Gold Investing 101 - Beware Unallocated Gold Accounts With Indebted Bullion Banks and Mints (Part II) Investors looking to gold again but gold buyers need to exert caution Royal Mint - a royally expensive way to help the government Unallocated gold - unsecured creditor of a bank? If you cannot hold it, you do not own it Own gold bullion coins as insurance, to reduce counter party risk and to preserve wealth Conclusion - Reduce counter parties, Don’t over complicate Yesterday we pointed out how the gold market is seeing renewed interest from new, first time gold buyers and gold investors. Concern unites them - they are concerned about the current trajectory of the world - politically, financially, economically, monetarily and environmentally. As the old adage goes though - 'all the glitters is not gold' and novice, and indeed experienced, investors need to be careful that they are not seduced by 'shiny trinkets' which look ostensibly attractive but in fact are fraught with risk and not the safe haven that gold bullion is - when owned in the safest ways possible. We looked at collectible gold and silver coins with massive premiums, gold plated coins masquerading as "pure gold coins" and the assortment of such coins for sale on eBay and other online retail platforms.

Topics:

GoldCore considers the following as important: Australia, Bank of England, Bitcoin, British government, Business, China, Counterparties, currency, economy, Gold as an investment, Gold bar, Gold coin, Gold Standard, Hong Kong, Money, National Debt, Perth Mint, Pound sterling, Precious Metals, Reuters, Silver as an investment, Sovereign Debt, Sovereigns, trade deficit, UK Government, United States dollar, Western Australia, Zurich

This could be interesting, too:

investrends.ch writes Bitcoin sackt immer weiter ab

investrends.ch writes Bitcoin – Rekord liegt jetzt bei mehr als 106’000 Dollar

Claudio Grass writes “THE BIG BULL MARKET IN GOLD AND SILVER HAS ONLY JUST BEGUN”

Claudio Grass writes “THE BIG BULL MARKET IN GOLD AND SILVER HAS ONLY JUST BEGUN”

- Investors looking to gold again but gold buyers need to exert caution

- Royal Mint - a royally expensive way to help the government

- Unallocated gold - unsecured creditor of a bank?

- If you cannot hold it, you do not own it

- Own gold bullion coins as insurance, to reduce counter party risk and to preserve wealth

- Conclusion - Reduce counter parties, Don’t over complicate

Yesterday we pointed out how the gold market is seeing renewed interest from new, first time gold buyers and gold investors. Concern unites them - they are concerned about the current trajectory of the world - politically, financially, economically, monetarily and environmentally.

As the old adage goes though - 'all the glitters is not gold' and novice, and indeed experienced, investors need to be careful that they are not seduced by 'shiny trinkets' which look ostensibly attractive but in fact are fraught with risk and not the safe haven that gold bullion is - when owned in the safest ways possible.

We looked at collectible gold and silver coins with massive premiums, gold plated coins masquerading as "pure gold coins" and the assortment of such coins for sale on eBay and other online retail platforms.

Today, we move up the food chain of the gold market and look at some of the bigger beasts who offer various gold investment schemes - two of which are unallocated gold accounts with bullion banks and with government institutions and mints.

Below we take a look at some of these popular options and explain why they might not be the gold standard of gold investment.

For all of our talk about avoiding gold scams you might think that the wisest thing to do would be to go straight to the source in order to buy your commemorative coin or even a bullion coin. Whilst this does remove the risk of buying a fake, it certainly does not remove the chances of being royally ripped off when it comes to the price and buying intrinsically worthless coins are very high prices. This is most likely the case when it comes to newly minted commemorative coins.

The Telegraph writes that the Royal Mint's London Olympic 2012 coins set was priced at £1,295, almost twice the value of each coin's gold content (38 grams of 22-carat gold). One wonders how much a 2008 ‘Olympic handover’ coin is now going for given it was trading for 5% below the original retail price, in 2009 despite a 30% climb in the sterling price of gold.

The mark-up of such coins is not the only problem with the Royal Mint. In recent years there has been a push to bring in more investors who are keen to hold both their bullion and bullion coins in storage with the government owned institution.

When investors decide to invest in gold, one of the contributing factors is that they are looking for an investment that not only has reduced counter party risk, but also is kept out of the reach of those institutions that are responsible for the financial crisis that has caused you, the investor, to want to invest in gold.

Most investors accept that the global financial crisis was in large part due to irresponsible banks with reckless trading and lending policies. Many also believe that "regulatory capture" and a lack of prudent regulation of banks by governments contributed to the crisis.

If you are concerned about the solvency of banks and governments, why would you invest some of your hard earned savings in institutions and governments who are heavily indebted and vulnerable in the event of another debt crisis?

The Royal Mint is 100% owned by the UK Treasury and pays a dividend to the UK government, each year. Whilst the Royal Mint’s decision to offer storage solutions is a great way to alert people to the possibilities of gold investing, it distracts somewhat from the key reasons why investors choose to hold gold in the first place.

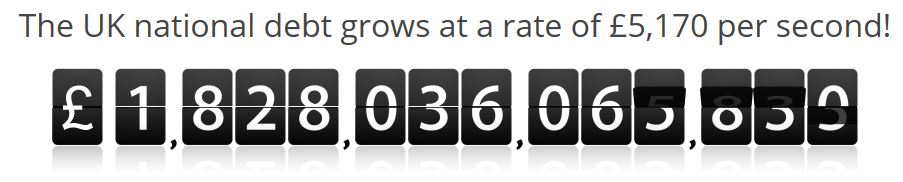

The UK national debt - the accumulation of years of massive overspending and more recently the bailing out of banks - continues to surge and is now over £1.82 trillion and over 90% of the value of the UK economy.

Whilst gold confiscation has never happened in the UK, there is evidence of other forms of financial confiscation that have happened with the support of British government and associated institutions.

Investors choose gold, and gold has lasted for hundreds of years as a preferred investment asset, because it is border less and autonomous.

Gold cannot be printed or devalued by currency debasement and negative interest rates. When stored in allocated, segregated storage outside of the banking and government system but within safer jurisdictions, then it will be nigh impossible to be removed from you whether through bail-ins or asset confiscation.

Whilst history has shown that gold has held its value and can preserve the value of the your portfolio, there are still checks that investors need to make to protect the gold that they are buying.

When placing gold in storage, that is not only allocated but also segregated and in a safe jurisdiction then the investor is doing their utmost to do not only reduce counterparty risk but to also ensure the integrity of the gold’s chain of custody.

The Royal Mint’s Gold Sovereigns and Britannia’s are some of our biggest selling coins, so we’re not against the government-owned organisation. But, as with buying gold on eBay or choosing collectors coins, it is not a huge leap to argue that by storing gold with the Royal Mint you are undoing some of the reasons you chose to hold gold in the first place.

Unallocated gold

Despite the fact that the financial crisis is still wreaking havoc around the world, (see the Euro and sovereign debt levels for just two examples) some investors and even family offices still appear to trust the banking system when it comes to storing their wealth. This is also why it is surprising that people choose to hold gold in the Royal Mint.

But it is not just the Royal Mint that investors should consider carefully. Even once investors have made the wise decision to allocate some money to gold, they decide to do it with the ‘help’ of their banks.

More often than not holding gold with a bank includes what is referred to as unallocated gold storage.

Holding physical gold with a bank is no different to when you deposit cash with them. You instantly become a creditor to the bank. You are now longer the legal owner of that gold. Suddenly ‘free storage’ should seem a very costly arrangement.

Investors buy gold for several reasons but as mentioned when talking about the Royal Mint, one of these reasons is to reduce counter party risk and the exposure to the institutions that have lead to the current economic situation and significant wealth destruction. So when gold buyers choose to do so with a bank or an institution that offers unallocated gold, this conflicts somewhat with many of the key reasons to hold gold.

When there is unallocated gold, the gold may or may not exist. Even if it does exist then the bank may be putting it to use, in the same way they do with your cash in the bank. When you hold unallocated gold with a bank then you are the creditor and they are the legal holder of the gold.

Whilst on file this gold may appear to be unallocated to you, the regulators will see it as part of the bank’s liquid reserves. A great deal for the bank that is able to show liquidity that it has not had to pay anything for. Not so great for you when the bank runs into further financial difficulties.

In contrast, allocated gold accounts mean that you are the legal owner of your gold. That means that if anything happens to the gold provider, then the bullion is still yours. Unallocated gold just means that there is a promise by the gold provider or bank to give you your gold (or pay you for your gold) should you come to request it or sell it. But imagine how high the counterparty risks are here. You are relying on the promise of an institution, most likely a financial institution to protect your gold investment that may or may not physically exist.

Allocated gold is of little use to banks and, therefore, if they offer it, they usually charge a far higher premium for the service than the likes of GoldCore do. Even if banks and other reputable bullion dealers offer reasonable allocated storage (where the gold is legally owned by you) then this is still not enough. GoldCore advises investors opt for allocated and segregated storage with outright legal ownership of individual coins and bars (including serial numbers).

If you cannot visit, inspect and hold your gold or take delivery of it in a matter of days then you do not own your gold and you are exposed.

Perth Mint Unallocated gold remains the exception to the rule. We would not allow our clients to buy and own Perth Mint certificates if we considered them risky.

The Perth Mint of Western Australia remains a AA+ rated government institution (est. 1899) and therefore there is far less risk in being an unsecured creditor of the Perth Mint than in your typical unallocated account with a bank or bullion dealer.

The safety of Perth Mint Certificates is due to the fact that you have a direct relationship with the Perth Mint. We advise clients to have a combination of PMCP and GoldCore Secure Storage - private offshore storage in Zurich, Singapore and Hong Kong. Geographic diversification is important in these uncertain times and it is good to not have all your eggs in the one basket.

Ultimately, owning physical gold coins and bars in your possession is the safest way to own gold and we urge all clients to own some physical - however we realise that for certain clients and indeed for companies and institutions, this will not be suitable for them.

Conclusion - Reduce Counterparties, Don’t Overcomplicate

Despite what you might read, gold is a very simple commodity and form of money and as a result investing in it can and should be a very simple process.

The problem with today’s financial system is that banks have created an environment where we think we can get greater returns for less, or that we don’t need to understand what we are really investing in.

Or worse, they have made us so untrusting of them that we seek to find profit in areas outside of the financial system - in places such as eBay marketplaces or coins that happen to have a certain person or event recorded on them.

Investors need to look for simple gold products such as gold bars and sovereign coins, as well as services that offer both allocated and segregated storage.

You are investing in gold in order to protect your wealth and reduce the risks associated with counterparties. You also want a service that means you can sell when you want to, in the knowledge that you have not bought something that came with a huge markup and relied on the fashions of the marketplace, as we see with certain coins.

Instead, investors considering gold need to realise that the precious metal in its purest physical form - coins and bars - has maintained its role as a key component in portfolios and as a store of value across hundreds of years. They must ask, therefore, does anything really need to change in the way that I buy and store it?

The answer is no - keep it simple by taking delivery of actual bullion coins and bars or storing in an allocated and segregated manner in the safest vaults in the safest jurisdictions in the world.

Access Daily or Weekly Updates Here

Gold and Silver Bullion - News and Commentary

Gold steady near lowest in over four weeks, rate hike outlook drags (Reuters.com)

Gold Executives Say Good Assets Are ‘Hard to Come By’ (Bloomberg.com)

U.S. Stocks Slump With Bonds as Dollar Fluctuates (Bloomberg.com)

Trade Deficit in U.S. Widens to Largest in Almost Five Years (Bloomberg.com)

China gold reserves unchanged at 59.24 mln fine troy oz at end Feb (Reuters.com)

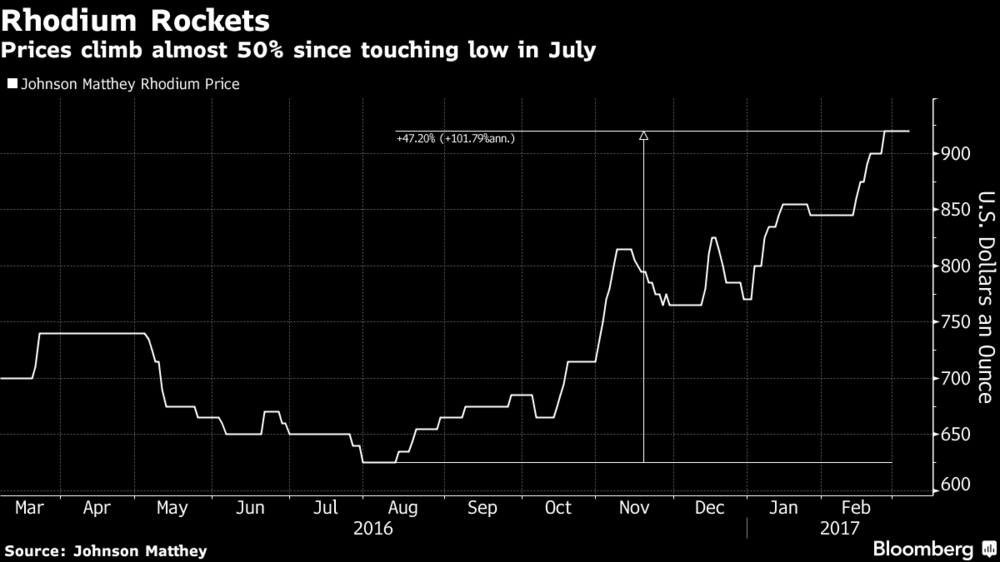

One of Rarest Precious Metals Is on Best Run in a Decade (Bloomberg.com)

Bitcoin at record but has yet to prove it is a store of value (Bloomberg.com)

Quarter of Mexico's Gold Reserve is 'Unallocated' at Bank of England (Guillermobarba.com)

China’s Pain Could Be Gold Investors’ Gain (ValueWalk.com)

The Path to $10,000 Gold (Dailyreckoning.com)

Gold Prices (LBMA AM)

08 Mar: USD 1,213.30, GBP 997.70 & EUR 1,149.00 per ounce

07 Mar: USD 1,223.70, GBP 1,003.56 & EUR 1,157.62 per ounce

06 Mar: USD 1,231.15, GBP 1,004.74 & EUR 1,162.82 per ounce

03 Mar: USD 1,228.75, GBP 1,005.12 & EUR 1,168.05 per ounce

02 Mar: USD 1,243.30, GBP 1,013.17 & EUR 1,181.14 per ounce

01 Mar: USD 1,246.05, GBP 1,007.18 & EUR 1,182.50 per ounce

28 Feb: USD 1,251.90, GBP 1,006.90 & EUR 1,180.79 per ounce

Silver Prices (LBMA)

08 Mar: USD 17.40, GBP 14.32 & EUR 16.48 per ounce

07 Mar: USD 17.70, GBP 14.52 & EUR 16.74 per ounce

06 Mar: USD 17.81, GBP 14.53 & EUR 16.83 per ounce

03 Mar: USD 17.66, GBP 14.44 & EUR 16.76 per ounce

02 Mar: USD 18.33, GBP 14.93 & EUR 17.42 per ounce

01 Mar: USD 18.33, GBP 14.89 & EUR 17.40 per ounce

28 Feb: USD 18.28, GBP 14.70 & EUR 17.24 per ounce

Recent Market Updates

- Gold Investing 101 – Beware eBay, Collectibles and “Pure” Gold Coins that are Gold Plated

- “Think About and Prepare For” Euro Catastrophe

- Silver On Sale – 4% Fall On Massive $2 Billion of Futures Selling

- Trump Avoid Debt Crisis ? “Extremely Unlikely” – Rickards

- Art Market Bubble Bursting – Gauguin Priced At $85 Million Collapses 74%

- Gold’s Value – Weight, Beauty, Rarity, Peak Gold and Secure Storage – Interview

- Oscars Debacle – Movies More Costly As Dollar Devalued

- Gold Up 9% YTD – 4th Higher Weekly Close and Breaks Resistance At $1,250/oz

- The Oscars – Worth Their Weight in Gold?

- Gold To Benefit from Rising Inflation and Higher Than “Official” China Gold Demand

- Russia Gold Buying Is Back – Buys One Million Ounces In January

- Gold The “Ultimate Insurance Policy” as “Grave Concerns About Euro” – Greenspan

- Sharia Standard May See Gold Surge

Interested in learning more about physical gold and silver?

Call GoldCore and speak with a Gold and Silver Specialist today!