Via GEFIRA, Some say that the common currency prevents less productive economies from cheating by weakening their national currencies and forces them to become more efficient and competitive. Industrial production data shows that it is not the case. Italy, France, Greece and Portugal have not only stopped producing more; they are producing now less than in 1990! The decay started immediately after the introduction of...

Read More »Bundesbank Considers Electronic Money

In the Welt, Karsten Seibel reports about the Bundesbank pondering over digital money. The Riksbank does the same.

Read More »L’Allemagne est le patron-sponsor de l’Eurosystem.

L’Eurosystem fait sauter les frontières nationales et unifie le système du trafic de paiement… Lors des échanges commerciaux et interbancaires, il y a des banques émettrices de monnaie et vis-à-vis une banque réceptrice. Normalement, à la fin de la journée, tout cela devrait être ramené à l’équilibre. Ceci n’est plus le cas depuis la crise américaine de 2007 (subprimes) comme nous le voyons sur le graphique...

Read More »Global Wealth Update: 0.7 percent Of Adults Control $116.6 Trillion In Wealth

Today Credit Suisse released its latest annual global wealth report, which traditionally lays out what is perhaps the biggest reason for the recent “anti-establishment” revulsion: an unprecedented concentration of wealth among a handful of people, as shown in its infamous global wealth pyramid, an arrangement which as observed by the “shocking” political backlash of the past few months suggests that the lower ‘levels’...

Read More »Trumpflation Takes A Breather As Global Stocks Rise, Oil Jumps On Renewed OPEC “Deal Optimism”

With the Trumpflation euphoria easing back slightly overnight, leading to a modest paring in the USD index and US Treasury yields, Asian and European stocks rose, while US equity futures rebounded to just shy of new all time highs, as crude jumped on renewed optimism that OPEC will agree to cut output; Italian equities underperformed ahead of the Italian referendum; metals rebounded from last week’s losses as yields dropped and the dollar halted its longest winning streak versus the euro....

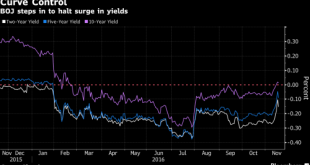

Read More »BOJ “Fires Warning At Bond Market” Sending Global Yields, Dollar Lower; All Eyes On Yellen

Yesterday morning we noted why, in light of the ongoing global bond rout, all eyes would be on the BOJ, and specifically whether Kuroda would engage his "Yield control" operation to stabilize the steepness of the JGB yield curve and implicitly support global bond yields in what DB said would be "full blown helicopter money" where the "BoJ is flying the copter over the US and may be about to become the new US government’s best friend." And sure enough that is precisely what Kuroda did last...

Read More »European Central Bank gold reserves held across 5 locations. ECB will not disclose Gold Bar List.

Submitted by Ronan Manly, BullionStar.com The European Central Bank (ECB), creator of the Euro, currently claims to hold 504.8 tonnes of gold reserves. These gold holdings are reflected on the ECB balance sheet and arose from transfers made to the ECB by Euro member national central banks, mainly in January 1999 at the birth of the Euro. As of the end of December 2015, these ECB gold reserves were valued on the ECB...

Read More »When It Comes To Household Income, Sweden & Germany Rank With Kentucky

Submitted by Ryan McMaken via The Mises Institute, Annual Median Equivalized Disposable Household Income in USD Last year, I posted an article titled “If Sweden and Germany Became US States, They Would be Among the Poorest States” which, produced a sizable and heated debate, including that found in the comments below this article at The Washington Post. The reason for the controversy, of course, is that it has nearly...

Read More »Central Bank Austria Claims To Have Audited Gold at BOE. Refuses To Release Audit Report

Submitted by Koos Jansen from BullionStar.com After years of gradually securing its official gold reserves (unwinding leases) the central bank of Austria claims to have completed the audits of its 224 tonnes of gold stored at the BOE. However, it refuses to publish the audit reports and the gold bar list. What could possibly be so sensitive to hide from public eyes? After the Germans had activated a program to...

Read More »Cashless Society – Is The War On Cash Set To Benefit Gold?

Submitted by Jan Skoyles via GoldCore.com, Introduction Cash is the new “barbarous relic” according to many central banks, regulators, and some economists and there is a strong, concerted push for the ‘cashless society’. Developments in recent days and weeks have highlighted the risks posed by the war on cash and the cashless society. The Presidential campaign has been dominated for months and again this week by the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org