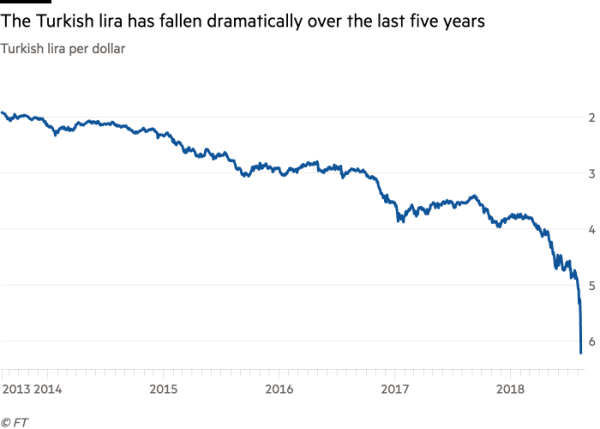

Turkey has been almost constantly in the news over the past year, as troubling headlines about its economy and political situation continue to pile up. In a currency meltdown that escalated last summer, the Turkish lira has plunged by nearly 40%, threatening the Turkish economy as a whole. In January, inflation topped 20%, with skyrocketing food prices having an especially severe impact on the population. At the same time, unemployment hit 14.7%, its highest level in a decade, and a figure that’s only expected to rise further, as the Turkish economy is projected to contract by 2% in 2019. Politically, the country’s intense friction with the US, as well as its internal upheaval, have also provided plenty of reasons for concern and clouded its outlook going forward. An artificial boom

Topics:

Claudio Grass considers the following as important: Economics, Finance, Gold, Politics

This could be interesting, too:

Investec writes The Swiss houses that must be demolished

Claudio Grass writes The Case Against Fordism

Claudio Grass writes “Does The West Have Any Hope? What Can We All Do?”

Investec writes Swiss milk producers demand 1 franc a litre

Turkey has been almost constantly in the news over the past year, as troubling headlines about its economy and political situation continue to pile up. In a currency meltdown that escalated last summer, the Turkish lira has plunged by nearly 40%, threatening the Turkish economy as a whole. In January, inflation topped 20%, with skyrocketing food prices having an especially severe impact on the population. At the same time, unemployment hit 14.7%, its highest level in a decade, and a figure that’s only expected to rise further, as the Turkish economy is projected to contract by 2% in 2019. Politically, the country’s intense friction with the US, as well as its internal upheaval, have also provided plenty of reasons for concern and clouded its outlook going forward.

An artificial boom and a very real bust

After the hotly contested and high-stake local elections at the end of March delivered severe blows to the Erdogan regime, the prospects of further instability were soon solidified. Erdogan, already in power for 18 years, is now pushing for a rerun of Istanbul mayoral election, following his party’s narrow defeat. It is precisely this timing, of a political inflection point combined with a recession, that makes the situation in Turkey all the more precarious.

For the last two decades, the country’s economy has been instrumental to the expansion and consolidation of power for Turkey’s President. However, the adoption of populist monetary policies and the artificial, debt-fueled growth has become increasingly unsustainable, as is usually the case. As the cracks are now apparent in the country’s economy, support is also at critical lows for the ruling party. In the midst of a recession, with further political friction on the horizon and a potential rerun in Istanbul, investors are justifiably concerned that political goals will overshadow the urgent need to resolve the economic woes of the country. The tough measures needed to stop the lira’s death spiral and to control the toxic debt ticking bomb, are unlikely to be winning electoral arguments.

The Turkish President is, after all, known for his interference in the economy and the private sector, while the central bank itself has lost credibility, as its independence has come under widespread doubt. Just before this last election, for example, it used its reserves to prop up the lira, with the relevant published data revealing that its foreign exchange reserves declined more than $2 billion in the week prior to the vote. According to rating agency Moody’s, gross and net reserves were “already at very low levels.”

Apart from shaking investors’ trust and encouraging suspicions over the politicization of the central bank, the move also failed to support the currency, as the lira has continued to plummet anyway, under the pressure of the extensive concerns over the country’s dwindling reserves. Further pressure is exerted on the weakened currency, and on Erdogan’s credibility for that matter, by the increasingly dominant dollarization trend domestically. More and more Turkish citizens are turning to the USD and the Euro to protect their purchasing power, and even use them in their everyday transactions. According to recent reports by the Financial Times, foreign currency deposits by residents jumped by $2.1 billion in the last week of March, bringing the total to $167 billion.

The Turkish government has nevertheless been persistent in ignoring the flashing danger signs. Instead, the Erdogan regime remains focused on the political aspects of the current crisis, blaming all problems on foreign conspiracies and insisting on policies that would only serve to paper over the core weaknesses of the economy. Despite their efforts to control inflation and to pull the economy out of the recession, the fundamentals are still dire and investor sentiment remains very low. A new reform program unveiled in mid-April also failed to convince market participants of an improved outlook, with a J.P. Morgan survey showing that more than 80% of investors did not have confidence in the government’s ability to revive the economy. The plan merely included a $5 billion injection to struggling state banks, with no references to spending cuts or to any other realistic fiscal steps that would concretely help rein in the spiraling debt problem.

In the upcoming part 2, we’ll examine the implications of Turkey’s debt and increased default risk, as well as the potentially extensive damage it can inflict outside the country and on its European debtholders.

Claudio Grass, Hünenberg See, Switzerland

www.claudiograss.ch

Bildrechte: iStock.com/PashaIgnatov