Swiss Franc The Euro has risen by 0.12% to 1.0664 EUR/CHF and USD/CHF, June 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Investors begin the new week, perhaps slowed a bit by the weekend developments and the growth of new infections. Equities are mixed. The MSCI Asia Pacific Index snapped a four-day advance, though India bucked the regional trend and gained 1%. Europe’s Dow Jones Stoxx 600 is recovering...

Read More »Coronavirus: Swiss authorities not open enough in early weeks, says medical expert

© Jan Gajdosik | Dreamstime.com The Swiss authorities should have been more open about what they did and didn’t know about the SARS-CoV-2 virus in the early stages, according to Bertrand Kiefer, doctor, ethicist and editor of the Swiss Medical Review. Speaking to RTS, Kiefer said he believes the public should be treated like adults. A paternalistic approach to communication in such situations is ineffective, in his view. Switzerland’s Federal Office of Public Health...

Read More »Swiss National Bank forecasts deflation until 2022

On 18 June 2020, the Swiss National Bank (SNB) said it would maintain its negative rate of interest (-0.75%) and remains willing to intervene more strongly in the foreign exchange market. The coronavirus pandemic has led to a severe downturn in economic activity and a decline in inflation both in Switzerland and abroad. The bank presented a new lower inflation forecast than the one it issued in March 2020. The red line in the chart above shows deflation exceeding...

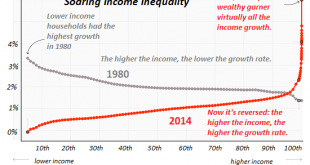

Read More »For the Rich to Keep Getting Richer, We Have to Sacrifice Everything Else

They’re hoping the endless circuses and trails of bread crumbs will forever distract us from their plunder and the inequalities built into America’s financial system.. The primary story of the past 20 years is the already-rich have gotten much richer, with destabilizing economic, social and political consequences. The Federal Reserve and its army of academic / think-tank / financier apologists, lackeys, toadies, apparatchiks and sycophants have several rather thin...

Read More »WARNING: The U.S. Banking System ISN’T as Strong as Advertised

Despite a year of tumult on Wall Street and Main Street, the banking system seems to be holding up remarkably well… for now. Whereas previous financial crises were marked by a surge in bank failures, hardly any have gone under so far in 2020. The Federal Deposit Insurance Corporation (FDIC) reports that only 1% of FDIC-insured banks are on the “problem list” for financial weakness. “Banks are safe,” according to FDIC chair Jelena McWilliams. “There are no concerns...

Read More »Does the Free Market Corrupt People?

The political theorist Michael J. Sandel is a popular teacher at Harvard, and his lectures circulate widely on YouTube and elsewhere. He attracted attention as a serious political theorist with his critical work on John Rawls, Liberalism and the Limits of Justice (1982). As most readers will know, I’m no fan of Rawls, and it’s easy to find poor arguments in his A Theory of Justice. But Sandel totally misunderstands him, and his attack on Rawls fails. From the...

Read More »Coronavirus: cheap drug substantially cuts severe case death risk, according to large UK trial

© Sudok1 | Dreamstime.com A trial at Oxford University suggests an existing low cost drug can cut the risk of death from Covid-19 substantially. Tests involving 6,000 hospitalised Covid-19 patients suggest the drug can cut the risk of death for those on ventilators from 40% to 28%. For patients needing oxygen the risk of death could be cut from 25% to 20%. The findings are potentially the biggest breakthrough in Covid-19 treatment so far. Lead researcher Prof Martin...

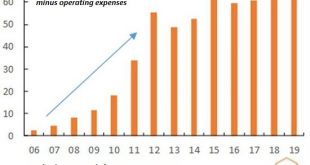

Read More »Our Wile E. Coyote Economy: Nothing But Financial Engineering

Ours is a Wile E. Coyote economy, and now we’re hanging in mid-air, realizing there is nothing solid beneath our feet. The story we’re told about how our “capitalist” economy works is outdated. The story goes like this: companies produce goods and services for a competitive marketplace and earn a profit from this production. These profits are income streams for investors, who buy companies’ stocks based on these profits. As profits rise, so do stock valuations. It’s...

Read More »The War On Cash – COVID Edition Part II

The digital “toll” It doesn’t require too dark an imagination to realize the gravity of the concerns over the digital yuan. China is a true pioneer when it comes surveillance, censorship and political oppression and the digital age has given an incredibly efficient and effective arsenal to the state. Adding money to that toolkit was a move that was planned for many years and it is abundantly clear how useful a tool it can be for any totalitarian regime. The ability...

Read More »Coronavirus: the rising number of mild cases with symptoms lasting months

© Piyapong Thongcharoen | Dreamstime.com Those with mild Covid-19 symptoms are supposed to recover after two weeks. However, a rising number of relatively young people with mild cases report symptoms months later. Johns Hopkins Medicine says that those with mild cases of COVID-19 appear to recover within one to two weeks. For severe cases, recovery may take six weeks or more. But more and more people who have had mild cases are reporting symptoms several months after...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org