Someone once said that the stock market is always climbing a wall of worry. Maybe that had been true in some long-ago day, but whether or not it might nowadays is beside the point. The nugget of truth which makes the prosaism memorable is the wall rather than the climber. There’s always something going on somewhere to get worked up over. And it matters to far more than financial actors, the entire global economy must surmount what can seem like an unending series of...

Read More »Goldilocks And The Three Central Banks

This isn’t going to be like the tale of Goldilocks, at least not how it’s usually told. There are three central banks, sure, call them bears if you wish, each pursuing a different set of fuzzy policies. One is clearly hot, the other quite cold, the final almost certainly won’t be “just right.” Rather, this one in the middle simply finds itself…in the middle of the other two. Running red-hot to the point of near-horror, that’s “our” Federal Reserve. The FOMC minutes...

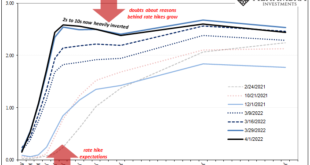

Read More »The Short, Sweet Income Case For Ugly Inversion(s), Too

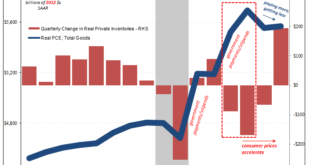

A nod to just how backward and upside down the world is now. The economic data everyone is made to pay attention to, payrolls, that one is, in my view, irrelevant. As is the consumer price estimates from earlier this week, the PCE Deflator. That’s another one which receives vast amounts of interest even though it is already old news. Yet, in the very same data release as the PCE, some other accounts importantly tied to labor, personal income, they slip unnoticed...

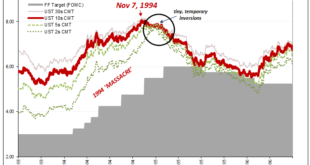

Read More »We Can Only Hope For Another (bond) Massacre

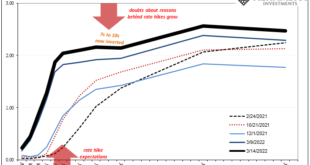

To begin with, the economy today is absolutely nothing like it had been almost thirty years ago. That fact in and of itself should end the discussion right here. However, comparisons will be made and it does no harm to review them. I’m talking about 1994, or, more specifically, the eleven months between late February 1994 and early February 1995. Fearing inflation (the only time in its history, including much of the Great Depression, the Fed didn’t fear inflation...

Read More »It Wouldn’t Be TIC Without So Much Other

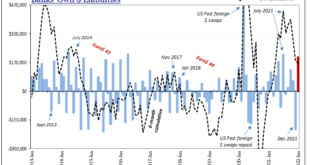

With the Fed (sadly) taking center stage last week, and market rejections of its rate hikes at the forefront, lost in the drama was January 2022 TIC. Understandable, given all its misunderstood numbers are two months behind at their release. There were some interesting developments regardless, and a couple of longer run parts that deserve some attention. Picking up where TIC left off from December, when more indicated bad (tight money) than good (not as tight),...

Read More »The Fed Inadvertently Adds To Our Ironclad Collateral Case Which Does Seem To Have Already Included A ‘Collateral Day’ (or days)

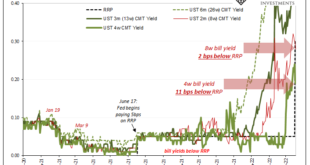

The Federal Reserve didn’t just raise the range for its federal funds target by 25 bps, upper and lower bounds, it also added the same to its twin policy tools which the “central bank” says are crucial to maintaining order in money markets thereby keeping federal funds inside the band where it is supposed to be. The FOMC voted to increase IOER from 15 bps to 40 bps, and the RRP from 5 bps to 30 bps. That RRP, or reverse repo program, is meant to be something of a...

Read More »Media Attention All Over FOMC, Market Attention Totally Elsewhere

The Federal Reserve did something today, or actually announced today that it will do something as of tomorrow. And since we’re all conditioned to believe this is the biggest thing ever, I’ll have to add my own $0.02 (in eurodollars, of course, can’t be bank reserves) frustratingly contributing to the very ritual I’m committed to seeing end. We shouldn’t care much about the Fed. Live look at Jay Powell’s press conference.#ratehikeshttps://t.co/leCyV8Wak4...

Read More »There Is An Absolutely Solid Collateral Case For What’s Driving Curve Inversion(s) [Part 2]

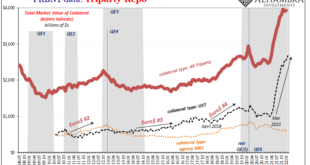

Securities lending as standard practice is incredibly complicated, and for many the process can be counterintuitive. With numerous different players contributing various pieces across a wide array of financial possibilities, not to mention the whole expanse of global geography, collateral for collateral swaps have gone largely unnoticed by even mainstream Economics and central banking. This despite the fact, yes, fact, securities lending was the epicenter of the 2008...

Read More »There Is An Absolutely Solid Collateral Case For What’s Driving Curve Inversion(s) [Part 1]

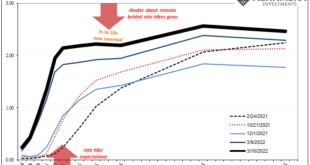

With the 7s10s already inverted, and the 5s today mere bps away, making a macro case for the distortion isn’t too difficult. Despite China’s “upside” economic data today, even the Chinese are talking more about their downside worries (shooting/hoping for “stability”) than strength. In the US or Europe, no matter the CPIs in either place there are cyclical (not just inventory) warning signs all over the place. Aside from these economic concerns, is there a pure money...

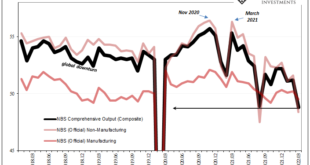

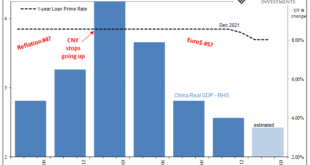

Read More »China’s Loan Results Back The PBOC Going The Opposite Way From The Fed

This week will almost certainly end up as a clash of competing interest rate policy views. Everyone knows about the Federal Reserve’s upcoming, the beginning of what is intended to be a determined inflation-fighting campaign for a US economy that American policymakers worry has been overheated. The FOMC will vote to raise the federal funds range (and IOER plus RRP) for the first time since December 2018 Over in China, however, it’s nearly certain to be the opposite....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org