Summary: Spain and Portugal need to make some relatively small budget adjustments or will be denied some transfer payments. Spain’s political situation is fluid, but another window of opportunity to break the logjam is at hand. The euro seems immune to these fiscal developments; some retracement objectives are in sight. The eurozone finance ministers have accepted the EC’s recommendation that Spain and...

Read More »FX Daily, August 09: Sterling Slips to a Four-Week Low, EUR/CHF still trending up

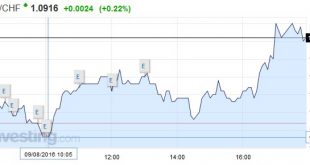

Swiss Franc The upwards tendency of the euro against CHF continues.The 100 day EMA of 1.0901 has passed. Click to enlarge. FX Rates In an otherwise uneventful foreign exchange market, sterling’s slide for its fifth consecutive session is the highlight. It was pushed below $1.30 for the first time since July 12. Initial resistance for the North American session is seen near $1.3020, while the $1.2960 area...

Read More »Bernanke’s Advice: More Emphasis on Data, Less on Fed Guidance

Summary: Bernanke reviews the changes in the long-term dot plots. There as been a clear trend toward lower long-term growth, unemployment and Fed funds equilibrium. The full adjustment may not be over. Former Fed Chair Bernanke keeps a blog at Brookings. His latest post offers insight into how to think about Federal Reserve, and in particular, Fed officials’ understanding of the US economy. Bernanke’s...

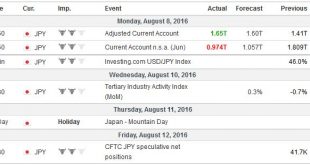

Read More »FX Daily, August 08: Stocks Up, Bonds Down, Dollar and Yen are Heavy

Swiss Franc Click to enlarge. FX Rates Investors favor risk assets today. Global stocks are moving higher in the wake of the pre-weekend US rally that saw the S&P 500 close at record levels. Bond yields are mostly firmer, again with US move in response to the robust employment report setting the tone in Asia. European bonds participated in most of the pre-weekend move and are consolidating today with a...

Read More »Great Graphic: Oil Recovery Extends

Summary: Oil prices extend last week’s rally. Last week’s rally was driven by the fall of gasoline inventories. Today’s advance was helped by speculation over next month’s IEA meeting. This Great Graphic from Bloomberg shows the September light sweet crude oil futures contract since peaking in early June near $52.75. It reached a low last week of about $39.20. The turn last week came on news that although oil...

Read More »China: Political and Economic Developments

Summary: Balance of power in China between “princleling and youth league may be at risk. Foreigners have stopped up their purchases of onshore CNY bonds. Tensions are rising between China and Japan and China and South Korea. This is the period in the monthly cycle that China releases most of its high frequency data. The process is well under way. Over the weekend, China reported its reserve figures that...

Read More »FX Weekly Preview: Light Economic Calendar Week Allows New Thinking on Macro

Summary: Policy outlook is clear: ECB and BOJ review next month, FOMC still looking for opportunity. Inventory cycle making quarterly US GDP forecasting difficult, but it looks like re-acceleration still the more likely scenario than recessions. Why didn’t European bank stress tests results have more impact? The drip-feed of high frequency economic data from the major economies slows in the week ahead. The data...

Read More »FX Weekly Review, August 01 – August 05: Does the Jobs Report Give the Greenback Legs?

Swiss Franc Currency Index Our weekly comparison with the dollar index: The positive performance of the Swiss franc index was reversed on Friday. Finally the dollar index had a better week than the Swiss Franc index. Click to enlarge. Swiss Franc Currency Index (3 years) The Swiss Franc index is the trade-weighted currency performance (see the currency basket) On a three years interval, the Swiss Franc had a...

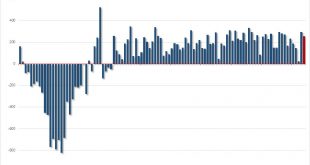

Read More »Weekly Speculative Positions: Record Sterling Shorts, Net Short in Swiss Francs

For a period that included a BOJ and FOMC meeting and the US GDP, speculators in the currency futures were unusually quiet. Summer holidays with family may be more important. Of the 16 gross currency futures speculative positions we track, 12 of them were less than 5k contracts. There was only one gross position adjustment more than 10kcontracts. Euro bears covered 13.2k gross short euro contracts,...

Read More »US Jobs Surprise, Canada Disappoints

Summary: Underlying concerns about US labor market ease after two robust reports. Sept Fed views will not change much. Canada’s data is disappointing, BOC optimism may be challenged. United States Nonfarm payrolls The market’s angst over the underlying trend in the US labor market eases with the help of the second consecutive robust report. The 255k rise in non-farm payrolls was well above expectations, and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org