Anyone who advocates the ideas of the Austrian school of economics, whether broadly and publicly or even in the context of private discussions with friends and acquaintances, will almost immediately find themselves grappling with the tricky question of how to distill the core essence of what Austrian economics actually is, and how to convey those truly definitive characteristics as briefly and simply as possible. Given the nearly 150 years during which Austrian theory has been continuously growing and evolving, this is certainly no small task, especially seeing as the definitive texts in this tradition tend to be thousand-page treatises which newcomers are unlikely to approach with enthusiasm. So what actually is the most essential characteristic of Austrian

Topics:

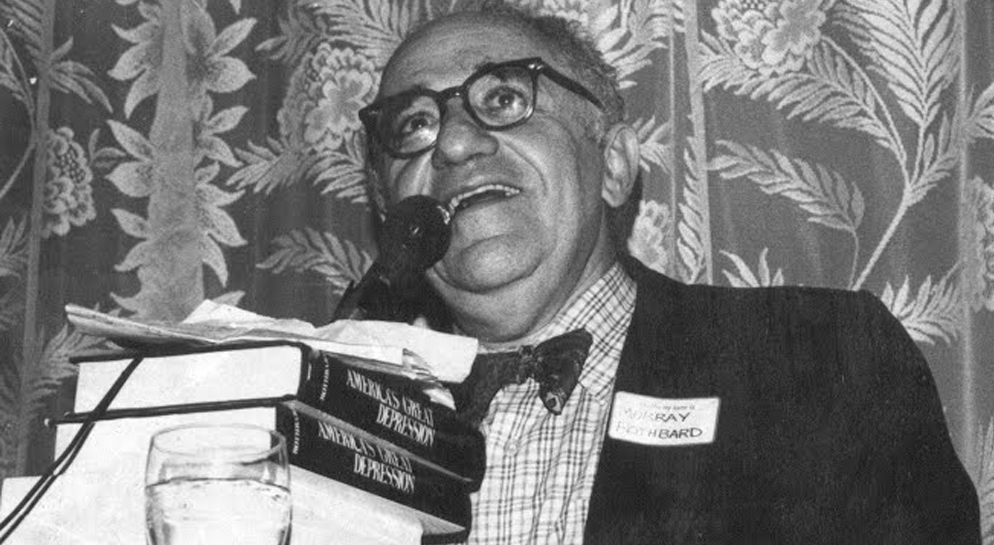

George Pickering considers the following as important: 6b) Mises.org, Featured, Murray Rothbard, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Anyone who advocates the ideas of the Austrian school of economics, whether broadly and publicly or even in the context of private discussions with friends and acquaintances, will almost immediately find themselves grappling with the tricky question of how to distill the core essence of what Austrian economics actually is, and how to convey those truly definitive characteristics as briefly and simply as possible. Given the nearly 150 years during which Austrian theory has been continuously growing and evolving, this is certainly no small task, especially seeing as the definitive texts in this tradition tend to be thousand-page treatises which newcomers are unlikely to approach with enthusiasm.

Anyone who advocates the ideas of the Austrian school of economics, whether broadly and publicly or even in the context of private discussions with friends and acquaintances, will almost immediately find themselves grappling with the tricky question of how to distill the core essence of what Austrian economics actually is, and how to convey those truly definitive characteristics as briefly and simply as possible. Given the nearly 150 years during which Austrian theory has been continuously growing and evolving, this is certainly no small task, especially seeing as the definitive texts in this tradition tend to be thousand-page treatises which newcomers are unlikely to approach with enthusiasm.

So what actually is the most essential characteristic of Austrian economics? Is it our generally sympathetic view of pure free markets? Our views on sound money and central banking? Our theory of the business cycle? And are there any shorter texts, especially by major thinkers in the tradition, which are brief and digestible enough to be recommended to newcomers while still offering profound and persuasive insights into what truly makes Austrians different?

Upon first reading the fourth of Mises’s great masterworks, Theory and History, I found myself struck by how brilliantly and completely Rothbard’s preface accomplishes this distillation of the core characteristic of Austrian economics—namely its unique praxeological method—so much so that I was considerably delayed from actually beginning Mises’s book due to repeated rereadings of the preface. More striking still is how little discussed Rothbard’s preface is, even among seasoned Austrians, and despite its status as, in my view, a near ideal introduction to the Austrian school as a whole.

Providing the opening for Mises’s great methodological work gave Rothbard the opportunity to set down his perspective on the importance of the praxeological method and the key arguments in its favor, in perhaps their most succinct presentation of his career. In addition to this, Rothbard effortlessly—almost covertly—invites the novice reader into the territory of broader metaeconomic questions, and even finds time to touch on some more arcane distinctions, such as his divergence from Mises on the a priori nature of the action axiom.

The preface admittedly does not claim to introduce anything groundbreaking or new into the literature on Austrian methodology, and much of what Rothbard presents here is more fully elaborated in his methodological articles, which today can be found collected as the first 140 pages of his book Economic Controversies. However, the fact that Rothbard was able to present such a broad sweep of Austrian methodology, conveyed with profound depth while still maintaining his characteristically clear and accessible writing style, and all in a preface scarcely longer than the average newspaper editorial, sets this preface apart as a truly brilliant encapsulation of the methodological soul of Austrian economics, with huge untapped potential as an introductory text.

Methodology as the Core of Austrian Economics

The final sentence of Rothbard’s preface to Theory and History contains what may as well have been its title: “Without praxeology no economics can be truly Austrian.”1 It is this identification of the praxeological method as what it fundamentally means to be Austrian which, though a straightforward point to make in the opening of a book on Austrian methodology, marks Rothbard’s preface as a valuable and highly focused introductory text on the Austrian school.

Indeed, this point is perhaps even more essential to understanding true Austrian economics in our own time than it was when Rothbard wrote the preface, which first appeared in the Mises Institute’s 1985 reissue of Theory and History. Although Austrian economics could by no means be described as part of the current mainstream of economic thought, it is also no longer suffering through the true wilderness period it endured throughout most of Rothbard’s own life. Wholehearted acceptance of the Misesian paradigm remains rare among academics, but awareness and intelligent discussion of Austrian ideas is no longer completely unheard of in economics departments, and many market-sympathetic mainstream economists today consider themselves somewhat influenced by Austrian (or at least Hayekian) ideas.

This is certainly a welcome development, yet one which should nevertheless provoke a certain healthy trepidation among Austrians as our ideas are adopted (and adapted) by others. Without the firm foundation of the praxeological method, these theories will likely lose much of their persuasiveness, clarity, and internal consistency as they undergo piecemeal reinterpretation by mainstream free marketeers, potentially reflecting poorly on the Austrian school as a whole. As a consequence, a front-and-center identification of the praxeological method as the indispensable core of true Austrian economics is now arguably even more vital than it was at the time of Rothbard’s writing. After all, Rothbard notes that “adherence to the free market…is now not uncommon among economists (albeit not with Mises’s unerring consistency), but few are ready to adopt the characteristically Austrian [praxeological] method,”2 and this correlation between muddled methodology and faltering support for free markets is no coincidence.

Methodological Dualism and “Directions” of Scientific Investigation

After a brief introduction establishing the context and importance of Mises’s Theory and History, the very first aspect of Austrian methodology that Rothbard emphasizes at the outset is the concept of methodological dualism. This is “the crucial insight that human beings must be considered and analyzed in a way and with a methodology that differs radically from the analysis of stones, planets, atoms, or molecules.”3

It is easy to understand how novice Austrians might be tempted to rush straight past this sort of abstract, methodological point in favor of the school’s more exciting and obviously applicable theories on business cycles or free markets. However, a correct and fully understood grasp of methodological dualism is an essential first step if one wishes to gain a genuine understanding of pure Misesian economics. Indeed, without such a grasp, the Misesian insistence on a purely logical-deductive method would be easy to view as an inconvenient eccentricity, standing in the way of the career-advancing merits of mathematical analysis. Little wonder, then, that it has been non-Misesian Austrians who have more often found themselves tempted to undermine the clarity and integrity of their own work by half-hearted adoption of empiricism.

Rothbard lays out several arguments in favor of methodological dualism, including the fundamental point that human beings, unlike mere physical matter, have the capacity to choose, change their values, and alter their own courses of action, rather than exclusively being controlled by measurable external forces. He also summarizes the brilliantly fundamental and persuasive argument—which he had elaborated more fully in other methodological articles such as the classic “In Defense of Extreme Apriorism”—that the natural sciences and economics operate in entirely opposite “directions” of scientific investigation.

In the natural sciences, what is visible and easily measurable are the final outcomes resulting from the interactions of the underlying laws and forces, whereas those laws and forces themselves are not self-evident. Therefore it makes sense for the natural scientist to first observe and collect data about those empirical phenomena and then tentatively work their way backwards toward a description of the underlying forces at play. A physicist, for example, cannot directly observe or intuitively know the precise nature of the universal law of gravitation on an experiential level, but they can empirically observe the movements of objects under the effects of gravity, present an explanatory hypothesis, and then use laboratory experiments to test whether or not observed facts falsify that hypothesis.

Economists, however, are in precisely the opposite situation: the fundamental laws of economics are self-evident, axiomatic, and can be known with apodictic certainty, whereas the causes of particular real-world events cannot be directly known, measured, or isolated. If the number of barrels of oil sold by a particular oil company falls from one month to the next, this historical event will inevitably be the complex resultant of many factors. The economist cannot directly observe which different factors and laws contributed to that outcome, or to what extent, nor could they possibly find out by repeating the process in laboratory conditions and holding different variables constant. But the economist can know the self-evident law that, other things being equal, people will demand more units of a good at a lower price than at a higher price, and it can therefore be said with apodictic certainty that, other things being equal, the number of barrels sold by the oil company would have been higher if the price had been lower.

In other words, rather than starting with empirical facts and then grasping backward toward theories, economists start with the self-evident and axiomatic “fact that human beings have goals and purposes and act to attain them,”4 from which they can then deduce increasingly precise and applicable theories.

These two arguments—the fact that human beings are to some extent self-directed and can change their values and courses of action, thus making each particular historical case of human action radically heterogeneous, incommensurable, and impossible to repeat in “laboratory” conditions, and the fact that economics has a fundamentally different “direction” of scientific investigation than the natural sciences—combine to strongly make the case that applying the empirical-inductive method of the natural sciences to economics is not only unnecessary and fruitless, but, on a fundamental level, does not even make sense.

How Should Theory and History Interact?

This aspect of Rothbard’s preface touches on a point of broader significance, especially for those engaged in the study of economic history, a field toward which the upcoming generation of Austrians has increasingly been drawn due to its relatively less hostile intellectual climate. If history is comprised of unique and radically heterogeneous events from which economic theory can draw no lessons, how, if at all, can noncontingent theory and contingent history be meaningfully brought together? In other words, what is the point of economic history, and what should economic historians actually be doing? This is a question for which Austrians boast a convincing answer while the mainstream approach is arguably not only wrong, but internally self-contradictory.

Rothbard’s preface highlights time and again how “each historical event is a complex, unique resultant of many causal factors.”5 However, his emphasis on this point is not intended to draw a hard wall of separation between theory and history, but rather to stress that historical events cannot be homogenized and quantified in a way that could allow valid theoretical insights to be inferred from them. On the contrary, it is “the complex historical event itself [that] needs to be explained by various theories.”6 It is the role of the economic historian to apply pure economic theory to the task of explaining the causal forces at work behind the events of history, which cannot themselves be directly observed. This is an indispensable function not only in the case of events long passed, but perhaps even more so to those investigating “history” in the Misesian definition, which includes all events occurring before the present instant in time, including what would usually be called current events.

This sort of clear and concrete definition of the role and purpose of economic history is very noticeably absent from the mainstream approaches to that subject. After all, many mainstream economists are well aware of the imperfections and limitations of building up hypothetical theories on the cacophonous data of empirical reality, which leaves them still more timid in their attempts to use that theory to explain the events of history.

However, the problem for mainstream economic historians arguably runs far deeper than this. If one subscribes to the mainstream view that it is from the data of history that economic theory must first be derived, it is difficult to then turn around and use that same theory to explain the events of history without becoming dizzy from the circularity of it all. This uncomfortable truth is rarely explicitly acknowledged, but it is painfully apparent in the lack of overall purpose and consistency exhibited by much of the work produced. If deprived of the use of economic theory to explain the facts of history, economic historians are not only reduced to mere chroniclers of dry facts, unable to explain causation or the broader forces at play, but are furthermore deprived of the very tool which would otherwise inform them of which events and factors are even worth chronicling to begin with.

Prediction vs. Explanation

Given the brevity of Rothbard’s preface to Theory and History, it is a testament to the brilliance of its author that it is not only able to summarize the core arguments for the praxeological method, but also to touch on broader, metaeconomic questions, such as whether prediction or explanation should be the fundamental purpose of economic science.

This conflict relates closely to the overall themes of the preface not only due to its importance to Austrian methodology in general, but also due to how closely positivism is intertwined with the desire to predict future economic outcomes. In order to make quantitative predictions, the mainstream economist must first attempt to find quantitative correlations which can then be extrapolated into the future, which requires them to “treat individuals not as unique creatures, each with his or her own goals and choices, but as homogenous and therefore predictable bits of ‘data.'”7

It is easy to picture the array of interests pressuring economists in the direction of prediction rather than explanation, from businesses that believe they could profit from enhanced foresight to political agents wishing to fine-tune their interventions. However, the important point Rothbard stresses is that empirical-mathematical analysis inevitably goes hand-in-hand with the desire to use economics as a predictive, rather than explanatory, tool. After all, it is no accident that “the original motto of the Econometric Society [was] ‘Science is Prediction.'”8

Apriorism or “Broad Empiricism”?

One topic to which Rothbard devotes a surprising amount of space in this short preface is his divergence from Mises on whether or not economics can truly be regarded as an a priori discipline. This is a distinction of which many more casual followers of the Austrian school are likely not even aware, while even some dedicated Austrians might be surprised at the amount of attention Rothbard pays it in this short introductory piece.

However, Rothbard, who was well known for his timidity and deference when it came to publicly disagreeing with his mentor, nevertheless went so far as to call Mises’s use of the term a priori “idiosyncratic” and unnecessarily confusing.9 In place of apriorism as the foundation of the action axiom and other underlying principles of economics, Rothbard instead appeals to what he calls broad empiricism, and argues in favor of self-evidence as a legitimate and neglected epistemic justification for such fundamental statements.

Is the fact of human purposive action “verifiable”? Is it “empirical”? Yes, but certainly not in the precise, or quantitative way that the imitators of physics are used to. The empiricism is broad and qualitative, stemming from the essence of human experience; it has nothing to do with statistics or historical events. Furthermore, it is dependent on the fact that we are all human beings and can therefore use this knowledge to apply it to others of the same species. Still less is the axiom of purposive action “falsifiable.” It is so evident, once mentioned and considered, that it clearly forms the very marrow of our experience in the world.10

Although many who are aware of this split between Mises and Rothbard likely view it as predominantly a mere terminological difference, the fact that Rothbard gives it such a direct and detailed appraisal in this short preface indicates that he viewed it as a matter of more fundamental importance. And although it would be beyond the scope of this article to dig deep enough to come out with a firm stance on one side or the other, this nevertheless spotlights an interesting topic with potentially far-reaching implications, on which more work could fruitfully be done in the future.

Conclusion

In addition to being one of the most neglected masterpieces of the Austrian school, Ludwig von Mises’s Theory and History is arguably the greatest single work on the important topic of Austrian methodology, especially the Mises Institute’s edition that includes Rothbard’s preface. The preface not only contextualizes Mises’s magisterial work, but also allows Rothbard to summarize its key contributions in his usual crystal-clear style, while further drawing the reader into broader questions of epistemology and the fundamental purpose of economic science. Furthermore, in tackling the task of summarizing the key points of Austrian methodology in such a short preface, Rothbard almost inadvertently provided us with a near-ideal introductory piece on what Austrian economics truly is, with great potential as an assignable reading for either students or interested newcomers to these ideas.

The importance of an early grounding in methodology for budding Austrians is painfully apparent in the inconsistent and counterproductive work of many mainstream economists, even supposed free marketeers. If more attention is able to be directed toward the introductory potential of shorter methodological works, such as Rothbard’s preface to Theory and History, we can expect future generations of Austrians to become ever stronger and more consistent, not only in their methodology, but in their advocacy of sound economics in general.

- 1. Murray Rothbard, preface, in Ludwig von Mises, Theory and History: An Interpretation of Social and Economic Evolution (Auburn, AL: Ludwig von Mises Institute, 2007), p. xix.

- 2. Ibid., p. xiii.

- 3. Ibid., p. xiii.

- 4. Ibid., pp. xv–xvi.

- 5. Ibid., p. xvii.

- 6. Ibid., p. xviii.

- 7. Ibid., p. xiv

- 8. Ibid., p. xiv.

- 9. Ibid., p. xv.

- 10. Ibid., pp. xvi–xvii.

Tags: Featured,Murray Rothbard,newsletter