“Perhaps they think that they will exercise power for the generall good, but that is what all those with power have believed. Power is evil in itself, regardless of who exercises it.” – Ludwig von Mises, Nation, State, and Economy After the Federal Reserve’s monetary policy U-turn earlier this year and the central bank’s decision to cut interest rates for the first time in a decade, mainstream investors and analysts believe that holding rates lower and for...

Read More »The Fed’s Capitulation: What It Means For Gold Investors

“Perhaps they think that they will exercise power for the general good, but that is what all those with power have believed. Power is evil in itself, regardless of who exercises it.” – Ludwig von Mises, Nation, State, and Economy After the Federal Reserve’s monetary policy U-turn earlier this year and the central bank’s decision to cut interest rates for the first time in a decade, mainstream investors and analysts believe that holding rates lower and for longer will help keep...

Read More »“More of the same” at the ECB increases gold’s appeal

“The intellectual leaders of the peoples have produced and propagated the fallacies which are on the point of destroying liberty and Western civilization.” Ludwig von Mises, Planned Chaos It took multiple meetings and over 50 hours of official negotiations for EU leaders to reach an agreement on the appointments for the top jobs of the EU and the ECB, but in mid-July the results finally came in. The ECB was particularly in focus, as bad news keeps piling up for the Eurozone economy and...

Read More »“More of the same” at the ECB increases gold’s appeal

“The intellectual leaders of the peoples have produced and propagated the fallacies which are on the point of destroying liberty and Western civilization.” Ludwig von Mises, Planned Chaos It took multiple meetings and over 50 hours of official negotiations for EU leaders to reach an agreement on the appointments for the top jobs of the EU and the ECB, but in mid-July the results finally came in. The ECB was particularly in focus, as bad news keeps piling up for the...

Read More »New solutions to old problems: The CoreLedger Decentralized Token Economy Operating System

“Systems which are in an unnatural state, like our current financial system, only need a push to relax all the accumulated energy and evolve into something new.” Dr. Johannes Schweifer, Co-Founder and CEO of CoreLedger. Following the rise and fall of Bitcoin and the crypto rush-and-crash of 2017, words like “blockchain” and “tokenization” have entered the mainstream. However, as most people watching, or even participating, in the crypto-mania didn’t actually have a clear understanding...

Read More »“THE BIGGEST PROBLEM IS THE DEBT PROBLEM” – INTERVIEW WITH H.S.H. PRINCE MICHAEL OF LIECHTENSTEIN (PART II)

“Like medieval alchemy that failed to turn lead into gold, today’s easy-money folly of central banks and governments will lead to crisis, not economic growth and prosperity.” – H.S.H. Prince Michael of Liechsteinstein Claudio Grass (CG): Despite its formidable tradition and the “Old-World” heritage that Liechtenstein was founded upon, the tiny principality has been incredibly agile and efficient in embracing and fostering entrepreneurship, innovation and new technologies, the most...

Read More »“THE BIGGEST PROBLEM IS THE DEBT PROBLEM” – INTERVIEW WITH H.S.H. PRINCE MICHAEL OF LIECHTENSTEIN (PART I)

“In fact, it is easier for governments to control the spending of people in debt than those with savings. A person with financial resources is free, while debtors are hostage to their creditors.”H.S.H. Prince Michael of Liechtenstein The rare resilience and the economic and strategic prowess of the Principality of Liechtenstein have elevated the small alpine nation to a bright example internationally in terms of prudent governance. It offers countless lessons in long-term planning, in...

Read More »THE ROAD TO SERFDOM – BY THE EXAMPLE OF VENEZUELA – PART II

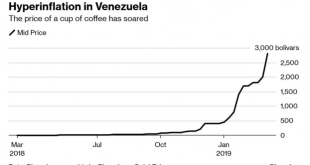

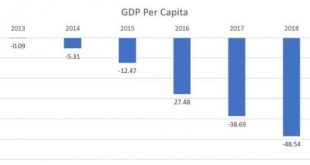

“Inflationism, however, is not an isolated phenomenon. It is only one piece in the total framework of politico-economic and socio-philosophical ideas of our time. Just as the sound money policy of gold standard advocates went hand in hand with liberalism, free trade, capitalism and peace, so is inflationism part and parcel of imperialism, militarism, protectionism, statism and socialism.” Ludwig von Mises, On the Manipulation of Money and Credit, p. 48 Claudio Grass (CG): We have all...

Read More »The Road to Serfdom – by the example of Venezuela – Part I

“Venezuela is the current poster child of interventionist failure” When looking at the quality of the media coverage of Venezuela’s crisis and the interpretations of the factors that caused it, the superficiality of most analyses quickly becomes apparent. The explanations offered by many “experts” and commentators largely ignore the country’s history and fail to take into account the pre-existing political and economic dynamics that heavily contributed to, if not predetermined,...

Read More »All this borrowing to consume is unsustainable and the bill is overdue

INTERVIEW WITH KEITH WEINER June has been an interesting month for gold, as geopolitical events, market fluctuations and developments on the monetary policy front fueled an exciting ride for the precious metal. As long-term investors with a strict focus on the big picture, short-term moves and speculative angles are largely irrelevant in and of themselves, but they do provide important signals that, without fail,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org