The US dollar rose against all the major currencies last week. The importance of the price action does not lie with the magnitude or the breadth of the advance. Instead, the two takeaway technical observations are 1) the seemingly one-way market for euro and yen ended and 2) the dollar-bloc currencies appear to have put in at least a medium-term top. We hasten to note that the fundamental developments have not shifted a more dollar-friendly near-term direction. Investors, judging from...

Read More »Great Graphic: Non-Consensus Thinking on Trade

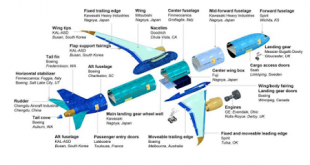

This Great Graphic was posted by Eric Nelson, the managing editor of the Chamber of Commerce’s Above the Fold publication. It shows many of the different components of the 737 single-aisle airplane and where they are sourced. There is a complex supply chain that stretches from Australia, through Asia (e.g., Japan, South Korea, and China) through Europe (France, Sweden, the UK, and Italy). It extends into Canada and several US states as well. Some of the foreign-sourced...

Read More »FX Daily, May 5: Dollar Performance Turns More Nuanced

The US dollar is firm, near the best levels of the week against the euro, yen, and sterling. However, against the dollar-bloc and several actively traded emerging market currencies, including the Turkish lira and South African rand, the greenback has given back some of yesterday’s gains. Oil is snapping a four-day decline. News that US output fell by 113k barrels a day last week, the biggest drop in eight months, coupled with a Canadian wildfire that is threatening as much as one...

Read More »Cool Video: Trump and the Dollar–Bloomberg TV

I was invited to discuss the potential impact of a Trump presidency on the US dollar with Bloomberg's with Joe Weisenthal, Oliver Renick, and Alix Steel on "What'd You Miss" show yesterday afternoon, Of course the topic lends itself to all sorts of partisanship. However, I put aside my own political axes and focused on two potential channels through which could impact the dollar. The first is through a foreign economic policy that undermines US treaty obligations under various trade...

Read More »Political Crisis in Turkey is Not Good for Europe

It has been long recognized by the investment community that power in Turkey was concentrated in Erdogan’s hands. He enjoys incredible power in the ceremonial presidential post and brooks no rivals. Common among authoritarian leaders they habitually turn on hand-picked successors as they grow fearful of competitors. This is precisely what has played out in Turkey in recent days and now has come to a head. Prime Minister Davutoglu returned from a trip to Europe and the Middle East to...

Read More »EM FX Technical Picture

In light of the Fed’s dovish tilt in March, the global liquidity outlook turned further in favor of EM. As a result, EM extended the bounce off the January/February lows. There’s no clear narrative as to why EM is softer this week, but it just seems to be a much-needed correction and positioning flush-out. Bottom line: a dovish Fed (for now) should limit this sell-off, and the EM rally could resume for a while longer before turbulence returns later this year. We expect many EM...

Read More »Great Graphic: CAD Takes out Trendline

CAD BGN Curncy It has been painful trying to pick a bottom of the US dollar against the Canadian dollar. But now a 4-5 point downtrend from the secondary high in late-January is being violated today. It is found near CAD1.2785 today. Intraday penetration is one thing, but some models may take the signal on a closing basis only. CAD BGN Curncy The US dollar recorded the multi-year high against the Canadian dollar on January 20 a little below CAD1.47. Since then the Canadian...

Read More »Great Graphic: Odds of President Trump Rise (Predictit)

TRUMP . USPREZ16 This Great Graphic is a 90-day history of the “betting” at PredictIt that Trump becomes the new US President. With Cruz suspending his campaign, the odds of Trump have risen just above 40%. TRUMP.USPREZ16 The US national interests and challenges to those interests do not change much from year-to-year, and this may help explain the continuity in US foreign policy (including foreign economic policy). Trump’s campaign style emphasized a break from the conventional...

Read More »Greenback Firmer, but has it Turned?

There is one question many investors are asking after noting that with Cruz dropping out of the Republican primary, Trump has secured the nomination, and that is whether the dollar has turned. The greenback has extended yesterday’s reversal higher. The euro had briefly poked through $1.16 and closed on its lows a little below $1.15. Sterling peaked above near $1.4770 and finished near$1.4535 for a potential key reversal. Despite weakness in US stocks and a sharp drop in US yields, two...

Read More »Two Decisions from Europe

It might not be on investors’ calendars, but European officials will take steps toward addressing two issues tomorrow. First, the EC will make a preliminary recommendation of visa-free travel in the Schengen area for Turkish passport holders. Second, the ECB governing council will hold a non-monetary policy meeting. It is expected to discuss the future of the 500-euro note. In exchange for implementing previously agreed upon measures to address the refugees going from Turkey to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org