In February 2017 while preparing for a presentation in Gothenburg about central bank gold, I emailed Sweden’s central bank, the Riksbank, enquiring whether the Riksbank physically audits Sweden’s gold and whether it would provide me with a gold bar weight list of Sweden’s gold reserves (gold bar holdings). The Swedish official gold reserves are significant and amount to 125.7 tonnes, making the Swedish nation the...

Read More »Time to Hedge State Reserve Funds with Gold?

Financially prudent individuals set aside surplus funds to protect against unforeseen expenditures. This way, when faced with loss of income, house repairs, car trouble, or anything else, they will have a buffer against unanticipated downturns. In the same vein, almost every state in the United States has established a “savings account” for government operations. Primarily to mitigate a decline in tax revenues that...

Read More »Digital Gold – For Now Caveat Emptor

Digital Gold On The Blockchain – For Now Caveat Emptor – Bitcoin surpasses gold price – a psychological and arbitrary headline – Royal Mint blockchain gold asks you to trust in the UK government – Royal Canadian Mint and GoldMoney blockchain product asks you to trust in government and the technology, servers, websites etc of the providers – Invest in a gold mine using cryptocurrency – but wait until 2022 for your gold...

Read More »Digital Gold – For Now Caveat Emptor

Digital Gold On The Blockchain - For Now Caveat Emptor - Bitcoin surpasses gold price - a psychological and arbitrary headline - Royal Mint blockchain gold asks you to trust in the UK government - Royal Canadian Mint and GoldMoney blockchain product asks you to trust in government and the technology, servers, websites etc of the providers - Invest in a gold mine using cryptocurrency - but wait until 2022 for your gold and trust the miners that it is there - Blockchain and gold will...

Read More »Gold Investing 101 – Beware Unallocated Gold Accounts With Indebted Bullion Banks and Mints (Part II)

Gold Investing 101 - Beware Unallocated Gold Accounts With Indebted Bullion Banks and Mints (Part II) Investors looking to gold again but gold buyers need to exert caution Royal Mint - a royally expensive way to help the government Unallocated gold - unsecured creditor of a bank? If you cannot hold it, you do not own it Own gold bullion coins as insurance, to reduce counter party risk and to preserve wealth Conclusion - Reduce counter parties, Don’t over complicate Yesterday we...

Read More »Not Recession, Systemic Rupture – Again

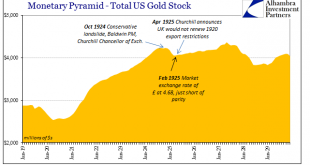

For the very few in the mainstream of economics who venture further back in history than October 1929, they typically still don’t go much last April 1925. And when they do, it is only to further bash the gold standard for its presumed role in creating the conditions for 1929. The Brits under guidance of Winston Churchill made a grave mistake, one from which gold advocates could never recover given what followed. There...

Read More »Not Recession, Systemic Rupture – Again

For the very few in the mainstream of economics who venture further back in history than October 1929, they typically still don’t go much last April 1925. And when they do, it is only to further bash the gold standard for its presumed role in creating the conditions for 1929. The Brits under guidance of Winston Churchill made a grave mistake, one from which gold advocates could never recover given what followed. There...

Read More »If It Didn’t Abandon The Gold Standard, U.S. Empire Would Have Collapsed…

The U.S. will never go back on a gold standard. The notion that a U.S. Dollar backed by gold would solve our financial problems is pure folly. Why? Because, if the U.S. Empire didn’t abandon the gold standard in 1971, it would have collapsed decades ago. Unfortunately, some of the top experts in the precious metals community continue to suggest that revaluing gold much higher, to say…. $15,000-$50,000 an ounce, would...

Read More »Ending Taxation on Monetary Metals

Imagine if you asked a grocery clerk to break a $20 bill, and he charged you $1.40 in tax. Silly, right? After all, you were only exchanging one form of money for another. But try walking to a local precious metals dealer in more than 25 states and exchanging a $20 bill for an ounce of silver. If you do that kind of money exchange, you will get hammered with a sales tax. That’s the price you can pay for bucking the...

Read More »Sound Money and Your Personal Finances

Sound money principles can serve to help grow the economy and restrain government. The political class, however, doesn’t particularly want to restrain itself. Washington, D.C. is addicted to the easy money policies that have enabled $20 trillion in national debt accumulation and tens of trillions more in unfunded liabilities. Even with a new and unconventional GOP president who vows to take on waste and overregulation,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org