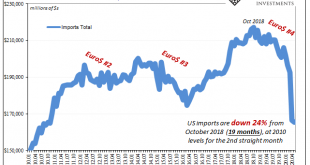

Unlike some sentiment indicators, the ISM Non-manufacturing, in particular, actual trade in goods continued to contract in May 2020. Both exports and imports fell further, though the rate of descent has improved. In fact, that’s all the other, more subdued PMI’s like Markit’s have been suggesting. Getting closer to a bottom. Unlike any of the sentiment numbers, however, these trade figures better demonstrate just how far from a rebound let alone recovery the world...

Read More »Stocks Always Go up. Until They Don’t.

Economist Irving Fisher famously said just before the 1929 stock market crash, “Stock prices have reached what looks like a permanently high plateau.” Whoops. Fisher wasn’t just any old economist. Joseph Schumpeter called him “the greatest economist the United States has ever produced.” Milton Friedman and James Tobin agreed. After the sharp March COVID crash, stocks have come roaring back: nevermind the pandemic, protests in the streets, shuttered businesses, and...

Read More »Inside Geneva: World trade at a crossroads

In this episode of our Inside Geneva podcast, we look at the role of the World Trade Organization as it chooses a new leader amid challenging times. Every country has to trade: to sell goods, and to import others that aren’t produced at home. But who makes the rules around trade? Host Imogen Foulkes is joined by former World Trade Organization (WTO) official Peter Ungphakorn, former Reuters correspondent and trade journalist Tom Miles, and analyst Daniel Warner, to...

Read More »FX Daily, July 9: The Dollar is Sold through CNY7.0 as Chinese Equities Continue to Rally

Swiss Franc The Euro has fallen by 0.05% to 1.0623 EUR/CHF and USD/CHF, July 9(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Investors continue to clamor into risk assets. Led by Chinese shares, the MSCI Asia Pacific Index pushed higher for the third session this week to new five-month highs. Europe’s Dow Jones Stoxx 600 is trying to snap a two-day decline with the help of better than expected revenues for its...

Read More »New Geneva platform to ‘anticipate societal changes’

World leaders have been addressing an online international summit on jobs and Covid-19. Keystone / Sandra Steins A new international platform is to be launched in Geneva to anticipate the effects of societal changes amidst the Covid-19 crisis, Swiss President Simonetta Sommaruga said on Wednesday. Switzerland is supporting this initiative and calls on states to help the International Labour Organisation (ILO) in the face of the current jobs crisis, she added. The new...

Read More »The American Economy in Four Words: Neofeudal Extortion, Decline, Collapse

Our society has a legal structure of self-rule and ownership of capital, but in reality it is a Neofeudal Oligarchy. Now that the pandemic is over and the economy is roaring again–so the stock market says–we’re heading straight back up into the good old days of 2019. Nothing to worry about, we’ve recovered the trajectory of higher and higher, better every day in every way. Everything’s great except the fatal rot at the heart of the U.S. economy hasn’t even been...

Read More »The “Old” vs. the “New” Liberalism

It is not disputed that the popular meaning of liberal has changed drastically over time. It is a well-known story how, around 1900, in English-speaking countries and elsewhere, the term was captured by writers who were essentially social democrats. Joseph Schumpeter (1954: p. 394) ironically observed that the enemies of the system of free enterprise paid it an unintended compliment when they applied the name liberal to their own creed, historically the opposite of...

Read More »Dollar Bid as Market Sentiment Yet to Recover

The US has started the formal process of withdrawing from the WHO; the dollar continues to benefit from risk-off sentiment but remains stuck in recent ranges The White House is asking Congress to pass another $1 trln stimulus plan by early August; President Trump hosts Mexican President AMLO for a two-day visit Chancellor Sunak addresses UK Parliament today; Brexit talks continue; Nigeria devalued its official exchange rate yesterday RBNZ is considering an extension...

Read More »FX Daily, July 8: Consolidation is the Flavor of the Day

Swiss Franc The Euro has risen by 0.12% to 1.063 EUR/CHF and USD/CHF, July 8(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The S&P 500’s longest advance this year was stopped seemingly as concern that the flare-up in the virus will slow the recovery. The sell-off in airlines and hotels helped spur a broader bout of profit-taking. Most Asia Pacific bourses advanced, led by the continued rally in Hong Kong...

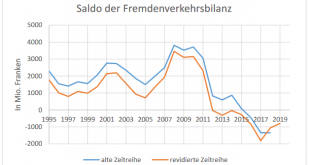

Read More »No lack of foreign tourism demand in 2019

07.07.2020 – Foreign demand was strong in 2019. The income side of the tourism balance of payments grew, reaching a record level of CHF 17.8 billion. At the same time, people living in Switzerland did not increase their expenditure when travelling abroad, despite price conditions that were more favourable. The tourism balance of payments was negative at CHF -798 million, according to initial estimates from the Federal Statistical Office (FSO). Saldo der...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org