicted by the lockdowns and the shutdowns is really very extensive an persistent. Of course, I’m referring to the damage to the real economy, that is, to actual businesses, households and the countless citizens that were...

Read More »Is The Bull Market Over For Gold?

Gold has not made new highs in many months. Gold peaked last year at US$2067 on August 6. The 7 month down leg of more than 18% as been deep enough and long enough that some commentators are now saying that the bull market has now turned to a bear market for gold. Losing faith is understandable because falling prices feel bad. But this week we want to show that current prices may not reflect reality. We will review the story of Archegos Capital Management which...

Read More »Monetary Metals Issues Gold Token

Scottsdale, Ariz, April 1, 2021— Monetary Metals® announces that it has issued a gold token. Unlike the company’s other products, this one is not designed to pay a yield. In a sign of the times, the company intends this product to generate big speculative gains. It is designed to GO UP! It is (at issue date) 2,000 fine bucks of gold. However, some guy predicted it would go up to 4,000 or maybe even 5,122 fine bucks of gold. “It’s magical,” gushed Monetary Metals CEO...

Read More »“If you increase the competition of ideas, more truth emerges”

Interview with Icaros For this interview, I have reached out to Icaros, principal author of the blog coronacircus.com. He is part of a group of liberty lovers working to build a “freedom cell” in the Swiss Alps. Before the interview, he told me the project is advancing well, as four new families have joined recently. I also happen to know him in real life, although he is completely unaffiliated to my commercial activity. His background is information technology, and he sees the...

Read More »“There is no such thing as a free lunch, but the temptation to distribute one or to get one seems to be too strong”

Interview with Daniel Model: Part II of II Claudio Grass (CG): All over the West, we saw extreme pain and suffering caused by the mass unemployment that the lockdowns and shutdowns triggered. Across the board, every government’s answer to all this destruction was helicopter money. Do you think throwing cash at this problem was enough and do you find that the various support and relief measures were sufficient to counterbalance all of the deleterious effects of those policies? ...

Read More »“There is no such thing as a free lunch, but the temptation to distribute one or to get one seems to be too strong”

Interview with Daniel Model: Part I of II During these absurd and uncertain times, it is easy to be consumed by the 24-hour news cycle, to be constantly distracted by the latest news and updates, and eventually to lose track of what really matters. We are indeed facing unprecedented challenges and we are witnessing a historic turning point in the relationship of the individual citizen to the state and to centralized power in general. Thus, one cannot be blamed for the urge to...

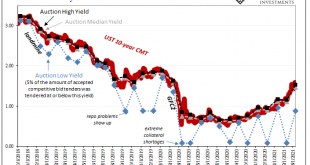

Read More »What Gold Says About UST Auctions

The “too many” Treasury argument which ignited early in 2018 never made a whole lot of sense. It first showed up, believe it or not, in 2016. The idea in both cases was fiscal debt; Uncle Sam’s deficit monster displayed a voracious appetite never in danger of slowing down even though – Economists and central bankers claimed – it would’ve been wise to heed looming inflationary pressures to cut back first. Combined, fiscal and monetary policy was, they said,...

Read More »Gold is the money of the kings. Silver is the money of the bourgeoisie. Fiat is the money of the slaves.

Gold has been used as money (or a store of value) for thousands of years. It’s always been valuable to humans, for some reason, and it’s withstood everything history has thrown at it. Silver too. Fiat money is what we use today. It’s essentially money created out of thin air, on a spreadsheet, by banks and the government via monetary policy, and it has absolutely nothing backing it. This is why currencies come and go, such as the Zim Dollar which lasted a few decades....

Read More »The bitcoin surge in its proper context

Over the last few weeks we’ve been witnessing a historic surge in the Bitcoin price, a seemingly unstoppable ride that the mainstream media headlines can hardly keep up with. Especially following the news that Elon Musks’ Tesla bought $1.5 in the cryptocurrency, sending it to new record highs, most of the media coverage appears to be focused on all the wrong things. Part fear-mongering over the many “risks” of bitcoin, part pleading for governments to step in and...

Read More »The bitcoin surge in its proper context

Over the last few weeks we’ve been witnessing a historic surge in the Bitcoin price, a seemingly unstoppable ride that the mainstream media headlines can hardly keep up with. Especially following the news that Elon Musks’ Tesla bought $1.5 in the cryptocurrency, sending it to new record highs, most of the media coverage appears to be focused on all the wrong things. Part fear-mongering over the many “risks” of bitcoin, part pleading for governments to step in and regulate the entire...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org