◆ World’s wealthy are being urged by their financial advisers to hold more gold as they question the strength of the stock market rally and are concerned about the long-term impact of global central banks’ cash splurge. ZURICH /LONDON (via Reuters) – As stock markets roar back from the coronavirus led rout, advisers to the world’s wealthy are urging them to hold more gold, questioning the strength of the rally and the long-term impact of global central banks’ cash...

Read More »FX Daily, June 25: Contagion Growth and Calendar-Effect Saps Investor Enthusiasm

Swiss Franc The Euro has fallen by 0.17% to 1.0644 EUR/CHF and USD/CHF, June 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Given the huge run-up in risk assets this quarter, and the technical indicators warning of corrective forces, concerns over the new infections is pushing on an open door. The S&P 500 gapped lower yesterday and fell 2.6%, led by energy and airlines. The NASDAQ snapped an eight-day...

Read More »Weekly View – Alive and kicking

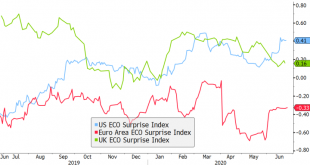

In spite of renewed fears of coronavirus clusters in Beijing, data last week suggested the more consumer-oriented sides of the Chinese economy were tracking improvements in industry, with a year-on-year increase in auto sales in May. UK retail sales were also encouraging, but the biggest surprise came from the US where May’s 18% rise in retail sales month on month was double analysts’ expectations. Popular metrics like pedestrian, air and auto traffic, credit card...

Read More »A Swiss-Japanese alliance that has thrived in the crisis

Roche’s HQ, overlooking the Rhine river in Basel. Keystone / Georgios Kefalas It was the start of one of the most unusual cross-cultural marriages when Roche bought a controlling stake in Chugai Pharmaceutical for $1.4bn back in 2002, promising arm’s length management. In the course of the 18 months of negotiations it took to reach a deal, Chugai, a Japanese pioneer in biotechnology, presented a single sheet of paper with a list of conditions it would not budge on,...

Read More »UBS raises USD 440 million for Rockefeller sustainable investment fund

Zurich, June 24 2020 – UBS is investing in Rockefeller Asset Management’s Global Environmental, Social and Governance (ESG) Equity fund, broadening the sustainable investment opportunities that it offers to clients. UBS, the world’s largest global wealth manager, has allocated directly to the fund through its 100% sustainable multi-asset portfolio, which surpassed USD 10 billion in size earlier this year. The fund is also available to UBS Global Wealth Management...

Read More »Dollar Firm as Risk-Off Sentiment Returns

Risk-off sentiment has picked up from reports that the US will impose new tariffs against the EU; there’s also been a messy set of headlines regarding the virus contagion outlook in the US The IMF will release updated global growth forecasts today; the dollar is benefiting from risk-off sentiment; another round of fiscal stimulus in the US is in the works Brazil announced a slew of new easing measures to improve liquidity conditions in local credit markets; Mexico...

Read More »Why the Central Bank “Bailout of Everything” Will Be a Disaster

Despite massive government and central bank stimuli, the global economy is seeing a concerning rise in defaults and delinquencies. The main central banks’ balance sheets (those of the Federal Reserve, Bank of Japan, European Central Bank, Bank of England, and People’s Bank Of China) have soared to a combined $20 trillion, while the fiscal easing announcements in the major economies exceed 7 percent of the world’s GDP according to Fitch Ratings. This is the biggest...

Read More »The Forgotten Greatness of Rothbard’s Preface to Theory and History

Anyone who advocates the ideas of the Austrian school of economics, whether broadly and publicly or even in the context of private discussions with friends and acquaintances, will almost immediately find themselves grappling with the tricky question of how to distill the core essence of what Austrian economics actually is, and how to convey those truly definitive characteristics as briefly and simply as possible. Given the nearly 150 years during which Austrian...

Read More »FX Daily, June 24: Risk Appetites Satiated for the Moment

Swiss Franc The Euro has fallen by 0.07% to 1.0672 EUR/CHF and USD/CHF, June 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The rally in risk assets in North America yesterday is failing to carry over into today’s activity. Asia Pacific equities were mixed. Korea and Indonesia led the advances with more than 1% gain. China and Taiwan also gained. Japan and Hong Kong. Europe’s Dow Jone’s Stoxx 600 is giving...

Read More »Restricted Market Trading Comments

By Dara O’Sullivan, Derrick Leonard, and Ilan Solot There were minimal changes to the status quo as the week commences. Bangladesh has announced revised trading hours on the local exchanges. No change of status in Nigeria and Kenya as they both continue to face limited liquidity. Please see trading comments below. Bangladesh: Effective June 18, the Dhaka Stock Exchange (DSE) and Chittagong Stock Exchange (CSE) revised their trading hours until further notice. The...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org