In February 2013, the Chinese Golden Week fell late in the calendar. The year before, 2012, New Year was January 23rd, meaning that the entire Spring festival holiday was taken with the month of January. The following year, China’s New Year was placed on February 10, with the Golden Week taking up the entire middle month of February. For economic statistics, that meant extreme difficulty translating year-over-year changes. That’s why for the major economic accounts, like IP and FAI, the Chinese government doesn’t bother. January and February data are aggregated together because there really isn’t much point trying to figure out what’s base effect distortion and what’s real economic advance. China’s Customs Bureau

Topics:

Jeffrey P. Snider considers the following as important: $CNY, China, China Imports, Copper, currencies, economy, EUR, exports, Featured, Federal Reserve/Monetary Policy, global trade, Gold, golden week, hkd, imports, Markets, new year, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

In February 2013, the Chinese Golden Week fell late in the calendar. The year before, 2012, New Year was January 23rd, meaning that the entire Spring festival holiday was taken with the month of January. The following year, China’s New Year was placed on February 10, with the Golden Week taking up the entire middle month of February.

For economic statistics, that meant extreme difficulty translating year-over-year changes. That’s why for the major economic accounts, like IP and FAI, the Chinese government doesn’t bother. January and February data are aggregated together because there really isn’t much point trying to figure out what’s base effect distortion and what’s real economic advance.

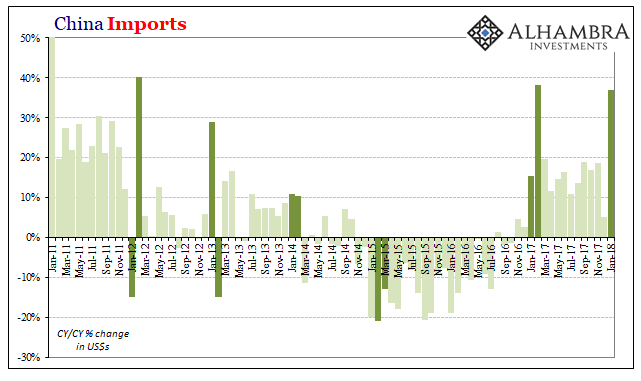

China’s Customs Bureau does not follow that convention. As a result, China’s imports jumped by 29% in January 2013 over holiday-shortened January 2012. Given the rough go for the Chinese economy at the time, slowing down precipitously throughout the prior year, even recognizing the distortions many claimed it portended good things anyway. “Much better than expected” they would say, as if there was any way to tell one way or the other.

Imports declined 15% year-over-year in February 2013. For the two months combined, imports in January and February 2013 were just 5% more than in January and February 2012.

If this might sound familiar, it’s because I wrote out practically the same exact caveats almost exactly one year ago.

| The Custom’s Bureau reports today that once again China’s imports were up sharply, +36.9%. But that was in comparison to a January 2017 that was partially taken up by the New Year and Spring Festival. Some are claiming that despite the differences in holiday timing, the Golden Week is later in February this year, that is a good number anyway (particularly following a very bad one in December). What 36.9% means is really anyone’s guess. |

China Imports, Jan 2011 - 2018(see more posts on China Imports, ) |

| For the record, exports increased only 11.1%.

More interesting than any of that, China’s currency finally hit an air pocket. CNY was down sharply today, which isn’t surprising given what has gone on over the past two weeks or so (liquidations). |

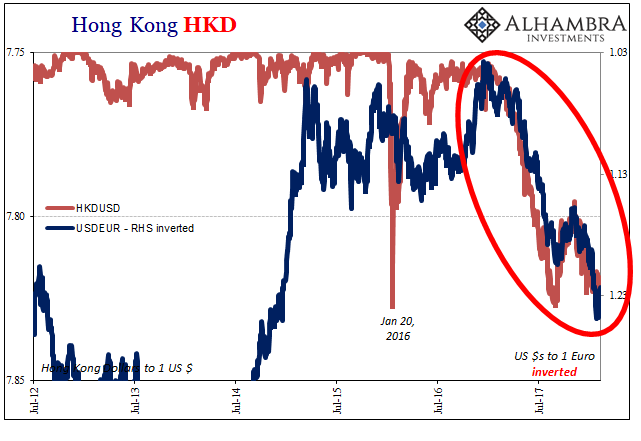

Hong Kong HKD, Jul 2012 - Feb 2018 |

| What was surprising was CNY’s continued rise despite losing support (read: “dollar” flow) from a weaker euro and relatedly a stronger Hong Kong dollar. |

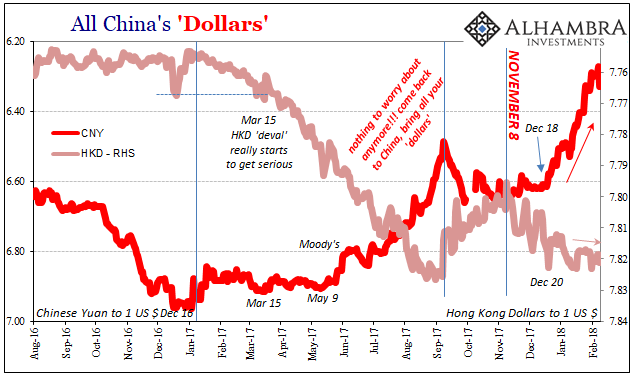

All China's Dollars, Aug 2016 - Feb 2018 |

| We have to note that Chinese authorities for the first time in two years loosened restrictions on corporate overseas investments, feeding the whole “capital flight” narrative for CNY’s 2014-16 drop. |

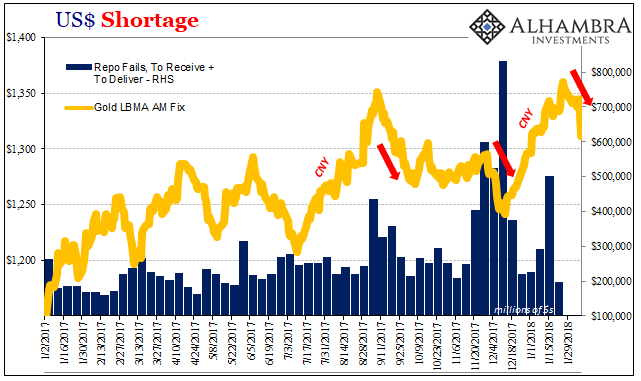

USD Shortage, Jan 2017 - Feb 2018 |

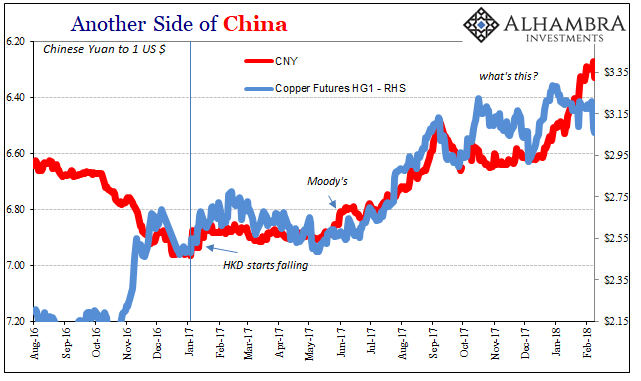

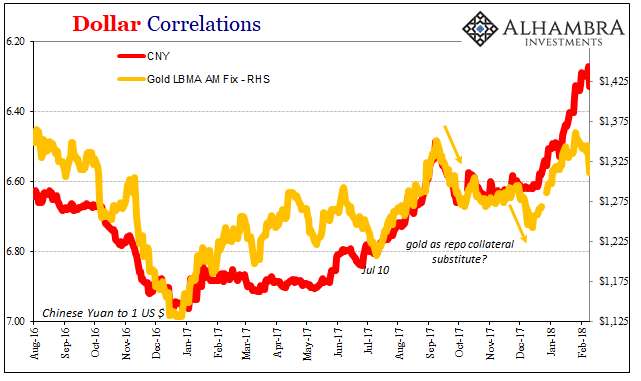

| That may have had some impact on the currency’s direction, but copper was down big yesterday, preceding CNY’s fall, while gold is down big today. Both are consistent with EUR falling, or the “rising dollar.” Crude is lower, as are EM currencies like BRL and RUB. |

Another Side of China, Aug 2016 - Feb 2018 |

| All this is short-term stuff, of course, but interesting nonetheless, far more than China’s January imports. Especially in context. |

Dollar Correlations, Aug 2016 - Feb 2018 |

Tags: $CNY,$EUR,China,China Imports,Copper,currencies,economy,exports,Featured,Federal Reserve/Monetary Policy,global trade,Gold,golden week,hkd,imports,Markets,new year,newsletter