Life is good. They could not have imagined what we have now, back in the dark ages. So I have never understood why people prep for a return to the dark ages. The only thing I can think of is that they don’t really picture what life is like. 14 hours a day of back-breaking labor to eke out a subsistence living. Subject to the risks of rain, sun, and insects. Prepping makes no sense to me. I don’t know if I would choose...

Read More »Who Would Invest in a Gold Bond?

Berkshire Hathaway CEO Warren Buffet famously dismissed gold. “Gold has two significant shortcomings, being neither of much use nor procreative.” I have recently written about how a government with gold mining tax revenues can use gold. The benefits of issuing gold bonds include reducing risk, and getting out of debt at a discount. Pretty useful, eh? As to his second point, one should never confuse suppressed with...

Read More »The Great Gold Upgrade, Report 15 July 2018

In part I the Great Reset, we said that a reset is a terrible thing. The closest example is the fall of Rome in 476AD, in which more than 90% of the population of the city fled or died. No one should wish for this to happen, but we are unfortunate to live under a failing monetary system. Debt is growing exponentially. A way must be found to transition to the use of gold. We covered a few ways that won’t work. The Fed...

Read More »The Great Reset, Report 8 July 2018

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Before it collapsed, the city of Rome had a population greater than 1,000,000 people. That was an extraordinary accomplishment in the ancient world, made possible by many innovative technologies and the organization of the greatest civilization that the world had ever seen. Such an incredible urban population depended on...

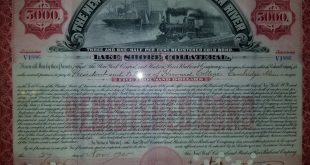

Read More »The Benefits of Issuing Gold Bonds

A gold bond is debt obligation that is denominated in gold, with interest and principal paid in gold. As I will explain below, it’s a way for the issuer to pay off its debt in full, and there are other advantages. Sometimes, I find that it’s helpful to show a picture of what I’m talking about. At the Harvard Club in New York, an old gold bond is hanging on the wall among other memorabilia. This is a gold bond bought by...

Read More »Idaho House Votes Overwhelmingly to Remove Income Taxation from Gold & Silver

- Click to enlarge Boise, Idaho (February 12, 2018) – The Idaho State House today overwhelmingly approved a bill which helps restore constitutional, sound money in the Gem State. State representatives voted 60-9 to pass House Bill 449 sending the measure introduced by House Majority Leader Mike Moyle and Senate Assistant Majority Leader Steve Vick to the Senate for a hearing in the Local Government and Taxation...

Read More »Falling Interest Rates

Left: the first IKEA store located in Älmhult in Sweden, near the residence of the company’s founder (nowadays the store is a museum); right: a Task Rabbit car. - Click to enlarge Amassing Unproductive Debt Last week, we discussed the marginal productivity of debt. This is how much each newly-borrowed dollar adds to GDP. And ever since the interest rate began its falling trend in 1981, marginal productivity of debt...

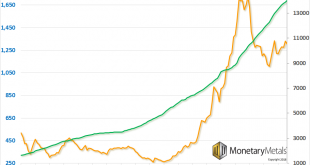

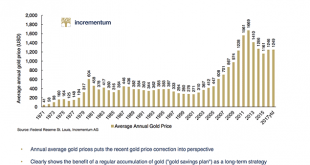

Read More »Key Charts: Gold is Cheap and US Recession May Be Closer Than Think

by Dominic Frisby of Money Week Every year, Ronald-Peter Stoeferle and Mark J Valek of investment and asset management company Incrementum put together the report In Gold We Trust – 160-plus pages of charts and thoughts, mostly gold-related, on the state of the world’s finances. There’s so much to look at and consider. It’s a sort of digital equivalent of a coffee-table book. Yesterday I got an email from them, containing a “best of” – a compendium of some of the best...

Read More »The Scaling Debate & Hard Fork Highlight Several Key Differences Between Bitcoin And Gold

Authored by Mike Krieger via Liberty Blitzkrieg blog, You know stuff’s going down when I write two posts in a row about Bitcoin, something which almost never happens anymore. In Friday’s piece, Is the Bitcoin Civil War Over? Here’s How I’m Thinking About Bitcoin Cash, I discussed a potential strategy that “big blockers” might attempt to execute should the 2x part of Segwit2x not happen later this year. Today, I want to discuss how the entire episode...

Read More »New Gold Pool at the BIS Switzerland: A Who’s Who of Central Bankers

This is an extract and summary from “New Gold Pool at the BIS Basle, Switzerland: Part 1” which was first published on the BullionStar.com website in mid-May. Part 2 of the series titled “New Gold Pool at the BIS Basle: Part 2 – Pool vs Gold for Oil” is also posted now on the BullionStar.com website. “In the Governor’s absence I attended the meeting in Zijlstra’s room in the BIS on the afternoon of Monday,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org