“An eternally high plateau” US markets made headlines once again, as they reached new highs recently, continuing a rally that seems to defy gravity and common sense. Despite the rise in investor anxiety and heightened volatility that seemed to signify a possible end to the bull market at the final quarter of the last year, exuberance has returned since the beginning of 2019, while overall the S&P 500 has risen by more than 300% since its March 2009 lows. Valuations are extremely high...

Read More »TURKEY’S INEVITABLE RECESSION – PART II

Spillover effects Turkey’s debt problem, coupled with the plummeting lira, is arguably the most important risk factor for the nation’s economy. To make matters worse, far from it posing a threat just to Turkey itself, it also has the potential to inflict significant damage elsewhere too, starting with key economies in the Eurozone. At first glance, the situation in Turkey might resemble many past similar scenarios of a heavily indebted nation with a plummeting currency that descends into...

Read More »TURKEY’S INEVITABLE RECESSION – PART I

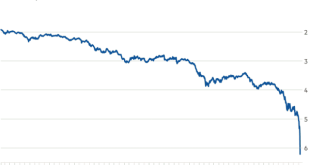

Turkey has been almost constantly in the news over the past year, as troubling headlines about its economy and political situation continue to pile up. In a currency meltdown that escalated last summer, the Turkish lira has plunged by nearly 40%, threatening the Turkish economy as a whole. In January, inflation topped 20%, with skyrocketing food prices having an especially severe impact on the population. At the same time, unemployment hit 14.7%, its highest level in a decade, and a...

Read More »Sound money: A Biblical perspective – Part I

«It is the mark of an educated mind to be able to entertain an idea without accepting it.»Aristotle In today’s world, it is obvious that the competition of ideas is under serious threat and with it, the much-needed discussions on how to deal with certain topics or try to understand the world we live in. That is particularly worrying, especially when one considers that the western world went through the process of...

Read More »Sound money: A Biblical perspective – Part I

«It is the mark of an educated mind to be able to entertain an idea without accepting it.»Aristotle In today’s world, it is obvious that the competition of ideas is under serious threat and with it, the much-needed discussions on how to deal with certain topics or try to understand the world we live in. That is particularly worrying, especially when one considers that the western world went through the process of Enlightenment roughly 200 years ago. In the words of Immanuel Kant:...

Read More »Merger mania: Consolidation in the gold mining sector

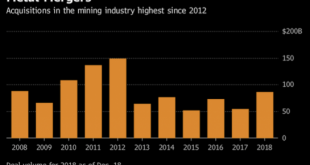

Late last year, Barrick Gold, the world’s largest gold miner in terms of reserves, made headlines when it announced its acquisition of Randgold Resources, in an $18bn mega-merger that marked a key moment for the mining industry. In January, United States gold giant Newmont and principal rival of Barrick, made public its own plans to buy Canada’s Goldcorp, the world’s third-largest bullion producer by market value, for...

Read More »Merger mania: Consolidation in the gold mining sector

Late last year, Barrick Gold, the world’s largest gold miner in terms of reserves, made headlines when it announced its acquisition of Randgold Resources, in an $18bn mega-merger that marked a key moment for the mining industry. In January, United States gold giant Newmont and principal rival of Barrick, made public its own plans to buy Canada’s Goldcorp, the world’s third-largest bullion producer by market value, for $10 billion. The deal, that is largely expected to go ahead and be...

Read More »“Today’s EU is the embodiment of bureaucratic hubris”

Interview with Dr. Markus Krall: When it comes to identifying and evaluating the key vulnerabilities and inherent risks of the banking and financial system, there are few who have the insights and practical experience that is required to truly understand the scale of the issue and its investing implications. This is precisely why Claudio Grass turned to Dr. Markus Krall, who graciously agreed to share his thoughts and observations, as well as his outlook on the future of the financial...

Read More »Claudio Grass – Sound Money & Human Liberty Are Inextricably Linked

SBTV speaks with Claudio Grass, an independent precious metals adviser based in Switzerland. A proponent of sound money and the Austrian School of Economics, Claudio shares his convictions on why human liberty and sound money are inextricably linked. Discussed in this interview: 02:39 Relationship between liberty and sound money 06:51 Keynesian view of money 09:58 Similarities between Austrian School and Keynesian economics? 14:00 Geopolitical issues clouding the near future 18:08...

Read More »ECB: running out of runway – Part II

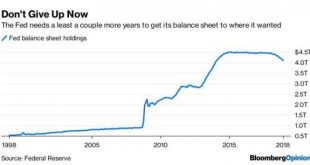

Knock-on effects Overall, under Mr. Draghi’s watch, the ECB’s balance sheet has ballooned to a previously unimaginable scale and aggressive policies like the extensive QE program and negative rates have encouraged the accumulation of debt and heavily distorted market mechanisms. Scores of “zombie” companies, that would have otherwise died off without the artificial life support of cheap credit, are now plaguing most...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org