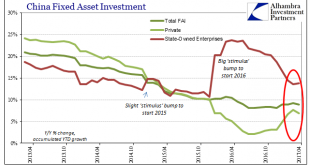

China’s PMI’s were uniformly disappointing with respect to what Moody’s was on about last week. Chinese authorities expended great effort and resources to get the economy moving forward again after several years of “dollar”-driven deceleration. There was a massive “stimulus” spending program where State-owned FAI expenditures of about 2% of GDP were elicited to make up for Private FAI that at one point last year was...

Read More »Simple (economic) Math

.The essence of capitalism is not strictly capital. In the modern sense, the word capital has taken on other meanings, often where money is given as a substitute for it. When speaking about things like “hot money”, for instance, you wouldn’t normally correct someone referencing it in terms of “capital flows.” Someone that “commits capital” to a project is missing some words, for in the proper sense they are “committing...

Read More »Not Do We Need One, But Do We Need A Different One

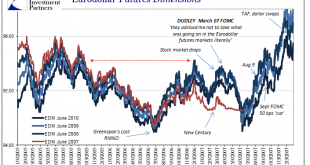

On March 24, 2009, then US President Barack Obama gave a prime time televised press conference whose subject was quite obviously the economy and markets. The US and global economy was at that moment trying to work through the worst conditions since the 1930’s and nobody really had any idea what that would mean. As President, Obama’s main task was not to deliver specifics about auto lending or the inner workings at...

Read More »Suddenly Impatient Sentiment

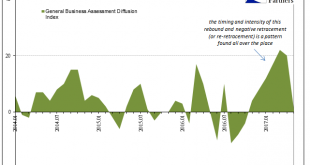

Two more manufacturing surveys suggest sharp deceleration in momentum, or, more specifically, the momentum of sentiment (if there is such a thing). The Federal Reserve’s 5th District Survey of Manufacturing (Richmond branch) dropped to barely positive, calculated to be just 1.0 in May following 20.0 in April and 22.0 in March. It follows an all-too-familiar pattern, where sentiment spiked to start this year after being...

Read More »Less Than Nothing

As I so often write, we still talk about 2008 because we aren’t yet done with 2008. It doesn’t seem possible to be stuck in a time warp of such immense proportions, but such are the mistakes of the last decade carrying with them just these kinds of enormous costs. It has been this way from the beginning, even before the beginning as if that was possible. The Great Financial Crisis has no official start date, but we...

Read More »Staying Stuck

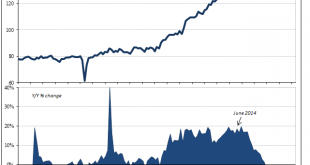

The rebound in commodity prices is not difficult to understand, perhaps even sympathize with. With everything so depressed early last year, if it turned out to be no big deal in the end then there was a killing to be made. That’s what markets are supposed to do, entice those with liquidity to buy when there is blood in the streets. And if those speculators turn out to be wrong, then we are all much the wiser for their...

Read More »Trying To Reconcile Accounts; China

Chinese economic data for April 2017 has been uniformly disappointing. External trade numbers resembled too much commodity prices, leaving an emphasis on them rather than actual economic forces. The latest figures for the Big 3, Industrial Production, Retail Sales, and Fixed Asset Investment, unfortunately also remained true to the pattern. Industrial Production had seemingly accelerated in March, rising to a 7.6%...

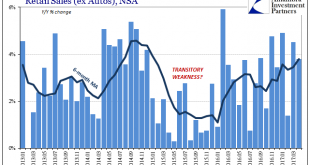

Read More »Reasonable Retail (Therefore Consumer) Expectations

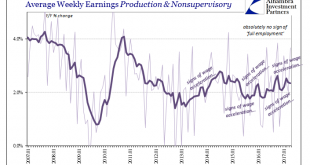

Retail sales estimates are not adjusted for inflation, but even so whenever they get down toward the 3% growth level you can be sure there is serious economic trouble. The 6-month average for overall retail sales dropped below 3% in March 2001, the month that marked the start of the official dot-com recession (though that is not the official name for the cyclical peak, it probably should be). They would remain near or...

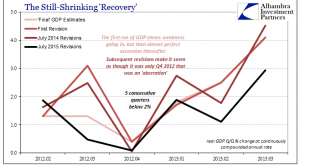

Read More »Hopefully Not Another Three Years

The stock market has its earnings season, the regular quarterly reports of all the companies that have publicly traded stocks. In economic accounts, there is something similar though it only happens once a year. It is benchmark revision season, and it has been brought to a few important accounts already. Given that this is a backward looking exercise, that this season is likely to produce more downward revisions...

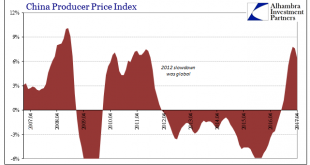

Read More »China Inflation Now, Too

We can add China to the list of locations where the near euphoria about inflation rates is rapidly falling apart. This is an important blow, as the Chinese economy has been counted on to lead the world out of this slump if through nothing other than its own sheer recklessness. “Stimulus” was all the rage one year ago, and for a time it seemed to be producing all the right effects. This was “reflation”, after all....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org