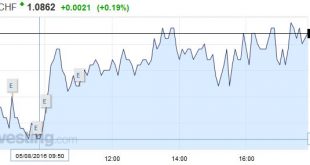

Swiss Franc As usual, when U.S. data is good, then the EUR/CHF appreciates. Click to enlarge. FX Rates The focus is squarely on the US employment data today, ahead of which the capital markets are mostly consolidating yesterday’s Bank of England inspired moved. The Australian and New Zealand dollars, alongside sterling, which is up about half a cent after losing two yesterday. The RBA’s monetary policy statement...

Read More »FX Daily, August 04: The BOE Owns Today, but Tomorrow is a Different Story

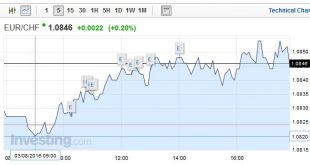

Swiss Franc The Swiss Franc appreciated today against the euro. Given that the Bank of England started monetary easing, this slight appreciation is unexpectedly weak – reason was probably intervention. The SNB intervention level should be around 1 billion francs. Numbers revealed in next week’s sight deposits. Click to enlarge. Bank of England The Bank of England owns today, though tomorrow will be about the US...

Read More »Carney Gets Ahead of Market Expectations; Sterling Slumps, Gilts Soar

Summary: BOE cuts rates and expands QE. Door is open to more easing. Sterling stabilizes after selling off 2 cents. Sterling has slumped two cents in the wake of the Bank of England’s announcement. It cut the base rate 25 bp and announced a resumption of its asset purchase program. It will buy GBP60 bln of Gilts and added corporate bonds to its purchase plan, which will be completed over the next six...

Read More »FX Daily, August 03: Consolidation Featured

Swiss Franc Click to enlarge. FX Rates The US dollar is consolidating yesterday’s losses. The greenback’s upticks have thus far been shallow and unimpressive, except perhaps against the New Zealand dollar, which is off 0.8% ahead of next week’s RBNZ meeting. Softer than expected labor cost increase reinforces the conviction that a 25 bp rate cut will be delivered next week. The asset markets are more...

Read More »Gorilla or Elephant, Chinese Surplus Capacity is the Challenge

Summary: China’s excess capacity is one of the most formidable challenges the China and the world face. Unexpectedly, China’s steel industry reported a profit in H1 16. M&A for industry rationalization and foreign markets seem to be the main ways China is trying to address the excess capacity. Americans have a saying about an 800-pound gorilla in a room. It refers to a person or organization so...

Read More »FX Daily, August 02: Greenback Slides Despite RBA Rate Cut and 7-year Low in UK Construction PMI

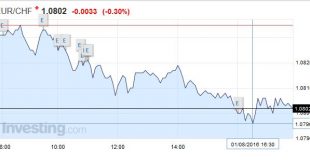

Swiss Franc The euro appreciated against both Swiss Franc and dollar. Swiss retail sales was again very weak, but emphasize our last month comment: The measurement of retail sales (and also GDP) ignore the active second-hand markets in Switzerland. The Swiss SVME PMI was at 50.1 close to contraction, another piece of bad data. Click to enlarge. FX Rates The US dollar is offered against the major currencies, but...

Read More »Great Graphic: The Decline in Durable Goods Prices

Summary: Service prices are rising, while goods prices have steadily fallen. Non-durable goods prices are stabilizing, while durable goods prices are still falling. The decline in durable goods prices is an important economic development. The rust line is service prices. They are steadily increasing. No deflation or disinflation here. Think about rent, medical services, education, and entertainment. The three...

Read More »Abe’s Fiscal Policy: More of the Same

Summary: Japan’s fiscal stimulus if smaller than it appear and is unlikely to boost the economy as much as officials may think. The problem in Japan is not that interest rates are too high or that pubic investment is too weak. The risk is that the yen strengthens further, and we suggest the dollar may fall toward JPY94.60. The Japanese government is delivering the other half of its fiscal policy today....

Read More »FX Daily, August 01: Dog Days of August Begin

Swiss Franc Click to enlarge. FX Rates The US dollar is trading with a small upside bias in narrow trading ranges. The main news has consisted of PMI reports, while investors continue to digest last week’s developments. In particular the BOJ’s underwhelming response to poor economic data and a missed opportunity to reinforce the fiscal stimulus, and the dismal US GDP. The dollar has been pinned today in the lower...

Read More »Great Graphic: Real Broad Trade-Weighted Dollar

Summary: The real broad trade-weighted dollar index rose in July for the third month. It peaked in January above trendline drawn through the Reagan and Clinton dollar rallies. Expect the trendline to be violated again before the end of the year. This Great Graphic, created on Bloomberg, depicts the Federal Reserve’s real broad trade-weighted index of the dollar. Real means that it is adjusted for inflation...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org