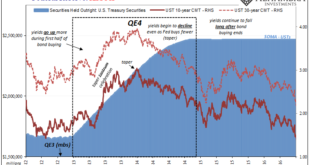

We’ve been here before, near exactly here. On this side of the Pacific Ocean, in the US particularly the situation was said to be just grand. The economy was responding nicely to QE’s 3 and 4 (yes, there were four of them by that point), Federal Reserve Chairman Ben Bernanke had said in the middle of 2013 it was becoming more than enough, creating for him and the FOMC coveted breathing space so as to begin tapering both of those ongoing programs.A full and complete...

Read More »Good Time To Go Fish(er)ing Around The Yield Curve

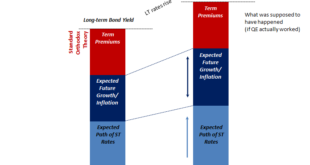

It should be as simple as it sounds. Lower LT UST yields, less growth and inflation. Thus, higher LT UST yields, more growth and inflation. Right? If nominal levels are all there is to it, then simplicity rules the interpretation. Visiting with George Gammon last week, he confessed to committing this sin of omission. Rates have gone up, he reasoned reasonably, therefore it would seem to follow how the market must be shifting expectations toward the more optimistic...

Read More »US CPI Reaches Seven On US Goods Prices, With Disinflation Setting In Everywhere Else (incl. US Services)

How is that US Treasury rates out in the independent longer end of the yield curve have now “suffered” a seven percent CPI to go along with double taper and triple maybe quadruple (if the whispers are to be believed) rate hikes this year, yet have weathered all of that allegedly bond-busting brutality with barely a market fluctuation? The short end of the curve, as noted here, is being pressured by only the last of those things, rate hikes, and from them creating...

Read More »China’s Petroyuan, Uncle Sam’s Checkbook, The Fed’s Bank Reserves: Who Really Sits On King Dollar’s Throne? (trick question)

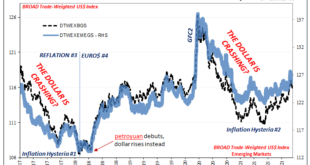

A full part of the inflation hysteria, the first one, was the dollar’s looming crash. The currency was, too many claimed, on the verge of collapse by late 2017, heading downward and besieged on multiple fronts by economics and politics alike. Basically, the Fed had “printed” too much “money” and the Chinese playing some “long game” were purportedly ready at any moment to snatch the role of world reserve by manipulative force from the out-to-lunch Americans. Those...

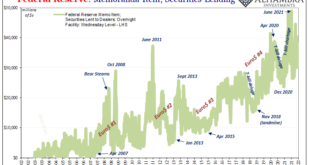

Read More »Sentiment v. Substance: Checking In On Collateral Via, Yes, The Fed

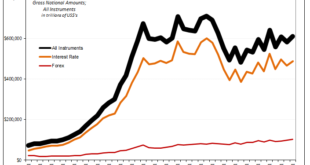

The Federal Reserve, like other central banks around the world, it does lend out the securities it owns and holds. Sophisticated modern wholesale money markets are highly collateralized, so much so that collateral itself takes on the properties of currency. Elasticity of collateral is as much – if not more – important as elasticity of other forms of wholesale money (therefore excluding bank reserves). Dealers, however, they don’t much like using the Fed’s Securities...

Read More »Conflict Of Interest (rates): 10-year Treasury Yield Highest in Almost Two Years

The dollar was high and going higher. Emerging markets had been seriously complaining. In one, the top central banker for India outright warned, “dollar funding has evaporated.” The TIC data supported his view, with full-blown negative months, net selling from afar that’s historically akin to what was coming out of India and the rest of the world. China was cutting its RRR multiple times. This was all following May 29, 2018, too, a day in the global “bond market”...

Read More »Taper Discretion Means Not Loving Payrolls Anymore

When Alan Greenspan went back to Stanford University in September 1997, his reputation was by then well-established. Even as he had shocked the world only nine months earlier with “irrational exuberance”, the theme of his earlier speech hadn’t actually been about stocks; it was all about money. The “maestro” would revisit that subject repeatedly especially in the late nineties, and it was again his topic in California early Autumn ’97. As Emil Kalinowski and I had...

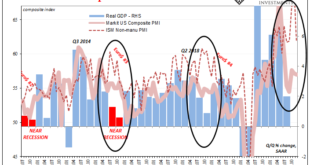

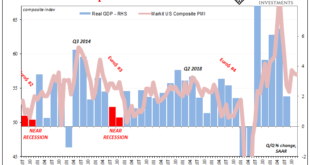

Read More »Previewing Payrolls By PMIs

With the monthly Friday Payroll Ritual lurking tomorrow morning, and having been focused on PMI estimates before it, a quick look at the ISM’s Non-manufacturing PMI especially its employment index to bridge the latter to the former. The update today for the month of December put the headline estimate at 62.0, down from 69.1 the month prior. Omicron? While a rather sharp and unexpected 7-point drop, other than the size of the decline at 62.0 there’s little to suspect...

Read More »As The Fed Seeks To Justify Raising Rates, Global Growth Rates Have Been Falling Off Uniformly Around The World

Sentiment indicators like PMI’s are nice and all, but they’re hardly top-tier data. It’s certainly not their fault, these things are made for very times than these (piggy-backing on the ISM Manufacturing’s long history without having the long history). Most of them have come out since 2008, if only because of the heightened professional interest in macroeconomics generated by a global macro economy that can never get itself going. What PMI’s do have going for them is...

Read More »How Many More Americans Might Have Quit Their Jobs Than The Huge Number Already Estimated, And What Might This Mean For FOMC Taper

There were a few surprises included in the BLS JOLTS data just released today for the month of November (note: the government has changed its release schedule so that JOLTS, already one month further in arrears than the payroll report, CES & CPS, will now come out earlier so that its numbers are publicly available for the same monthly payrolls before the next CES & CPS get released). Not really about the JOLTS figures themselves, though there are...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org