“An eternally high plateau” US markets made headlines once again, as they reached new highs recently, continuing a rally that seems to defy gravity and common sense. Despite the rise in investor anxiety and heightened volatility that seemed to signify a possible end to the bull market at the final quarter of the last year, exuberance has returned since the beginning of 2019, while overall the S&P 500 has risen by more than 300% since its March 2009 lows. Valuations are extremely high and investors are paying incredible premiums, buying largely overpriced equities, out of a very widespread “fear of missing out”. Record profits might seem enticing at first glance, yet they quickly become a warning sign instead of an invitation when one realizes that they are fueled by stock buybacks,

Topics:

Claudio Grass considers the following as important: Economics, Finance, Gold, Monetary, Politics

This could be interesting, too:

Investec writes The Swiss houses that must be demolished

Claudio Grass writes The Case Against Fordism

Claudio Grass writes “Does The West Have Any Hope? What Can We All Do?”

Investec writes Swiss milk producers demand 1 franc a litre

“An eternally high plateau”

US markets made headlines once again, as they reached new highs recently, continuing a rally that seems to defy gravity and common sense. Despite the rise in investor anxiety and heightened volatility that seemed to signify a possible end to the bull market at the final quarter of the last year, exuberance has returned since the beginning of 2019, while overall the S&P 500 has risen by more than 300% since its March 2009 lows. Valuations are extremely high and investors are paying incredible premiums, buying largely overpriced equities, out of a very widespread “fear of missing out”.

Record profits might seem enticing at first glance, yet they quickly become a warning sign instead of an invitation when one realizes that they are fueled by stock buybacks, which are in turn fueled by skyrocketing debt levels. And at the center of it all, is the loose money policies of the Federal Reserve. The recent monetary U-turn of the central bank may have set off yet another round of enthusiasm and jubilation in the markets for the moment, but it also made sure that when the party ends, it will end very badly indeed.

Fed U-turn impact

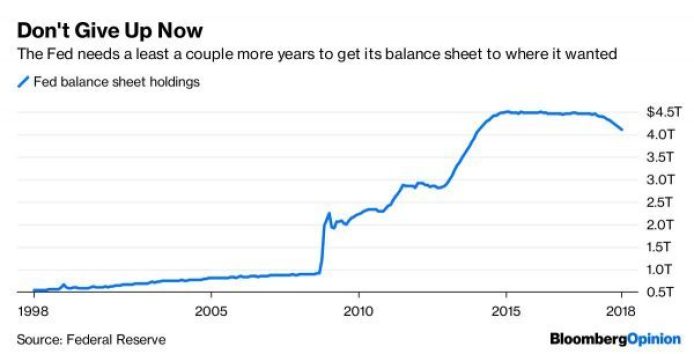

Although Fed Chair Powell, when he first took over the office, had vowed to remain impartial and apolitical and to do what’s best for the economy, in late March it became abundantly clear that this was a pledge he could not keep. After months of heated criticism and intense pressure from President Trump, who blamed the Fed for unsettling the markets, the central bank finally succumbed and announced its policy reversal. The Federal Open Market Committee (FOMC) made it clear that no more interest rate hikes are planned for this year, while the ambitious, and unique among major central banks, plan to reduce the Fed’s balance sheet (Quantitative Tightening, “QT”) is also set to slow down and to come to an early end in September. In other words, the Fed’s normalization process is over.

Having won this battle, the President and other like-minded members of the administration, were quick to push for more market accommodations. For example, President Trump called for a return to QE. His National Economic Council Director, Larry Kudlow, called for an interest rate cut, while was also quoted as saying that it’s possible that rates will never go up again during his lifetime. Naturally, such messages were highly popular with investors. The promise of continued cheap credit and the potential of additional liquidity down the line meant that the market rally quickly resumed, supported by hopes of an eternal uptrend.

Reality check

Putting aside the irrational excitement and the persistent denial to face facts that have been pervasive in the markets over the last years, the truth remains that the fundamentals still matter. The Fed and its fellow central banks have indeed done their very best to paper over the deep, structural problems and the unprecedented degree of support they have afforded to the markets did manage to postpone the inevitable to a remarkable extent. The price for this was steep, nevertheless. The distortions created in the equity, bond and real estate markets are monumental. At the same time, the accumulation of debt, on all levels of the economy, means that any attempt to return to anything even resembling a normal rate environment could prove to be catastrophic. Meanwhile, savers and pensioners continue to be penalized, and so does anyone with a long-term and responsible financial planning approach.

Overall, at this stage, it has become clear that the central bankers, too afraid of market tantrums and their political dimensions, will not choose to normalize their policies. The real danger now, however, is that sooner or later there will be no such choice to be made anymore. As the global economy slows down and with an increasing number of analysts and economists anticipating a recession within the next two years, it is very likely that central banks will be out of options altogether. Having already exhausted all their ammunition in their efforts to fight against what could have been a simple and likely manageable correction, they’ll have no dry powder left to combat the much more severe upcoming downturn. Furthermore, given the global extent of these systemic vulnerabilities and with all major central banks in the same weakened position, the impact of the next recession could be significantly more widespread and lasting than many might expect.

Implications for investors

It is true that the party might go on for a while longer in the US stock markets, especially after this latest push from the Fed, and this jubilant atmosphere is likely to fuel even more optimism by talking heads and “experts” who will once again celebrate the record-breaking bull market. However, it is crucial for the prudent investor to be skeptical, to do their own homework and to think for themselves, rather than buy into the mainstream commentary. Especially in times like these, the risk of falling victim to group-think is particularly heightened, even if that means ignoring common sense altogether.

Given the actions of central banks, the political pressure behind them and the willingness of the markets to keep believing in the sustainability of the current path, despite the ample evidence to the contrary, I am reminded of the words of Irving Fischer, “stocks have reached a permanently high plateau”; boldly and confidently uttered, just nine days before the 1929 crash.

This clearly underscores the value of independent thinking and a rational evaluation of the facts when it comes to investing. And at this stage, bearing in mind the myriad of systemic risks and the grim outlook for markets and the economy at large, it is imperative for the responsible investor to plan ahead and to protect their wealth with a solid, physical precious metals position.

Claudio Grass, Hünenberg See, Switzerland

www.claudiograss.ch

Bildrechte: Kaesler Media / Fotolia

This article has been published in the Newsroom of pro aurum, the leading precious metals company in Europe with an independent subsidiary in Switzerland. All rights remain with the author and pro aurum.

Feel free to share this article!

Always up to date: Follow pro aurum on Social Media

So, you won’t miss a thing! Information and chart analyses, gold and silver news, market reports, as well as our discount campaigns and events.