Fed dovishness is helping to curb financing costs for corporates but does not seem to be percolating down to the US consumer, whose debt-servicing costs are rising. This could be something to watch. The Federal Reserve (Fed)’s leading priority now is to help sustain the US business cycle, hence the concept of ‘insurance’ rate cuts put forward by Fed chairman Jerome Powell, with some echoes of Alan Greenspan’s philosophy in the 1990s. Low Fed interest rates tend to percolate quickly down to the corporate sector. Indeed, low borrowing costs help prevent a debt service-induced margin squeeze, which is usually how economic cycles end. (Another risk is margin suffocation due to sharply rising employee costs, but that

Topics:

Thomas Costerg considers the following as important: 5) Global Macro, Featured, Fed policy, Fed policy transmission, Macroview, newsletter, US consumer debt, US recession fears

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| Fed dovishness is helping to curb financing costs for corporates but does not seem to be percolating down to the US consumer, whose debt-servicing costs are rising. This could be something to watch.

The Federal Reserve (Fed)’s leading priority now is to help sustain the US business cycle, hence the concept of ‘insurance’ rate cuts put forward by Fed chairman Jerome Powell, with some echoes of Alan Greenspan’s philosophy in the 1990s. Low Fed interest rates tend to percolate quickly down to the corporate sector. Indeed, low borrowing costs help prevent a debt service-induced margin squeeze, which is usually how economic cycles end. (Another risk is margin suffocation due to sharply rising employee costs, but that seems to be in check too as wage growth remains tepid). A preventive focus on corporate borrowing is also good for avoiding a credit crunch, which is historically how fragility in one sector of the economy (for instance in the oil sector in 2016 or the retail sector crisis now) spreads out and pulls the rest of the economy with it. |

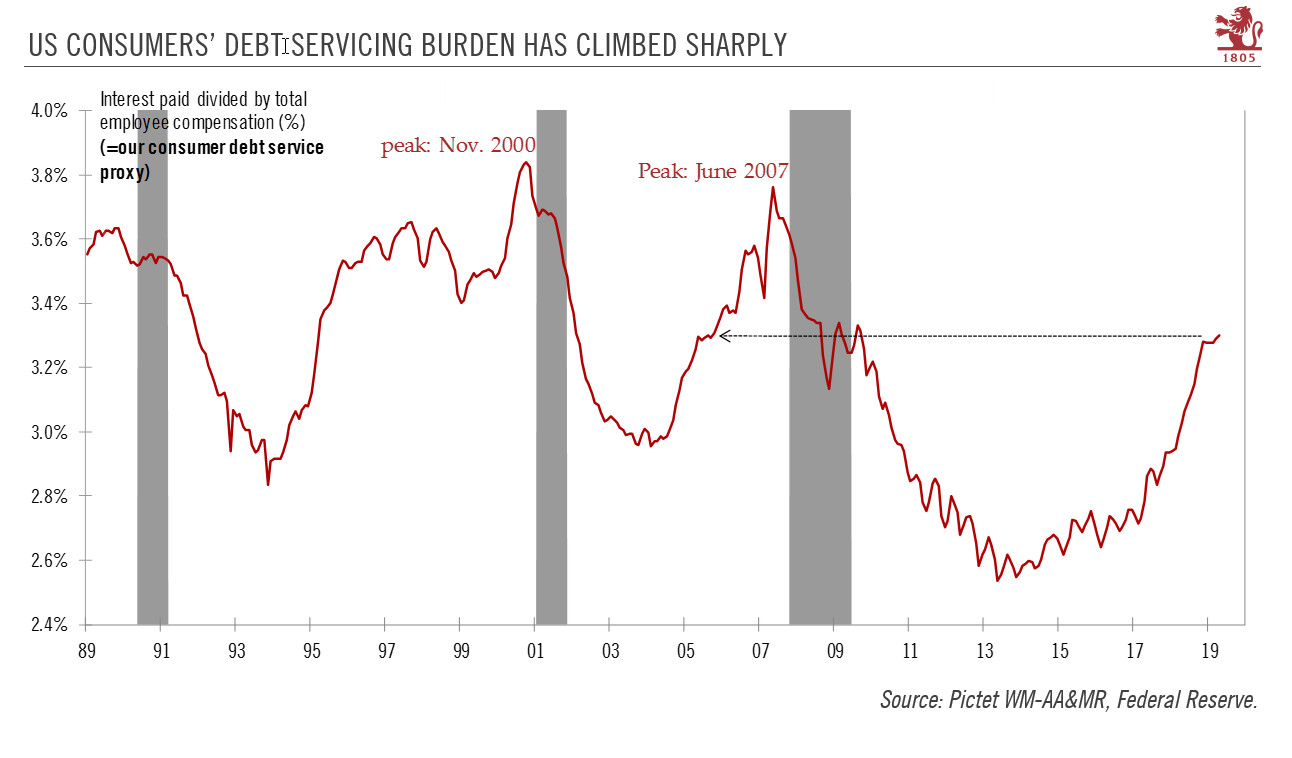

US Consumers' Debt Servicing Burden Has Climbed Sharply,1989-2019 |

However, it may be argued that the Fed is now too focused on corporates and not enough on US consumers, where a rising debt burden is being compounded by rising interest rates – in fact, the Fed’s dovish stance is not feeding through to them. Indeed, the average interest rate on credit card debt rose to a new high of 17.1% in Q2 2019, the highest since the data series began in 1994. According to the metric we use, the debt service burden, which rose particularly sharply last year, is comparable to the levels of mid-2005. The increased debt service burden, while still not at alarming levels, may be one source of fragility to monitor in the current cycle as it could cause a ‘sudden stop’ in consumer spending: a move by banks to clamp down on credit card debt is a big risk as consumption is expected to be the crucial driver of GDP growth going forward.

We remain of the view that while the US business cycle is mature, and therefore more exposed to risks, there is still no sign of imminent recession, especially given the relative strength of the corporate sector, which is being helped by low rates. However, the US consumer could be the US economy’s Achilles heel in the medium term.

Tags: Featured,Fed policy,Fed policy transmission,Macroview,newsletter,US consumer debt,US recession fears