INTERVIEW WITH KEITH WEINER June has been an interesting month for gold, as geopolitical events, market fluctuations and developments on the monetary policy front fueled an exciting ride for the precious metal. As long-term investors with a strict focus on the big picture, short-term moves and speculative angles are largely irrelevant in and of themselves, but they do provide important signals that, without fail, confirm the strategic superiority of precious metals holdings in this...

Read More »INTERVIEW WITH CARLOS A. GEBAUER – PART II

You can’t eat a cake that has not even been baked yet! Claudio Grass (CG): How do you assess the steps taken so far to fend off the collapse of the pension system, like increasing the retirement age? Do you believe such measures will suffice and how do you evaluate their impact on the citizens’ lives? Carlos A. Gebauer (CAG): Frankly speaking, measures like increasing the retirement age to extend the period of cash-inflow and abbreviate the time of outpayments or, as an alternative at...

Read More »INTERVIEW WITH CARLOS A. GEBAUER – PART I

“You can’t eat a cake that has not even been baked yet” For quite some time now, I have been closely following news and reports out of Germany regarding the country’s pension system and the immense pressure it is under, placing those who support it and depend on it at great risk. Germany might be widely celebrated as the economic powerhouse of the EU and as its higher net contributor, supporting countries like Greece and Poland, and yet it would appear that the German state is now...

Read More »THE PENALTY FOR SAVING

In previous articles, we have outlined in great detail the many faults of the current monetary policy direction of major central banks and the large-scale economic impact of keeping interest rates artificially low. Among the worst offenders is the ECB, that is unapologetically persistent on continuing this exercise in absurdity that are negative interest rates. Over the last few years, the effects of this decision have been felt by pensioners and by responsible, conservative investors,...

Read More »THE PENALTY FOR SAVING

In previous articles, we have outlined in great detail the many faults of the current monetary policy direction of major central banks and the large-scale economic impact of keeping interest rates artificially low. Among the worst offenders is the ECB, that is unapologetically persistent on continuing this exercise in absurdity that are negative interest rates. Over the last few years, the effects of this decision have...

Read More »THE WAR ON CASH: A CLOSER LOOK AT ITS FAR-REACHING IMPLICATIONS – PART II

Economic, social and human cost Beyond privacy, there is also widespread concern over the economic impact of a fully cashless system. For one thing, as citizens slowly become exclusively dependent on big banks and card companies the systemic risk to the wider economy spikes. But it goes further than that too. Without the option to keep some cash outside the banking system and retain some degree of financial flexibility, banks have the potential to essentially keep their clients hostage....

Read More »THE WAR ON CASH: A CLOSER LOOK AT ITS FAR-REACHING IMPLICATIONS- PART I

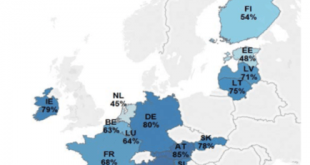

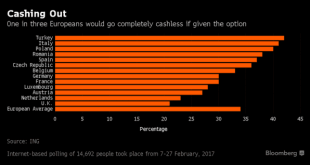

Much has been said and written over the last years on the topic of the gradual elimination of cash that we witness in our economic activity and everyday transactions. The massive and widespread political campaigns and practical measures geared at making cash a thing of the past and encouraging the use of electronic money instead have been a deeply divisive issue, especially as the institutional pressure intensifies. The push for a cashless society It is true that the rise of plastic...

Read More »REAL RECOVERY OR MARKET TRICKERY? Claudio Grass On The Everything Bubble – And The Asset Class That’s Still Cheap

[embedded content] Mainstream analysts and market bulls have some powerful numbers on their side: government-published unemployment figures remain low, America just had the best first quarter of a year for stocks since 1998, and the U.S. dollar is still the world’s reserve currency. But is all of this really indicative of a strong economy and a sustainable market, or is it just an illusion? You have a right to know the truth, so Portfolio Wealth Global just published a powerful interview...

Read More »THE CURRENT MONETARY ORDER IS NEARING ITS END

Interview with Dimitri Speck Given the massive intervention and monetary manipulation experiment by central banks over the last decade, the amount of distortions created in the market, as well as the record debt accumulation at all levels of the economy, have given rise to considerable risks for investors. For a more detailed understanding of these issues and for his outlook, I turned to Dimitri Speck, a renowned expert in the development of trading systems and in seasonal analysis,...

Read More »THE CURRENT MONETARY ORDER IS NEARING ITS END

Interview with Dimitri Speck Given the massive intervention and monetary manipulation experiment by central banks over the last decade, the amount of distortions created in the market, as well as the record debt accumulation at all levels of the economy, have given rise to considerable risks for investors. For a more detailed understanding of these issues and for his outlook, I turned to Dimitri Speck, a renowned expert...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org