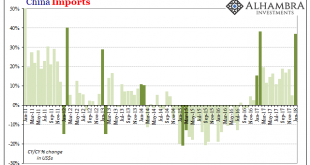

In February 2013, the Chinese Golden Week fell late in the calendar. The year before, 2012, New Year was January 23rd, meaning that the entire Spring festival holiday was taken with the month of January. The following year, China’s New Year was placed on February 10, with the Golden Week taking up the entire middle month of February. For economic statistics, that meant extreme difficulty translating year-over-year...

Read More »COT Blue: Interest In Open Interest

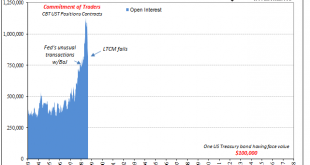

For me, the defining characteristic of the late nineties wasn’t the dot-coms. Most people were exposed to the NASDAQ because, frankly, at the time there was no getting away from it. It had seeped into everything, transforming from a financial niche bleeding eventually into the entire worldwide culture. We all remember the grocery clerks who became day traders. Behind all that was some darker evolutions. It was a period...

Read More »US Imports: A Little Inflation For Yellen, A Little More Bastiat

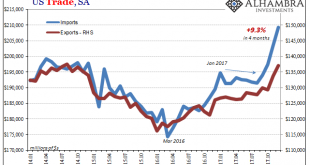

US imports rocketed higher once again in December, according to just-released estimates from the Census Bureau. Since August 2017, the US economy has been adding foreign goods at an impressive pace. Year-over-year (SA), imports are up just 10.4% (only 9% unadjusted) but 9.3% was in just those last four months. For most of 2017, imports were flat and even lower. The question is, obviously, what has changed? Did the boom...

Read More »How Global And Synchronized Is A Boom Without China?

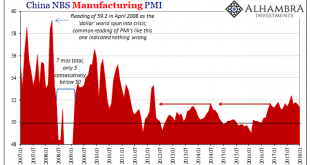

According to China’s official PMI’s, those looking for a boom to begin worldwide in 2018 after it failed to materialize in 2017 are still to be disappointed. If there is going to be globally synchronized growth, it will have to happen without China’s participation in it. Of course, things could change next month or the month after, but this idea has been around for a year and a half already. Without China, growth won’t...

Read More »The Historical Warnings of Money

It’s interesting, to me anyway, that an image of the Roman goddess Juno remains to this day on the logo of the Bank of England. There are many stories about her role as it relates to money, but what cannot be denied is that the very word itself came to us from her temple. The Latin moneta was derived from the word monere, a verb meaning to warn. Moneta was Juno’s surname. One fable has it where the goddess’s sacred...

Read More »Globally Synchronized What?

In one of those rare turns, the term “globally synchronized growth” actually means what the words do. It is economic growth that for the first time in ten years has all the major economies of the world participating in it. It’s the kind of big idea that seems like a big thing we all should pay attention to. In The New York Times this weekend, we learn: A decade after the world descended into a devastating economic...

Read More »December Durable Goods

Durable and capital goods orders and shipments all increased in December by growth rates consistent with those registered in the months leading up to the big storms Harvey and Irma. We continue to find evidence that accelerated growth in October and November was nothing more than the anticipated after-effects cleaning up after those hurricanes. New orders for durable goods (excluding transportation orders) had...

Read More »The Dismal Boom

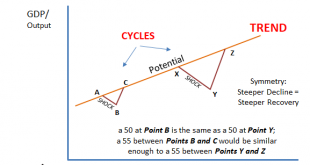

There is a fundamental assumption behind any purchasing manager index, or PMI. These are often but not always normalized to the number 50. That’s done simply for comparison purposes and the ease of understanding in the general public. That level at least in the literature and in theory is supposed to easily and clearly define the difference between growth and contraction. But is every 50 the same? That’s ultimately at...

Read More »Central Bank Transparency, Or Doing Deliberate Dollar Deals With The Devil

The advent of open and transparent central banks is a relatively new one. For most of their history, these quasi-government institutions operated in secret and they liked it that way. As late as October 1993, for example, Alan Greenspan was testifying before Congress intentionally trying to cloud the issue as to whether verbatim transcripts of FOMC meetings actually existed. Representative Toby Roth (R-WI) quizzed the...

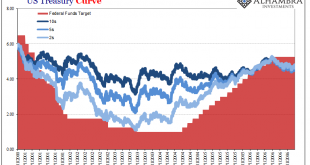

Read More »What About 2.62percent?

There’s nothing especially special about 2.62%. It’s a level pretty much like any other, given significance by only one phrase: the highest since 2014. It sounds impressive, which is the point. But that only lasts until you remember the same thing was said not all that long ago. Back last March, the 10-year yield had then, like now, broke above 2.60%. In doing so, it surpassed the previous recent high set in December...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org