A Morally and Economically Superior Monetary System It has been theoretically demonstrated and seen in general practice that a monetary system of 100% metallic money devoid of central banking checks monetary inflation, prevents a general rise in the price level, and eliminates the dreaded business cycle while making all sorts of monetary mischief nearly impossible. A gold standard is not only economically superior...

Read More »What Can Gold Do for Our Money?

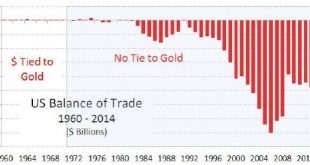

One of the chief virtues of a gold standard is that it serves as a restraint on the growth of money and credit. It makes runaway government deficit spending and major monetary catastrophes such as hyperinflation practically impossible. Opponents of a gold standard can’t defend the political malpractices that are enabled by a fiat currency regime. So instead they spin a narrative about how gold supposedly hampers the economy. According to Keynesian economics, spending boosts the economy...

Read More »Keith Weiner: Gold Standard etc.

Should the Gold Price Keep Up with Inflation? The popular belief is that gold is a good hedge against inflation. Owning gold will protect you from rising prices. Is that true? Who Lends to the Fed? Recently, I wrote to argue against the idea that the Federal Reserve prints money. This leads to our present question. To speak of borrowing and a ready market in which the Fed can borrow, means there is a lender. Who is the lender to the Fed? What is Money Printing? There is a populist idea...

Read More »How Unsound Money Fuels Unsound Government Spending

Sound money advocates are often hit with the charge of being “doom and gloomers.” Yes, we do warn that unsound monetary policies enable unsustainable fiscal commitments, which will lead eventually to a currency crisis. Sound money advocates are also often portrayed as party poopers. Yes, we do seek to take away the bottomless punch bowl of easy money and replace it with something more solid. However, we are not pessimists or killjoys by nature. To the contrary, we are quite optimistic about...

Read More »Why Janet Yellen Can Never Normalize Interest Rates

BALTIMORE – On Tuesday, the Dow sold off – down 133 points. Oil traded in the $36 range. And Donald J. Trump lost the Wisconsin primary to Ted Cruz. Overall, world stocks have held up well, despite cascading evidence of impending doom. With higher rates, Yellen risks corporate profits and bond defaults U.S. corporate profits have been in decline since the second quarter of 2015. Globally, 36 corporate bond issues have defaulted so far this year – up from 25 during the same period of 2015....

Read More »The Path to the Digital Gold Standard

Several Republican presidential candidates are floating the idea of returning to some form of a gold standard in the U.S., although none have gone into any great detail. So, how might a modern gold standard work? It’s a question that requires us to do more than just look to the past with an eye toward “restoring,” “bringing back,” or “returning to” gold-backed money. Sound money advocates need to also think creatively about how to adapt hard money principles to the current and future needs...

Read More »Keith Weiner in Zurich

Keith Weiner, chairman of the Gold Standard Institute United States, will be presenting in Zurich, this Wednesday, October 14 at 18.30. Title: Our Monetary System is Failing, and what we can do against it We hope that the Swiss National Bank will remain safe, during the collapse of the monetary system. We fear the collapse because money flows will direct towards Switzerland again and threaten the solvability of our central bank. Some background in English on the letter to Tsipras, in...

Read More »Keith Weiner: Gold Standard etc.

Will Gold Outperform Stocks? Will gold outperform? With the paperocentric theory, this is hard to answer. We have to estimate increases in the quantity of dollars and calculate how much it will cause prices to rise. Then we have to somehow put a value on gold. It boils down to a guess. The Bull Market in Stocks May Be Over The great stock bull market is, perhaps, done. To most people, a bull market is good, and its end is bad. After all, a rising market signifies a healthy economy....

Read More »Keith Weiner’s Page: Gold Standard etc.

Jackson Hole: Cherry Flavored Cyanide, or Strawberry The American Principles Project and the Atlas Network Sound Money Project, provided a much needed alternative in the Jackson Hole Summit. Move Over Entrepreneurs, Make Way for Speculation! The development of lending was a revolutionary breakthrough. Lending allowed the retiree to do business with the entrepreneur. The retiree has wealth, but no income. The entrepreneur is the opposite, with income but not wealth. The retiree lets...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org