The fact that German retail sales crashed so much in April 2022 is significant for a couple reasons. First, it more than suggests something is wrong with Germany, and not just some run-of-the-mill hiccup. Second, because it was this April rather than last April or last summer, you can’t blame COVID this time. Something else is going on. . In America, the Fed Cult is out to take credit for this brewing downturn (Jay Powell seeking his place alongside Volcker, which...

Read More »Dollar Gains Pared

Overview: Asia Pacific equities were mostly lower. China and India bucked the trend. Europe’s Stoxx 600 is steady with no follow through selling after yesterday reversal. US index futures are posting modest gains and are trying to snap a two-day drop. The US 10-year yield is firm at 2.91%, while European benchmark rates are 2-3 bp higher. Asia Pacific bonds were dragged lower by the sell-off in the US yesterday. The dollar is broadly lower. The Swedish krona...

Read More »Bank of Canada’s Turn

Overview: The recent equity rally is stalling. Asia Pacific equities were mixed, with Japan, South Korea, and Australia, among the major bourses posting gains. Europe’s Dow Jones Stoxx 500 is slipping lower for the second consecutive session, ending a four-day bounce. US equity futures are little changed. The US 10-year yield is edging higher at 2.86%, while European yields are slightly lower. The greenback is firm against most of the major currencies. The Australian...

Read More »‘Unconscionably Excessive’ Denial

What would “unconscionably excessive” even look, legally speaking? More to the issue, who gets to decide what constitutes “excessive?” The way the phrase has been inserted, it’s as if Congress today seeks to plant its members on some incorporeal higher plane than mere physical substance, too, diving deep into the moral consciousness of the nation and economy in order justify taking general action. Just last week, the House of Representatives passed a bill which...

Read More »Dollar and Yen Surge

Overview: Global equities are bleeding lower. Several large markets in the Asia Pacific region, including Hong Kong, Taiwan, and India are off more than 2%. Japan and Australian bourses fell by more than 1.5%. Europe's Stoxx 600 is off more than 2% and giving back the gains recorded in the past two sessions plus some. US futures are extending yesterday's loses. The sharp sell-off of equities has given the sovereign bond market a strong bid. The 10-year US Treasury...

Read More »No Rest for the Weary

Overview: Risk appetites are improving on the margin. Asia Pacific stocks still fell after the sharp losses on Wall Street on Monday. Still, China, Taiwan and Indian equities traded higher. Europe's Stoxx 600 is snapping a four-day 6.5%+ slide and is up around 1.2% in late European morning turnover. US equity futures are up over 1%. The 10-year Treasury yield that pushed to 3.20% yesterday is a little above 3% now. European benchmark yields are 5-7 bp lower and the...

Read More »The Week Ahead: US CPI and PPI Set to Soften

The Fed's 50 bp rate hike is behind us. Another 50 bp hike is expected next month. The April employment report will do little to calm the anxiety about the "too tight" labor market. The decline in the participation rate was disappointing and this coupled with decline in Q1 productivity raies questions about the economy's non-inflationary speed limit. One of the fascinating things about the markets is that sometimes the cause take place after the effect. This...

Read More »Fed Day

Overview: The markets are mostly treading water ahead of the FOMC decision later today. Tech stocks tumbled in Hong Kong and the Hang Seng fell a little more than 1%, while India was the worst performer in the region falling over 2% following an unexpected and intra-meeting hike by the Reserve Bank of India. It raised the repo rate to 4.4% from 4.0%. Europe's Stoxx 600 is a little lower and has been unable to close the gap from Monday created from the lower...

Read More »What Really ‘Raises’ The Rising ‘Dollar’

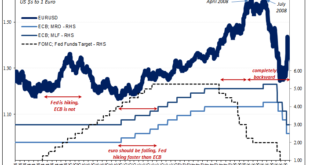

It’s one of those things which everyone just accepts because everyone says it must be true. If the US$ is rising, what else other than the Federal Reserve. In particular, the Fed has to be raising rates in relation to other central banks; interest rate differentials. A relatively more “hawkish” US policy therefore the wind in the sails of a “strong” dollar exchange regime. How else would we explain, for example, the euro’s absolute plunge since around May last year?...

Read More »China’s Covid Sends Commodities Lower and helps the Dollar Extend Gains

Overview: Fears that the Chinese lockdowns to fight Covid, which have extended for four weeks in Shanghai, are not working, and may be extended to Beijing has whacked equity markets, arrested the increase in bond yields, and lifted the dollar. Commodity prices are broadly lower amid concerns over demand. China’s CSI 300 fell 5% today and Hong Kong’s Hang Seng was off more than 3.5%. Most of the major markets in Asia Pacific were off more than 1%. Europe’s Stoxx 600...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org