Judging from investors’ reactions, the only thing worse that than the low volatility environment is when volatility spikes higher, as it did yesterday. Higher volatility is associated with weakening equity markets, falling interest rates, pressure on emerging markets, a strengthening yen and, sometimes, as was the case yesterday, heavier gold prices. A fragile stability has enveloped the markets after US equities markets stabilized yesterday and the dollar recovered from earlier losses. Those dollar gains have been pared and sterling recovered from what many are calling a mini-flash crash, during which sterling fell nearly 3/4 of a cent in a matter of minutes with no apparent trigger. A combination of algorithmic trading, market fragmentation, and less liquid conditions often in the US afternoon are seen as the main culprit. Swiss Franc EUR/CHF - Euro Swiss Franc, May 19(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF The pound to Swiss Franc rate has slipped from the recent highs of over 1.30 which were the best rates to buy Francs with pounds since September 2016. The pound to Franc rate has fallen as sterling suffers at the mercy of higher inflation and the Franc is bought as European markets fare well but there does remain a degree of international uncertainty.

Topics:

Marc Chandler considers the following as important: Canada, Canada consumer price index, EUR/CHF, Eurozone Consumer Confidence, Eurozone Consumer Price Index, Featured, FX Trends, GBP/CHF, Germany Producer Price Index, newslettersent

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Judging from investors’ reactions, the only thing worse that than the low volatility environment is when volatility spikes higher, as it did yesterday. Higher volatility is associated with weakening equity markets, falling interest rates, pressure on emerging markets, a strengthening yen and, sometimes, as was the case yesterday, heavier gold prices.

A fragile stability has enveloped the markets after US equities markets stabilized yesterday and the dollar recovered from earlier losses. Those dollar gains have been pared and sterling recovered from what many are calling a mini-flash crash, during which sterling fell nearly 3/4 of a cent in a matter of minutes with no apparent trigger. A combination of algorithmic trading, market fragmentation, and less liquid conditions often in the US afternoon are seen as the main culprit.

Swiss Franc |

EUR/CHF - Euro Swiss Franc, May 19(see more posts on EUR/CHF, ) |

GBP/CHFThe pound to Swiss Franc rate has slipped from the recent highs of over 1.30 which were the best rates to buy Francs with pounds since September 2016. The pound to Franc rate has fallen as sterling suffers at the mercy of higher inflation and the Franc is bought as European markets fare well but there does remain a degree of international uncertainty. The US dollar has been sold off lately and the Franc has been a main beneficiary. This will all probably subside in the coming weeks and rates back over 1.30 could easily be seen again, particularly if Theresa May wins a strong victory in the UK election on June 8th. The Swiss Franc was sold off following the election of Macron and sterling too received a boost at that time as the Euro struggled on concerns that Macron would not form a government easily. With such concerns seemingly addressed ahead of the French parliamentary elections on the 11th to 18th June the Euro should be stronger ahead. Whilst the Franc does loosely track the Euro the Swissie is a safe haven currency which means in times of political and economic uncertainty it performs well (strengthens) whilst in times of political and economic certainty it might weaken as investors have confidence to look elsewhere for their investments. This is why the Franc did weaken just after the French election. The pound is struggling this week as despite some good Retail figures, rising Inflation is being seen to eat into people’s back pockets. Looking forward however the UK election is likely to see a strong Tory victory on June 8th which could help the pound. This could see GBP/CHF over 1.30 but with the result arguably being priced into sterling now, the pound remains at risk of being a victim of its own success and not fulfilling the high expectations set. |

GBP/CHF - British Pound Swiss Franc, May 19(see more posts on GBP/CHF, ) |

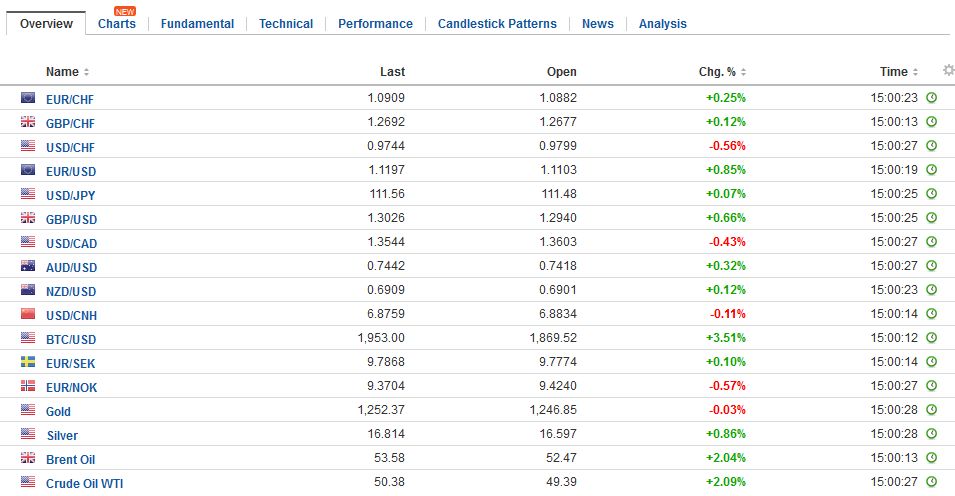

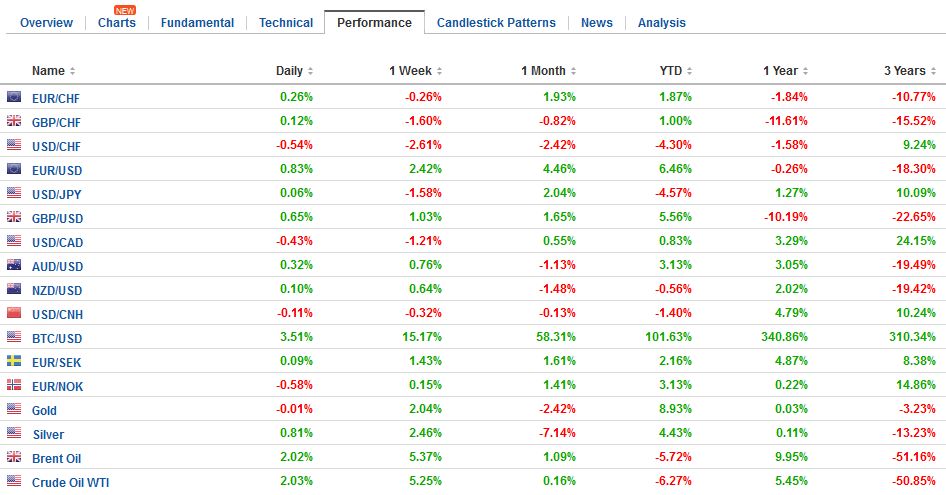

FX RatesThe recovery on Wall Street helped Asian and European markets steady today. The MSCI Asia Pacific Index eked out a small 0.15% gain, cutting this week’s loss in half. WE note that the South Korea’s KOSPI managed to post a small gain today and on the week, despite tensions on the peninsula not relaxing much, thought the Korean won weakened (0.2% on the day to be the weakest of the Asian currency complex). The won is essentially flat in the week. The US has reportedly sent another aircraft carrier into the region. Separately, China intercepted a US aircraft over the East China Sea. European shares are doing better. The Dow Jones Stoxx 600 is nearly 0.5% in late morning turnover, leaving it off 1.2% for the week and snapping a three-week advance. Materials and energy are the leading the market higher. Real estate and consumer discretionary are lagging, but all sectors are higher. Emerging markets are doing better today as well. The MSCI Emerging equity market index ended a seven-day advance Wednesday and fell 2% yesterday. Ahead of the Latam open, it is up about 0.4% today. It four-week rally is at risk. Mexico surprised many yesterday with its sixth consecutive rate overnight rate hike (6.75% from 6.50%). The peso had largely recovered from its mostly Brazil-induced slide before the central bank met and it has continued to edge higher today. Brazil’s situation does not appear to have stabilized much. The country ETF that trades in Japan fell another 6.5% earlier today. Of the two men who led the impeachment of the former president on corruption charges, one is in jail, and the other is president and allegedly is recorded supporting payoffs to the one in jail. The other more liquid and accessible emerging market currencies like the South African rand and the Turkish lira are also recovering from yesterday’s slide. |

FX Daily Rates, May 19 |

| Also, earlier today S&P lifted its rating on Indonesia one step to BBB-, which brings its back into investment grade status. This brings S&P into line with the leading rating agencies. However, it has a stable outlook, while Moody’s and Fitch have positive outlooks. The currency gained a little ground while the stock market surged to a new record high, and gained 2.5% on the day.

While markets are calmer than yesterday, nothing has been resolved. US political risks remain. Impeachment talk is not only unfounded but not politically realistic, even if some Democrats are pushing it. First, Trump’s support among Republicans remains high, according to recent polls. Second, the Republican’s have a 45-seat majority in the House of Representatives, where a vote to impeach requires a simple majority. In Senate, where the Republican’s have 52 seats, only 35 votes would be necessary to block a conviction. The more realistic threat is that the investigation into links with Russia distracts from the economic agenda, especially given the inexperienced team in the executive branch in terms of shepherding legislation through Congress. Investors are probably best served by monitoring progress on the economic agenda. There are three developments to note. First, with Lighthizer being confirmed as Trade Representative, the 90-day notice to renegotiate NAFTA formally was given. Ideas that a new agreement can be wrapped up by the end of the year seems unrealistically ambitious. Second, Treasury Secretary Mnuchin affirmed that a ultra-long bond (50-years or more) is being contemplated, despite a cool reception by primary dealers. Third, Speaker of the House Ryan indicated that he still favors the border adjustment tax, even though the White House has indicated that its current form is not acceptable. |

FX Performance, May 19 |

EurozoneThe euro has returned to approach yesterday’s highs. The price action reaffirms the importance of support we noted yesterday in the $1.1080-$1.1100 area. The intraday technicals are getting stretched, and barring new developments, not much more than a marginal new high seems likely. The JPY111.75-JPY112.00 may be sufficient to cap a stronger dollar recovery against the yen as the US 10-year struggles to push above 2.25%, as it nurses a nine basis point decline on the week. Sterling has edged back above $1.30. The $1.3055 retracement objective held yesterday and may be tested again today. Intraday technicals warn against a significant break above there before the weekend. The Australian dollar may have peaked after it made a marginal new high for the week near $0.7470. Support is seen by $0.7430. |

Eurozone Current Account, March 2017(see more posts on Eurozone Current Account, ) Source: Investing.com - Click to enlarge |

Eurozone Consumer Confidence, May 2017(see more posts on Eurozone Consumer Confidence, ) Source: Investing.com - Click to enlarge |

|

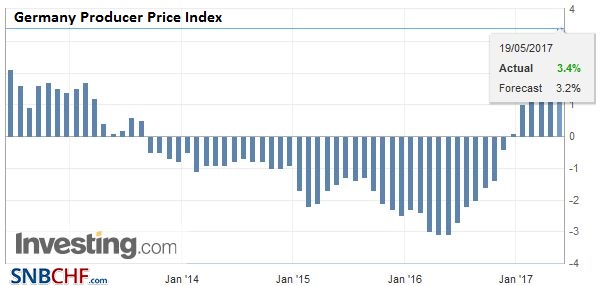

Germany |

Germany Producer Price Index (PPI) YoY, April 2017(see more posts on Germany Producer Price Index, ) Source: Investing.com - Click to enlarge |

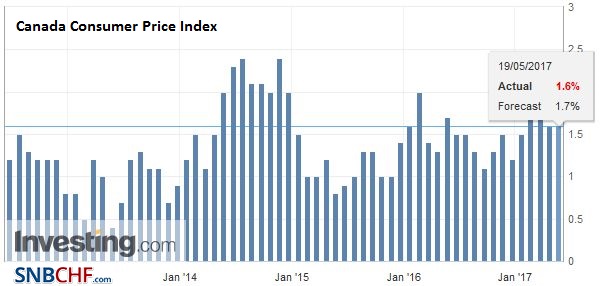

CanadaThe US economic calendar is clear. President Trump’s first trip abroad is about to begin. Saudi Arabia is the first stop. The Canada reports April CPI and March retail sales. The pace of inflation may tick up a little but remains subdued. Retail sales are expected to increase 0.3% after a 0.6% fall in February. The Bank of Canada meets next week, and there is little doubt that policy will remain steady. The US dollar is at new lows for the week and month against the Canadian dollar. It has been flirting with the CAD1.3575 retracement target for several days. A convincing break targets CAD1.3510 initially and then CAD1.3440. However, the intraday technicals warn that even a slight disappointment with the data could see the greenback bounce back. |

Canada Consumer Price Index (CPI) YoY, April 2017(see more posts on Canada Consumer Price Index, ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: Canada,Canada Consumer Price Index,EUR/CHF,Eurozone Consumer Confidence,Eurozone Consumer Price Index,Featured,GBP/CHF,Germany Producer Price Index,newslettersent